This site

is mobile

responsive

The Government announced a National Economic Recovery Plan (PENJANA) on 5th June 2020. These are the FAQs on Tax Incentives for Companies Relocating into Malaysia under PENJANA.

What are the Special Tax Incentives under PENJANA?

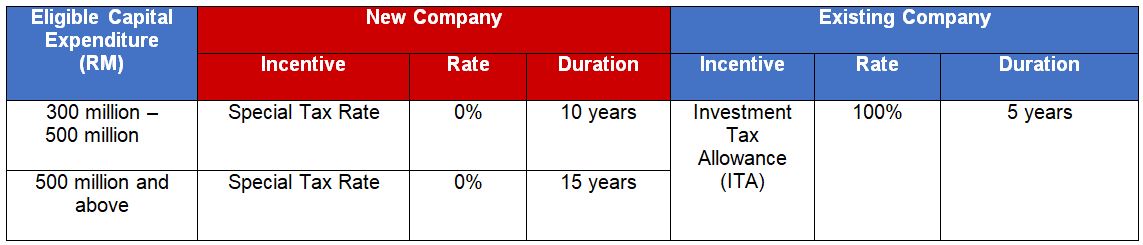

Tax incentives offered to a new and existing company relocating into Malaysia under the Income Tax Act 1967 are as follows:

What is the definition of a new company?

This refers to a company relocating its manufacturing facility for eligible activities from any country to Malaysia or a company establishing its new operation in Malaysia. This company does not have any existing manufacturing operations in Malaysia.

What is the definition of an existing company?

This refers to a foreign or locally owned company that has existing manufacturing operations in Malaysia and seeks to relocate its manufacturing operation from outside of Malaysia for a new business segment. The products from the new business segment are not part of their expansion project for existing products.

What is a Special Tax Rate?

A Special Tax Rate is offered to a new company with 0% tax rate on taxable income from the approved business activity for a period of up to 15 years subject to the specified amount of capital expenditure.

What are the criteria of this incentive for the Manufacturing Sector?

The company meets the definitions of ‘new company’ or ‘existing company’ as outlined under this incentive.

The company is to undertake manufacturing activities excluding the listed activities as in Appendix A.

What are the conditions of this incentive for the Manufacturing Sector?

The new company or existing company to incur the first capital expenditure within 1 year from the approval date;

The company to incur the minimum capital expenditure (not including land) within 3 years from the date of the first capital expenditure incurred as follows:

For a New Company

0% special tax rate for 10 years: between RM300 million to RM500 million; and

0% special tax rate for 15 years: above RM500 million.

For an Existing Company : above RM300 million

The Company will be subjected to the following conditions:

Fixed Asset Investment; and

80% Malaysians employment by the third year of the company’s production.

Existing companies applying for this incentive to keep separate accounts for products/activities with Tax Incentive and for products/activities without Tax Incentive; or to set up new entities to carry out the project.

The company is required to have a paid up capital of more than RM2.5 million.

Details of these conditions will be listed in the Tax Incentive Guidelines here

What percentage of statutory income can be deducted for an existing company?

For the existing company, this incentive offers an Investment Tax Allowance (ITA) of 100% of qualifying capital expenditure incurred within a period of 5 years. The allowance is offset against 100% from the statutory income of the activity.

What are the types of qualifying/eligible capital expenditure?

The qualifying/eligible capital expenditures are the same as stipulated under Section 29 (7) Promotion of Investments Act 1986 which are capital expenditures incurred on a factory building (excluding land) or any plant and machinery used in Malaysia.

What are the additional conditions for an existing company that is currently enjoying a tax incentive?

The existing company must keep separate accounts or incorporate a new entity to undertake such activities.

What is the procedure to apply for this incentive?

The company may submit an application to the Malaysian Investment Development Authority (MIDA) before 31 December 2022.

The application form can be downloaded here .

Where can I find more information on PENJANA?

Please visit the PENJANA website (https://penjana.treasury.gov.my/).