This site

is mobile

responsive

On 18 January 2021, YAB Prime Minister announced the launch of the Government’s latest assistance package to help alleviate the impact of the COVID-19 pandemic to the Rakyat and business communities. The PERMAI assistance valued at RM15 billion comprises a total of 22 initiatives, anchoring on three objectives:

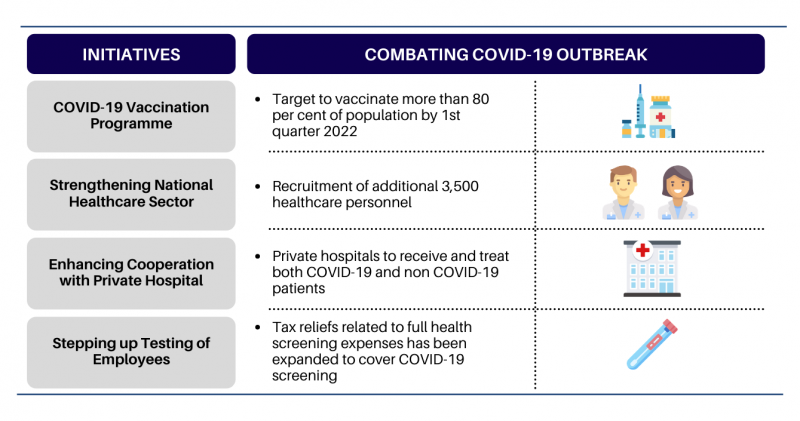

COMBATING THE COVID-19 OUTBREAK

The Government has allocated an additional budget of RM1 billion for the Ministry of Health (MOH), the National Security Council as well as other relevant agencies for combating the COVID-19 pandemic. This will also complement the other measures to strengthen the National Healthcare Sector, including the recruitment of an additional 3,500 healthcare personnel this year, on top of the 8,000 personnel recruited in 2020, and enhancing cooperation with private hospitals to alleviate the strain on public healthcare system.

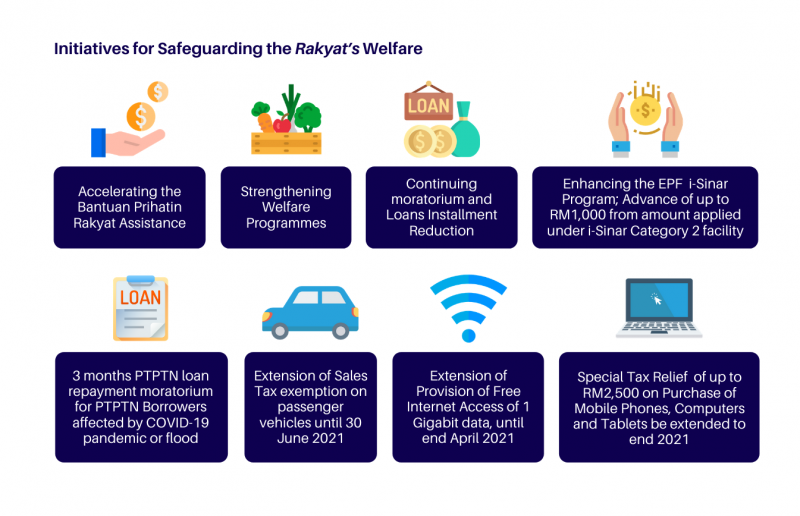

SAFEGUARDING THE RAKYAT’S WELFARE

The PERMAI assistance package will safeguard the Rakyat’s welfare, especially the vulnerable groups in the society. Among the existing programmes to be accelerated and strengthened include the Food Basket Programme; where essential food items are provided for each eligible households; and an allocation of RM25 million for the Government-Linked Companies/ Government-Linked Investment Companies (GLIC/GLC) Disaster Relief Network programme as a matching grant for social initiatives.

Besides, following the current Movement Control Order (MCO), the Government has also emphasised the continuous assistance offered by the banks on loan moratorium facility, including the extension of the moratorium and restructuring of loan repayments.

SUPPORTING BUSINESS CONTINUITY

The Government has announced the following measures to support the business community:

Improving the Wage Subsidy Programme

The Wage Subsidy Programme 3.0 under Social Security Organisation (SOCSO) will be enhanced, whereby all employers operating in MCO states will be eligible to apply. Eligible employers will receive a wage subsidy of RM600 for each of their employees earning less than RM4,000 a month, while the wage subsidy limit for each employer will be increased from 200 to 500 employees. This initiative which involves another allocation of RM1 billion, is estimated to benefit 250,000 employers and more than 2.6 million workers.

PERMAI Prihatin Special Grant

Expansion of the Prihatin Special Grant Plus assistance to cover 500,000 small and medium-sized enterprises (SMEs) in MCO states with one-off payment of RM1,000 each, while 300,000 SMEs in other states will receive RM500 each.

Providing One-off Financial Assistance to Taxi and Bus Drivers

One-off financial assistance of RM500 to 14,000 tourist guides and 118,000 taxis, school buses, tour buses, rental cars and ehailing vehicles.

Accelerating the Implementation of Microcredit Schemes

The Government will expedite the implementation of the RM1 billion microcredit facilities to assist micro enterprises and SMEs’ cash flow. These microcredit schemes include soft loans amounting to RM390 million by Bank Simpanan Nasional, RM350 million by Agrobank and RM295 million by Tabung Ekonomi Kumpulan Usaha Niaga (TEKUN).

Supporting and Boosting Online Businesses

The implementation of the SME and Micro SME e- Commerce Campaign and Shop Malaysia Online Campaign will be accelerated with an allocation of RM300 million to support entrepreneurs and businesses involved in online sales or e-Commerce platform.

Enhancing the Danajamin PRIHATIN Guarantee Scheme

To promote the growth of the private sector and maintain Malaysia’s competitive position as an investment destination of choice, the Danajamin Guarantee Scheme or SJPD, which was announced under the PENJANA package will be enhanced:

– Increase the maximum financing from RM500 million to RM1 billion

– Expand the scope to cover working capital with a guarantee period of up to 10 years; and

– Allow foreign-owned companies operating in Malaysia to obtain SJPD guarantee provided that Malaysian employees accounted for at least 75 per cent of their workforce.

Rescheduling and Extending the Moratorium Period for MARA Loans and MARA Premises Rental

MARA will extend its MARA Prihatin Peace of Mind 2.0 programme where borrowers can apply to reschedule the repayment of MARA education facilities or business loan moratorium until 31 March 2021. In addition, MARA will also provide a 30 per cent rental discount on business premises up to April 2021.

Continuing Electricity Bill Discounts

Provision of a special discount of 10 per cent on electricity bills for the period of January-March 2021 to six business sectors; comprising hotel operators, theme parks, convention centres, shopping malls, local airline offices, travel and tour agencies.

Introducing a Bus and Taxi Hire Purchase Rehabilitation Scheme Syarikat

Jaminan Pembiayaan Perniagaan will introduce a Bus and Taxi Hire Purchase Rehabilitation Scheme. A 50 per cent guarantee on financing from hire purchase and leasing companies will be provided for selected vehicles, such as sightseeing buses and taxis. This will enable buses and taxis operators to restructure their financing with a 12- month moratorium and lower monthly repayments.

Extending the Temporary Measures for Reducing the Impact of COVID-19 Act 2020

The Temporary Measures for Reducing the Impact of COVID-19 Act or Act 829, which came into force on 23 October 2020, was enacted to assist individuals and businesses that were economically impacted by the COVID-19 outbreak.

The effective period under this Act, covering the inability to perform contractual obligations, expired on 31 December 2020. Given the current situation and the MCO announcement, the Government has agreed to extend the effective period of inability to perform obligations to 31 March 2021.

Source: MIDA e-Newsletter January 2021