This site

is mobile

responsive

MIDA offers the following assistance to investors:

MIDA’s Headquarters in Kuala Lumpur houses senior representatives from key government agencies, each wielding substantial expertise in their respective field to advise investors and provide valuable insights on government policies and procedures.

What are the types of applications evaluated by MIDA?

MIDA evaluates the following:

Companies can submit their applications online and track its status at investmalaysia.mida.gov.my

What are the equity requirements for new, expansion or diversification projects?

Foreign investors can hold 100% equity in new manufacturing projects, as well as expansion or diversification ventures by existing companies, irrespective of exports level.

How does MIDA act as a single window in facilitating and assisting investors?

The establishment of MIDA in 1967 has been empowered to streamline government promotion, optimise resources, establish structured investment promotion agency (IPA) governance, attracting investment, and facilitating investors with their ventures in Malaysia. MIDA’s Headquarters in Kuala Lumpur also houses senior representatives from key government agencies, each wielding substantial expertise in their respective field to advise investors and provide valuable insights on government policies and procedures.

Find out more.

What is the InvestMalaysia Portal?

It is an online platform for companies to submit and track their applications.

What types of applications can I submit at the InvestMalaysia Portal?

Modules available includes:

What are the criteria to apply for a Manufacturing Licence?

A company with shareholder’s fund of RM2.5 million and above OR full-time manpower of 75 people or more can apply for a Manufacturing Licence.

How long does it take to approve for Manufacturing Licence?

According to MIDA’s Client Charter, the Manufacturing License will be approved within seven days (fast track) or 60 [1] days (normal track) upon receiving complete information.

Where can I find the status of my company’s application?

Upon receipt of applications, MIDA will issue an acknowledgment letter that includes the names of the relevant officers from the Industry Division. Applicants are advised to contact these officers for updates on their application status.

All online applications can be tracked via the InvestMalaysia portal .

If my company is exempted from a manufacturing licence, what other documents can I obtain from MIDA?

The applicant may obtain a ‘Confirmation Letter for Exemption from Manufacturing License’ by submitting their application via http://investmalaysia.mida.gov.my/ and should submit a copy of the following documents:-

Can I submit my application for a manufacturing licence online?

Applications can be submitted via http://investmalaysia.mida.gov.my/

Can I submit my applications in hardcopy?

No. Applications for the Manufacturing Licence and ICA10 can only be made online via http://investmalaysia.mida.gov.my/

For detailed information, please visit our ‘Setting Up Business’ section.

What are the main incentives for the manufacturing and services sectors?

There are two major tax incentives for the manufacturing and services sectors:

What is the difference between Pioneer Status and Investment Tax Allowance?

Pioneer Status:

Investment Tax Allowance:

For projects that involve significant capital expenditure and have a longer gestation period, it is more beneficial to opt for the Investment Tax Allowance.

Companies should study the options before applying either Pioneer Status or Investment Tax Allowance.

How does a company apply for Pioneer Status/Investment Tax Allowance?

Applications can be submitted via http://investmalaysia.mida.gov.my/.

Can I submit my applications in hardcopy?

No. Applications for Incentives can only be made online via http://investmalaysia.mida.gov.my/.

If my company does not have a manufacturing Licence, can I apply for Pioneer Status/Investment Tax Allowance?

A company exempted from a Manufacturing Licence is eligible to apply for Pioneer Status/Investment Tax Allowance if the products/activities are promoted and the project has fulfilled other related criteria.

How can I confirm that my products/activities are eligible to apply for incentives?

To access the list of promoted activities, click here.

For further information, visit Forms and Guidelines or refer to relevant publications here .

How long does it take to consider the application for the incentives?

The processing and decision of the application will be completed within six weeks from the date of receiving complete information.

How can I find out the status of my company’s application for the incentive?

Upon receipt of applications, MIDA will issue an acknowledgment letter that includes the names of the relevant officers from the Industry Division. Applicants are advised to contact these officers for updates on their application status.

All online applications can be tracked via the InvestMalaysia portal .

What is the difference between key post and the term post?

Key Post:

– held indefinitely by a foreigner based on the foreign ownership of the company.

– dependent on the amount of foreign paid-up capital of at least RM1 million.

– approval subject to a minimum foreign paid-up capital of the company of at least RM1 million or foreign paid-up capital stated in eSSM (whichever is higher); and a minimum basic salary of RM5,000.00 or proposed by the company (whichever is higher).

Term Post:

– post approved for up to 5 years for executive posts that require professional qualifications and practical experience; and for non-executive posts that require technical skills and experience.

– approval subject to a minimum basic salary of RM5,000.00; and minimum academic qualification and working experience in related fields (i.e. degree + at least 3 years working experience / diploma + at least 5 years working experience / certificate + at least 10 years working experience).

– subjected to the unavailability of Malaysians to fill up the post and Malaysians must be trained to eventually take over the post after the expiry of the term.

What should I prepare before submitting an application for expatriate posts to MIDA?

Companies situated in Peninsular Malaysia, with approved status in the manufacturing and selected services sectors, are eligible to apply for expatriate posts and Employment Passes (EP) through the Xpats Gateway System, accessible via the Immigration’s ESD Online System at https://xpatsgateway.com.my/. This revamped process ensures that applications are routed to MIDA for the issuance of the Expatriate Post Approval and EP Support Letter.

For companies in the manufacturing and selected services sectors located in Sabah and Sarawak, the application process for expatriate post applications can be made through the InvestMalaysia portal at https://investmalaysia.mida.gov.my.

Prior to submitting an application for an expatriate post approval to MIDA, the company is required to obtain the approval from Jabatan Tenaga Kerja Semenanjung Malaysia (JTKSM) for the employment of expatriates under Section 60(K) of Akta Kerja 1955. Starting 1 March 2023, companies can submit the applications for Kelulusan Penggajian Pekerja Asing approval letter from JTKSM through the Sistem Pengurusan Pekerja Asing Bersepadu (ePPAx) under the Pegawai Dagang category via https://www.eppax.gov.my/eppax/. The companies will receive digital decision letters from JTKSM in the form of email. The Kelulusan Penggajian Pekerja Asing approval letter issued by JTKSM is valid for a period of 6 months and the employer must obtain a new approval if the validity period expires.

The company is also required to advertise their job vacancies for a minimum of 30 days in the MYFutureJobs. Tportal and to conduct interview processes to source local talents. The company must also comply with the Social Security Organisation (SOCSO) guidelines. For any inquiries on MYFutureJobs portal, please contact SOCSO’s Customer Services Centre at 1-300-22-8000 / 03- 8091 5300 or email [email protected].

Are there any exemptions from advertising of job vacancies before submitting an expatriate post application to MIDA?

Yes, exemptions from advertising of job vacancies are given to the following categories:

Specialised skilled positions are not automatically excluded from advertising the vacancies in MYFutureJobs portal . Specialised skilled positions include specific and/or unique skills as well as strategic competencies to carry out tasks stipulated by the company.

What is the process of applying for an exemption of advertising of job vacancies?

Application for the exemption of advertising in MYFutureJobs portal can be done by completing the PDKK Form via http://bit.ly/PDKKPERKESO. Reasons for exemption are required to be indicated in the form.

Exemption will be granted after being approved by SOCSO via email : [email protected] and the company may proceed to apply for the expatriate post.

If the application is rejected, the company will be requested to advertise the vacancy in MYFutureJobs portal for a minimum of 30 days and conduct interviews to source local talents as stated. Companies need to submit the Expatriate Employment Committee (JPPD) Certificate from SOCSO when applying for the expatriate position to the Approving Agency.

However, companies do not require to advertise the expatriate positions or to obtain exemption of advertising in MYFutureJobs if; C-Suite & Key Posts / Minimum basic salary of RM15,000 and above / Investors or Shareholders or Owners of the company / Corporate Transfers or Placements or Trade Agreements / Representative Office Regional Office (RERO) status.

How to apply for an extension or additional expatriate posts?

Companies in the manufacturing and selected services sectors situated in Peninsular Malaysia, are eligible to apply for extension or additional expatriate posts and Employment Passes (EP) through the Xpats Gateway System, accessible via the via the Immigration’s ESD Online System at https://xpatsgateway.com.my/.

For companies in the manufacturing and selected services sectors located in Sabah and Sarawak, the application process for extension or additional expatriate post applications can be made through the InvestMalaysia portal at https://investmalaysia.mida.gov.my.

How long does it take for a decision on the application for expatriate posts?

Companies situated in Peninsular Malaysia, MIDA will process the application for expatriate post and Employment Pass (EP) support letter and a decision will be granted within 3 working days for FastTrack applications (Tier1 / Tier2); or within 10 working days for Normal rack applications (Tier3 / Tier4 / Tier5) upon submission of completed required information via the Immigration’s ESD Online System at https://xpatsgateway.com.my/.

For companies located in Sabah and Sarawak will be processed and a decision will be made within 30 working days upon receiving complete information through the InvestMalaysia portal at https://investmalaysia.mida.gov.my.

Single Window Platform

What is Single Window Platform (SWP)?

SWP streamlines the process of obtaining Support Letters for expatriate post and Employment Pass applications for companies located in Peninsular Malaysia and RE/RO with approved status by integrating Approving Agencies and Regulatory Bodies, including MIDA. This comprehensive solution simplifies the application process for companies seeking Support Letters when hiring expatriates via SWP Portal known as https://xpatsgateway.com.my/ at esd.imi.gov.my

What is the difference between Single Window Platform (SWP) and ESD Online System?

SWP, also referred to as the Xpats Gateway System, leveraging the existing ESD Online System to simplify the application process. It integrates and streamlines systems, facilitating the acquisition of the Support Letter from MIDA and Employment Pass approval from the Immigration Department Malaysia. SWP ensures improved coordination among Approving Agencies, Regulatory Bodies, and the Immigration Department Malaysia through a unified platform.

When is the implementation date of Single Window Platform (SWP)?

SWP was officially launched on 15 June 2023.

What type of pass is processed under Single Window Platform (SWP)?

SWP only processes Employment Pass for expatriates.

Does the company need to apply for MIDA Support Letter through the MIDA InvestMalaysia Portal once Single Window Platform (SWP) goes live?

Approved companies in the Manufacturing Sector, Selected Services Sector, and Representative Office/Regional Office (RE/RO) with Status under MIDA in Peninsular Malaysia can now use the Xpats Gateway System. This system, accessible through the ESD Online System at https://esd.imi.gov.my, enables them to apply for expatriate posts and Employment Passes efficiently.

For companies based in Sabah and Sarawak, as well as those applying for RE/RO Status approval, the application process for expatriate post support letters can be continued through MIDA InvestMalaysia portal at https://investmalaysia.mida.gov.my/

What is the status of companies that have paid and obtained MIDA Digital Certificate (DigiCert) through InvestMalaysia? Is it a waste to not use the InvestMalaysia portal to obtain MIDA support letter?

DigiCert must obtain other approvals via MIDA InvestMalaysia portal, such as Manufacturing license / Incentive / Status Approval / Grant / Exemption Letter from Manufacturing License. One of these documents is mandatory in the checklist on the Single Window Platform to obtain the MIDA Support Letter,serving as evidence that the company operates in a sector under MIDA’s purview (item 15).

How does the Single Window Platform (SWP) works?

SWP enables companies to obtain the Support Letter from MIDA, Employment Pass approval from the Immigration Department of Malaysia through the ESD Online system and Employment Pass endorsement, all in a single platform.

What are the sectors under MIDA’s purview?

1. Manufacturing sector:

2. Selected services sectors:

What is the processing time for the MIDA Support Letter?

MIDA Support Letter processing times: 3 working days for Fast Track and 10 working days for Normal Track.

Will MIDA notify the company if additional informations/documents are required for incomplete applications?

Through SWP, incomplete applications will not be considered for MIDA Support Letter.

What are the processes involved in Single Window Platform (SWP)?

Applications submitted to SWP are for expatriate positions, including the incumbents.

MIDA will evaluate and approve for the expatriate post; and evaluate and recommend the incumbent for Employment Pass approval. However, MIDA does not validate the incumbent on security matters i.e. their status (blacklisted/suspect list), outstanding taxation matters, passport details etc.

MIDA Support Letter will be digitally sent to company and the company will have a maximum duration of six (6) months to initiate for Employment Pass application via the

ESD Online System at https://esd.imi.gov.my.

Is there a limit to the number of expatriate post(s) that can be applied for?

No, there are no restrictions on the number of expatriate posts that a company can apply based on the company’s requirement.

What is the validity of MIDA Support Letter?

The validity of a MIDA Support Letter is six (6) months upon issuance date.

What should the company do if the expatriate post is not filled after the expiry of MIDA Support Letter?

Companies are required to re-apply for MIDA Support Letter via SWP for a new letter.

What are the documents that I need to upload in Single Window Platform (SWP) for MIDA to consider issuance of a Support Letter?

Companies are required to upload the following documents:

a)Approval of Manufacturing

License(ML)/Incentive/Grant/Status/Letter of Exemption from ML

b) Advertisement with MyFutureJobs. However, it is exempted if:

c) JTK approval under Section 60K, Employment Act 1955

d) The latest Organisation Chart that clearly indicates the existing expatriate(s) and the expatriate post/s being applied for.

e) Copy of Passport: All Pages (Full Booklet with Front & Back Pages)

f) Resume of the Expatriate

g) Certificates of Academic Qualifications (Certified True Copy)

h) Training schedule to localised the term post

i) Copy of Employment Contract that clearly indicates the expatriate’s salary and terms

j) Letter to justify the requirements of the position(s) with company letterhead.

k) Copy of Previous MIDA Expatriate Approval Letter(s) (if any)

We have received a MIDA Support Letter via the Single Window Platform (SWP). What is the next step?

Companies can proceed to initiate the Employment Pass application with the following steps:

Can companies change the MIDA Support Letter’s details once it has been issued?

No. Companies will be required to re-apply for the new MIDA Support Letter.

What steps should be taken, if a company wants to change or amend the details of MIDA expatriate post Approval and Employment Pass Support Letter that was approved before the implementation of the Single Window Platform (SWP) on June 15, 2023 (e.g., changing the factory address or company name)?

Companies can submit the application to SWP via Xpats Gateway System under new category.

Can companies use the previous MIDA expatriate post Approval Letter, issued before the implementation of the Single Window Platform (SWP), to obtain Employment Pass for the Key Post?

The MIDA expatriate post Approval Letter approved before the implementation of the SWP remains valid for the Key Post. Companies can upload in SWP to obtain the Employment Pass.

For companies seeking to apply for additional and/or extension of expatriate posts, which category should they choose?

Companies can choose New category for additional applications and Renew category for extension applications.

Will the company be notified if the Support Letter application is rejected by MIDA?

Yes, the rejected notification will be digitally sent to the company.

Is there a cooling period for re-applying if the Support Letter application is rejected by MIDA?

There is no waiting period to reapply for a new Support Letter.

If the application for the Employment Pass is rejected by the Immigration Department of Malaysia, can companies use the same MIDA Support Letter to reapply through the ESD Online System?

Yes, companies can reuse the valid MIDA Support Letter to re-apply through the ESD Online System

Whom can we contact at MIDA for assistance regarding any issues related to the MIDA Support Letter?

For any clarification, please do not hesitate to contact MIDA through;

Whom can we contact for assistance or support regarding any issues or inquiries related to Employment Pass approval?

The contact information is available on SWP at Xpats Gateway System, accessible via the ESD Online System at

https://esd.imi.gov.my (Contact Us);

More FAQs on Single Window Platform

For more FAQs on Single Window Platform please click here.

Investor Pass

What is Investor Pass?

Investor Pass provides entry permission for foreign investors who are frequent travellers with the purpose of seeking business opportunities and the duration of stay for a period of up to 12 months from the date of arrival at any international entry point.

The Investor Pass is leveraging the existing Social Visit Pass (SVP) with the Multiple Entry Visa (MEV) facility.

When will the Investor Pass be implemented?

The Investor Pass will be implemented on 1 April 2025.

What categories of foreign investors are eligible for the Investor Pass?

The Investor Pass is available to foreign investors in the following three (3) categories:

1. New Investors – Potential investors who have no investment record in Malaysia.

2. Investors in the Pipeline – Potential investors who have expressed interest, are in negotiations with the Malaysian Government, or have submitted project approval applications to MIDA.

3. Existing Investors – Investors with a track record of investments in Malaysia and ownership of SSM-registered companies, but not employed by any company in Malaysia.

Which economic sectors qualify for Investor Passes through MIDA?

What positions can be considered for the Investor Pass?

Business owner/ Founder/ Company Board of Directors/ Company Shareholders/ C-Suite (investment decision makers)/ Managerial.

Can an investor apply while in Malaysia?

No, applicants must be outside of Malaysia when applying for the Investor Pass.

What types of businesses can be undertaken under the Investor Pass?

All economic sectors are allowed except those listed as negative sectors under the Ministry of Domestic Trade and Cost of Living (KPDN).

(Please refer to Appendix 1)

What are the qualifying criteria for the Investor Pass?

1. Age 18 years and above.

2. Immigration status – Must not be on the Immigration Department of Malaysia ‘s Suspect List or Blacklist (SLBL ).

3. Security clearance – Must not have a criminal record under the Royal Malaysia Police’s (PDRM) Security Clear ance (BRI).

4. Employment status – Must be currently employed by a company registered in their country of origin.

5. Purpose of travel -Must be traveling for business purposes only.

6. Pass status – Must not hold any Long-Term Pass issued by the Immigration Department of Malaysia.

7. Passport Validity – Must possess a passport with validity period of not less than 6 months.

8. Employment Restriction – Not allowed to engage in any employment activities in Malaysia.

How can I apply for Investor Pass?

You can submit your application through Xpats Gateway System at https://xpatsgateway.com.my/

You have to use business email address with your name and company email domain for registration. Public email domains are not allowed.

MIDA issues the support letter for the Investor Pass application, while the Immigration Department of Malaysia is responsible for approval, subject to compliance with the latest government criteria and guidelines.

When should I submit my application to MIDA for support letter?

The application for MIDA support letter must be submitted to https://xpatsgateway.com.my/ at least seven (7) days prior to your departure date from the port of embarkation.

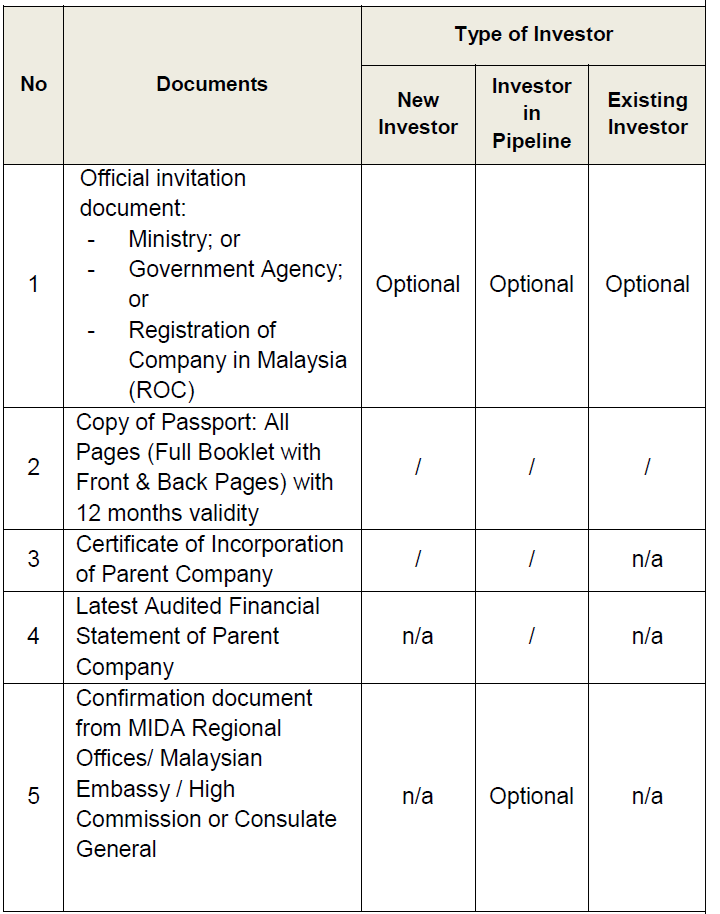

What are the documents required to be uploaded on the Xpats Gateway System for MIDA to consider a Support Letter?

Do all uploaded documents need to be stamped Certified True Copy (CTC)?

No, Certified True Copy is only required for documents that have been translated from a foreign language to English. The CTC must be obtained from the Embassy/Notary Public/Company Secretary.

What is the processing period for the Investor Pass?

The Investor Pass processing period are as follows, subject to the completion of information received;

– MIDA Support Letter – three (3) working days;

– Immigration Approval – two (2) working days.

What is the validity period of MIDA Support Letter?

The validity period of a MIDA Support Letter is six (6) months upon issuance date.

Will I be notified of the outcome of my Investor Pass application?

Yes, you will receive digitally within five (5) working days.

What should I do after receiving the MIDA support letter notification?

Upon receiving the notification that your application has been supported by MIDA, you are required to perform the payment for processing fees. The MIDA support letter will then be digitally forwarded to the Immigration Department for final consideration.

What steps should be taken, if I need to change or amend the details of Investor Pass approval?

Please send an email to the Immigration Department via [email protected] to inform on the changes together with the necessary supporting documents.

How long can the Investor Pass holders stay in Malaysia?

The Investor Pass is granted for a period of up to maximum 12 months and there is no extension. However, each Investor Pass is approved for a period of 6 months.

Can I renew the expiring Investor Pass to get the remaining 6 months?

Yes. In order to obtain an extension of the remaining 6 months, the application for MIDA support letter must be submitted to Xpats Gateway System at least 30 days before the expiry of the Investor Pass.

Will MIDA notify the applicant if additional information or documents are required?

Incomplete applications will not be considered for a MIDA Support Letter. Through the Xpats Gateway System, investors will be notified digitally if their application is rejected, along with the reason(s) for rejection.

What are the processes involved in Investor Pass application?

Refer Process Flow

How can I find out about the status of my application?

The application status can be checked online via https://xpatsgateway.com.my/

If I have been offered a permanent job with a company registered in Malaysia, can I enter the country using Investor Pass?

No, you cannot enter Malaysia using the Investor Pass.

The company offering you the job must apply for your Employment Pass (EP), and you must remain outside Malaysia while the application is being processed.

For EP application procedures, visit: https://www.mida.gov.my/media-release/single-window-platform-notice/

More FAQs on Investor Pass

For more FAQs on Investor Pass please click here.

How does a company apply for import duty and/or sales tax exemption?

Applications for import duty and/or tax exemption can be made via https://investmalaysia.mida.gov.my.

What type of applications that can be submitted for import duty and/or sales tax exemption?

Applications for import duty and/or sales tax exemption which involve the following need to be submitted online via https://investmalaysia.mida.gov.my:

Application for MIDA Confirmation Letter or Surat Pengesahan MIDA (SPM) to claim import duty and/or sales tax exemption from the Royal Malaysian Customs Department on machinery/equipment/spare parts/prime movers/container trailers/specialised tools/components/materials/specialised consumables goods for the following:

How long does it take to receive a decision on the application of import duty and/or sales tax exemption?

The decision will be made within 4 weeks upon receiving complete information.

What are the supporting documents required to be attached in the online application form?

A company applying for the exemption should submit a copy of the following documents:

What is the procedure to apply for the import duty and/or sales tax exemption?

Kindly refer here for the application guidelines and procedures.

Could a manufacturing company in the Free Industrial Zone (FIZ)/Licenced Manufacturing Warehouse (LMW) apply for duty exemption?

Manufacturing companies operating in the Free Industrial Zones (FIZ)/Licensed Manufacturing Warehouse (LMW) seeking duty exemption for the sale of their finished goods to the Principal Customs Area (PCA) must submit their applications directly to the Royal Malaysian Customs Department or the nearest Customs station.

What are services sub-sectors that are eligible to apply for status and/or incentives and/or expatriate applications through MIDA?

Companies undertaking the following selected services or activities may apply for status and/or incentives and/or expatriate:

For more detailed information, please refer to the ‘Malaysia: Investment in the Services Sector’ guidebook here.

What is the procedure to apply for status and/or incentives and/or expatriate application for the above services sub-sectors?

All applications can be made online via https://investmalaysia.mida.gov.my.

As for applications for the Replacement of Expatriate Post for RE/RO and Annual Compliance Assesment Form for PH should be submitted manually in three (3) sets using the relevant form and submit to:

Chief Executive Officer

Malaysian Investment Development Authority (MIDA)

MIDA Sentral

No. 5, Jalan Stesen Sentral 5

Kuala Lumpur Sentral

50470 Kuala Lumpur

How long does it take to receive a decision for the applications?

The application will be processed and a decision will be made within six weeks upon receiving complete information.

Post Incentive Applications

Guidelines can also be found here.

i. Application for Pioneer Certificate

When can I apply for the Pioneer Status Certificate?

The application for Pioneer Certificate should be submitted to MIDA within 24 months from the date of the incentive approval letter. Upon submission of the application, the applicant company should fulfil one of the following requirements:

How can I apply for the Pioneer Status Certificate?

The application for Pioeneer Status Certificate can be made via https://investmalaysia.mida.gov.my.

How does MIDA determine the Production Day for the Pioneer Certificate?

The Production Date of the Pioneer Certificate will be determined based on the followings:

How long does it take to process the Pioneer Status Certificate application?

The application will be processed within 30 days upon receiving complete information.

Are companies allowed to extend the application for their Pioneer Certificate if they are unable to meet the requirement?

An extension to obtain the Pioneer Certificate can be made to MIDA within 24 months from the date of the incentive approval letter by providing valid reasons. Each application will be evaluated based on the merits of each case.

What if the company failed to submit the application for Pioneer Certificate within the time period stipulated in the incentive approval letter?

The process of incentive withdrawal will be initiated, please contact the Investment Compliance Division here.

ii. Application for Determination of Effective Date for Investment Tax Allowance (ITA)

When to apply for the ‘Determination of Effective Date for Investment Tax Allowance’?

The application must be submitted within 24 months of the date of the approval letter via https://investmalaysia.mida.gov.my.

How long does it take to process the application for the ‘Determination of Effective Date for the Investment Tax Allowance’?

The application will be processed within 30 days upon receiving complete information.

iii. Application for Verification of Compliance to Investment Tax Allowance

When to apply for the 'Verification of Compliance to Investment Tax Allowance'?

The application for the Verification of Compliance to Investment Tax Allowance should be submitted to MIDA within the designated incentive period. Prior to making a tax claim with the Inland Revenue Board (IRB), the company must obtain approval for the verification. The application process can be completed via https://investmalaysia.mida.gov.my.

How long does it take to process the application for Verification of Compliance to Investment Tax Allowance?

The application will be processed within 30 days upon receiving complete information.

Post Licensing Applications

How do I make amendments or changes to my Manufacturing License?

For any amendment/changes on Manufacturing Licence (change of co. name, change of factory location, duplication and consolidation of ML etc.), application can be submitted via https://investmalaysia.mida.gov.my.

How do I update or waive the conditions of my Manufacturing License?

Applications to update or waive certain conditions (equity and export conditions etc.) may be submitted via https://investmalaysia.mida.gov.my.

How long does it take to process the Post Licensing applications?

The application will be processed within 30 days upon receiving complete information.

Invest Malaysia Facilitation Centre (IMFC)

(Pusat Memudahcara Pelaburan Malaysia)

When is the establishment of IMFC

1st December 2023.

What is IMFC?

Invest Malaysia Facilitation Centre (IMFC) establishment is an enhancement to the existing advisory service center at MIDA, with the primary objective of expediting the process of various approvals.

What is the function of IMFC?

Main function of the IMFC is to provide advisory services and guidance to the business community and investors.

Who are the members of IMFC?

IMFC is represented by

How do I set an appointment with IMFC members?

IMFC office is located at Level 16, MIDA Sentral, KL Sentral. IMFC members can be contacted through the list of IMFC Representatives at MIDA.

Would IMFC able to facilitate on matters other than business related matter?

The role of IMFC is to facilitate and expedite the affairs of the business community and investors’ journey in the manufacturing and selected services sectors.

Malaysia–Singapore Third Country Business Development Fund (MSBDF)

What is MSBDF?

The Malaysia–Singapore Third Country Business Development Fund (MSBDF) is an innovative initiative designed to fuel collaboration between businesses and associations from Malaysia and Singapore. Its mission is to facilitate Joint Trade Missions and Joint Feasibility Studies in third countries and Joint Pilots between Malaysia and Singapore, paving the way for exploring and seizing business and investment opportunities in third countries.

Why is MSBDF created?

The primary aim of the MSBDF is to strengthen the bonds of cooperation between Malaysia and Singapore’s private sectors. It supports joint ventures and collaborative initiatives, harnessing the combined strengths of both countries to explore and establish a presence in third-country markets.

Who oversees the evaluation of the MSBDF?

The Cross Border Investment Division (CBI) at MIDA is responsible for the evaluation of the MSBDF, ensuring each application aligns with the fund’s goals and criteria.

How do companies apply for MSBDF? Are hardcopy applications permitted?

Companies keen on applying should complete the BDF – 2024 application form, available for download [here] (insert link). Applications must be submitted via email to [email protected] and [email protected]. It’s important to note that we do not accept hardcopy submissions to streamline the process and maintain efficiency.

What is the timeline for MSBDF application evaluation?

The evaluation process for the MSBDF application is comprehensive, taking up to eight (8) weeks from the receipt of complete information. This ensures a thorough and fair consideration for each submission.

How can I track the progress of my MSBDF application?

For updates and inquiries about your application’s status, please reach out directly to the CBI Division at MIDA. They will provide you with the latest information and guidance.