This site

is mobile

responsive

Malaysia’s Robust Aerospace Sector

Aerospace has been identified as a strategic industry for Malaysia. The industry, energised by the implementation of the National Aerospace Industry Blueprint 2030, has generated high skilled jobs and developed an ecosystem of suppliers in the country. In 2019, revenue from manufacturing and maintenance, repair and overhaul (MRO) activities raked in an estimated RM18 billion and provided jobs for 26,000 skilled workers.

Malaysia’s strategic position and strong local supply chain have contributed to its position as a preferred location for many MRO companies. Over 230 aerospace-related companies have established operations here in the country. They are involved in (MRO), aero manufacturing, education and training, systems integration, and engineering and design activities. Notable players such as Airbus Helicopters, Airfoil Services, Sepang Aircraft Engineering and GKN Aerospace have leveraged on our skilled local competencies to serve their customers in this region. Our local industry champions include UMW Aerospace, CTRM, Aerospace Composites Malaysia (ACM) and Spirit Aerosystems Malaysia. These are among the top tier single-source suppliers to major global aerospace OEMs such as Airbus, Boeing and Rolls Royce.

Business Aviation–A New Growth Area

Business aviation is now becoming a new potential growth area to be explored as this sector is significantly expanding in the region. According to the report made by GlobeAir in comparing to commercial flights, flying private is 30 times less COVID-19 risky. With a minimal risk of infection and the ability to fly long distances, private aviation has proven to be a reliable choice among a wide variety of individuals, from the typical working-class to business people and government officials.

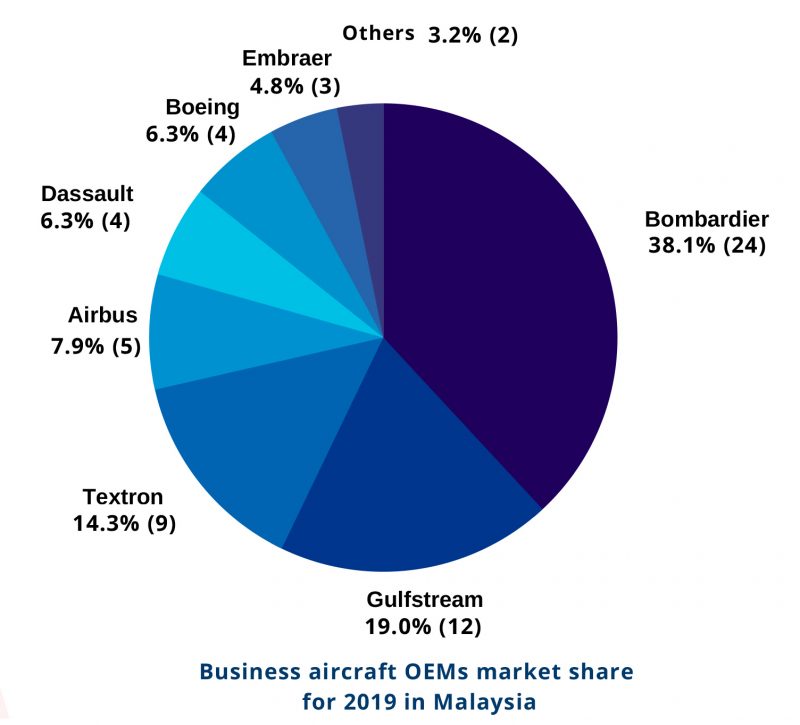

In commercial aviation, it is a two-way race between Airbus and Boeing. Meanwhile, in business aviation, the major OEMs competing in the region are Gulfstream, Bombardier, Dassault, Embraer, Cessna, Pilatus and HondaJet. Asian Sky Group estimated RM15.8 billion worth of new and used business jets or private jets were traded in the Asia Pacific region in 2019. From the same data source, the following graph indicates how OEMs performed in terms of the number of aircraft and market share in Malaysia for 2019:

OEMs assume a vital aspect of the ecosystem in business aviation. Apart from the operations and maintenance of business jets in the region, the industry has a significant characteristic that separates it from the commercial aviation industry, which is customisation and craftsmen. While commercial aircraft are mass-produced on the production line, business jets tend to be more handcrafted, especially for the interior of the aircraft. These require high-value craftsmen with skill sets in fine detailing and build-up engineering work, and could potentially be a key area of focus for growth in the region.

Nevertheless, while having many OEMs in the business aviation is an advantage, it is also a disadvantage. The main advantage is the variation of aircraft products and services that are available to owners and operators. However, this variation also provides complexities and challenges in terms of regulations, licensing and specialised competencies among engineers and technicians. For example, an engineer who is licensed to work on a Gulfstream aircraft may not be qualified to do repairs on a Bombardier aircraft; such is the regulatory compliant nature of the industry.

Major hubs for this sector include Beijing, Hong Kong and Shanghai, followed closely by Singapore in terms of business aviation aircraft movements. Notably, the Sultan Abdul Aziz Shah Airport in Subang has been trailing closely at around 3,500 aircraft movements, which is ahead of those in Macau and Bangkok. This city airport ecosystem, coupled with our strategic location and cost-competitiveness in terms of labour and infrastructure, has contributed to Malaysia becoming a strong competitor in this area. Based on the survey conducted by Frost and Sullivan in 2018, Subang Airport is the most favoured choice for the next business aviation hub in the region.

In Malaysia, Dassault Aviation has recognised the country’s industrial potential and acquired Malaysia’s largest business aviation MRO operation, ExecuJet. Malaysia has since become its biggest market in Southeast Asia, and they expect good prospects in the country and the surrounding region for its aircraft. In the manufacturing segment, Improvage Precision is an exemplary local company that supplies business jet seat components to major OEMs.

The business aviation sector is fast becoming a vital part of the aerospace industry in Malaysia. Besides MRO service providers, it has the potential to spur other supporting businesses such as Fixed Based Operators (FBOs), ground handlers, aircraft insurers and financing services, training institutions and also aircraft technical inspectors.

This sector can also be a potential revenue contributor to the government through highly efficient private aircraft registry which can be seen in tax haven locations such as in the Isle of Man, Guernsey, Malta and San Marino.

Nonetheless, the business aviation sector has not proven immune to the fallout from the COVID-19 pandemic. While this sector usually benefits from times of disruption when business travellers turn to private charters to fill the gaps left by restrictions on commercial aviation, the pandemic has also affected businesses. Given this, MIDA had an engagement with members of the Asian Business Aviation Association (AsBAA) Malaysia Chapter through a webinar on 10th June 2020 and a business workshop on 16th July 2020 led by Mr. Arham Abd. Rahman, Deputy CEO of MIDA. MIDA uses platforms such as this as an avenue for dialogue between industry players and government representatives to provide support and assistance during this unprecedented challenging time.

In mitigating the business impact of the pandemic, industry players need to review their strategy, industrial footprint and operating model to sustain their operations. A potential strategy for aerospace manufacturers to adapt to the ‘new normal’ is by re-examining their production technologies. Industry 4.0 technologies such as connected tools, Big Data, virtual reality and additive manufacturing could facilitate the stepping up of factories’ pace in increasing the operational effectiveness and flexibility of the entire production chain.

MIDA continues to support industry players through fiscal and non fiscal incentives to enable companies to invest in capability and technology development. Towards this end, they will be ready to take advantage of the increasing demand for aircraft once again when the industry recovers. MIDA’s engagement with the stakeholders has also helped to identify strategic initiatives that could help Malaysia to keep pace with other countries as well as to capture the upside growth of the aerospace sector which is a strategic enabler of future industries and technologies.