This site

is mobile

responsive

Global Speciality Chemicals Market

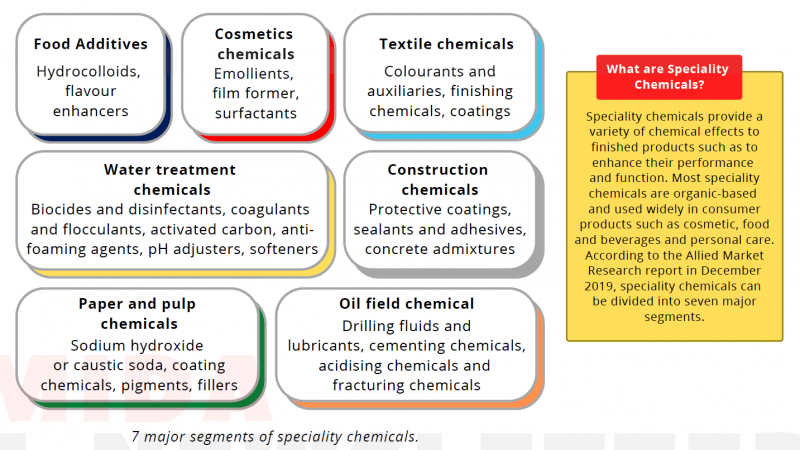

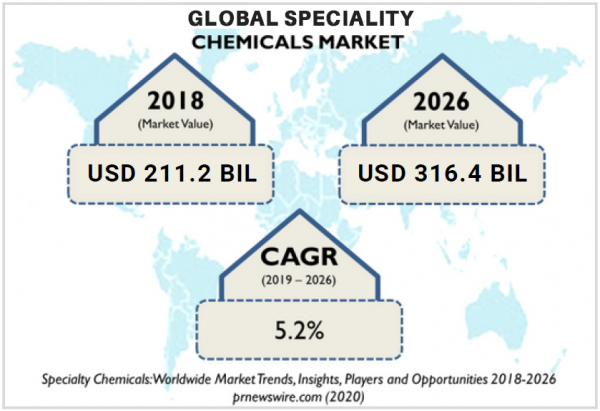

The market for speciality chemicals has emerged as among the top segments of the chemical industry globally. From 2019 to 2026, the global market of speciality chemicals is expected to grow at a compounded annual growth rate (CAGR) of 5.2%, reaching USD316.4 billion[1]. Asia Pacific is set to remain the largest market for speciality chemicals in terms of volume due to demands by established and rapidly industrialising nations like India, China, Japan, South Korea and Taiwan.

This growth is mainly driven by end-user industries such as food additives, cosmetic chemicals as well as pulp and paper. The current changing consumer lifestyle has also indirectly led to increasing demand for speciality chemicals, especially for cosmetics and food additives. Moreover, heavy investments in the construction industry in Asia Pacific such as India, China and Southeast Asia are expected to further boost the demand for speciality chemicals in this industry.

Currently established multinational companies, with their diversified product portfolio and ability to adopt modern technology, dominate the global speciality chemicals market.

These companies also have the capabilities to undertake continuous R&D, leading to further development of speciality chemicals. Among the top global players in the industry are Dow Chemicals (USA), BASF (Germany), Dupont (USA), Akzo Nobel (Netherlands) and DSM (Netherlands).

McKinsey’s 2017 report ‘Digital in Chemicals: From Technology to Impact’ anticipates the speciality chemical segment to be among the main sectors adopting digitalisation and automation of their production lines. This observation was based on the current trends of companies, which are going further by utilising advanced analytic models in their production to improve accuracy, collect realtime data and enhance the performance of finished products.

The report also highlighted that the chemical industry is poised to be an early beneficiary of the vastly expanded modelling and computational capabilities of quantum computing[2].

This new approach to computing has the potential to enable chemical companies to make better products, at a lower cost, in less time using artificial intelligence (AI) simulation. It can also assist in the formulation of mixtures by constructing complex molecularlevel processes involved in shorter periods of time. Furthermore, this industry can support the optimisation of mixtures to be effective for a whole range of applications in various industries such as cosmetics, electrical and electronics (E&E) and food.

Speciality Chemicals in Malaysia

For years, the chemicals and chemical products subsector is one of the largest contributors to investments in the manufacturing sector in Malaysia. In 2019 alone, the sub-sector ranked fifth in terms of approved investments in the manufacturing sector, accounting for RM4.8 billion or 11.7% of the total approved investments in the sector.

Although the chemicals and chemical products industry in Malaysia can be considered to be matured with a wellestablished ecosystem, there are immense opportunities amidst challenges. Among the biggest challenges faced by Malaysian manufacturers is to compete in the global market by offering high-quality products while maintaining lower cost margins. The increasing cost of doing business in Malaysia, especially for energy and labour cost, is a prevailing issue that needs to be mitigated to strengthen the speciality chemical segment in the country.

The manufacturing process of speciality chemicals, in itself, is dynamic and flexible. The raw materials, products, processes, operating conditions and equipment used may change regularly. Given that speciality chemicals requires complex formulation and customisation to make up the chemical producer’s portfolio, expertise in understanding chemical compositions, properties and applications of various speciality chemicals is very important. However, the development, innovation and new technologies within the industry are still driven by international companies that have well-equipped facilities such as BASF, Dow and DuPont. This puts additional pressure on local players to maintain their market share and remain competitive.

Strategy&, PricewaterhouseCoopers’ (PwC) global strategy consulting business, highlighted that the speciality chemicals segment is highly dependent on innovation.

However, investments made for innovation by the industry within Malaysia is still below par. This needs to be addressed in line with the rapid development of the industrialisation of the country.

In this regard, the Chemical and Advanced Materials Division of the Malaysian Investment Development Authority (MIDA) has been actively engaging with industry stakeholders to promote and facilitate investments in the speciality chemicals segment. The production of speciality chemicals is listed among the products or activities eligible for consideration of an incentive under the Promotion of Investment Act (PIA), 1986.

To date, the feedback received from the industry has been very encouraging. Recently, prominent Malaysian chemical company, Petronas Chemical Group Berhad (PCG) acquired Da Vinci Group B.V., a Netherlands-based company producing speciality chemicals such as silicones and lubricant oil additives. The acquisition marks PCG’s commitment to expanding its business into the promising speciality chemicals segment.

Opportunities in Speciality Chemicals Moving forward, Malaysia is looking to venture into new subsegments within the speciality chemicals segment. Industry players have begun exploring the possibility to produce speciality chemical products directly from crude oil by using Crude Oil to Chemicals (COTC) technology. Non-fuel products such as catalysts, aromatics, white spirits (naphtha), wax and white oil offer a huge market potential to be explored. These products can be used as additives for various industries such as food and beverages, construction and automotive.

Against the backdrop of the COVID-19 pandemic, industry players must be prepared to shift their manufacturing processes. There is an urgent need to implement new technology and digitalisation as well as to invest in R&D, both primary and secondary, to ensure operational production can continue to meet the needs of the market.

MIDA is also actively encouraging digitalisation in the manufacturing sector, particularly in the speciality chemicals segment.

Digitalisation can be the ‘magic’ wand for industry players to boost productivity and reduce errors of production. Malaysia welcomes speciality chemical manufacturers to continuously seek out innovative, new technologies to enhance the quality of their product, optimise their value chains and ultimately align with market needs.

The Malaysian Government, through MIDA will continue to support and strengthen Malaysia’s speciality chemicals segment. Potential players are encouraged to take the opportunity to explore the potential of leveraging Malaysia as their launch pad into the speciality chemicals market in Asia Pacific. Building upon the country’s comprehensive local supply chain and ecosystem, Malaysia is indeed strategically positioned to be the preferred regional investment destination, particularly in the speciality chemicals segment.