This site

is mobile

responsive

The global pandemic has contributed much strife and unexpected challenges to many in the past year. As governments and businesses undertake various response efforts, the utmost priority has been to ensure safety, hygiene and social distancing practices especially in the medical and food sectors. Personal protective equipment (PPE), such as medical masks, gloves, protection goggles and coveralls have now evolved into necessary commodities. The surge in demand for PPE has spurred policymakers, industry players and healthcare organisations to act swiftly to ensure a stable and sustainable PPE supply chain. Industry players can capture the rising opportunities by gaining a better understanding of the growing PPE market and differentiating themselves through innovation and technology.

Diagram 1: Products of PPE Source: Tang, Sammer & Brady, Mike & Mildenhall, Joanne & Rolfe, Ursula & Bowles, Alexandra & Morgan, Kirsty. (2020)

Snapshot of the Global Medical PPE Market

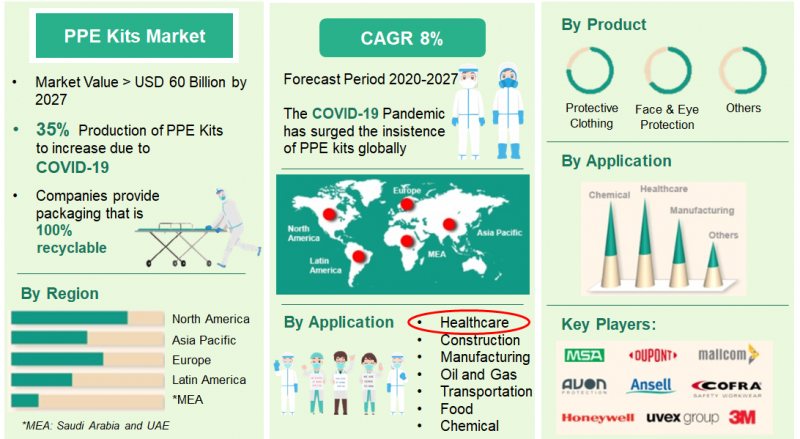

Prior to the peak of COVID-19 pandemic, the global PPE market size was valued at USD60 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 8 per cent from 2020 to 2027 (Source: FutureWise, May 2020). Research forecast that spending on PPE is going to be nearly tripled by 2027, with 60 billion units of PPE distributed in the first half of 2020 to help healthcare providers, a 15 per cent increase over the same period in 2019. In addition, demand for N95 respirators will continue to grow more than 5 per cent per year until 2024.

However, with the pandemic raging in 2020, the medical PPE market experienced a surge with significant increases of 1,200 per cent and 600 per cent for medical masks and medical gloves respectively. According to the World Health Orgnisation (WHO), it was estimated that 89 million medical masks are required for the COVID-19 response each month, along with 76 million examination gloves and 1.6 million medical goggles.

Diagram 2: Global Market Snapshot of PPE Industry

(Source: FutureWise, May 2020)

Openings for Companies in Malaysia

The upsurge in demand for PPE due to the pandemic is a window of business opportunities for many companies, be it existing players or newcomers to expand and diversify their investments into the most essential and profitable business ventures. Among the new public listed players in Malaysia that have announced their ventures into PPE manufacturing are Luster Industries, Iconic Worldwide and Parlo Bhd. Other non-traditional PPE players are also successfully making inroads into the business such as companies making plastic reels, made-up garments, bedsheets, automotive OEMs, ceramics, fashion conglomerates and designers. Notably, these companies are not only interested in manufacturing, but also opportunities in the distribution segment of the industry value chain.

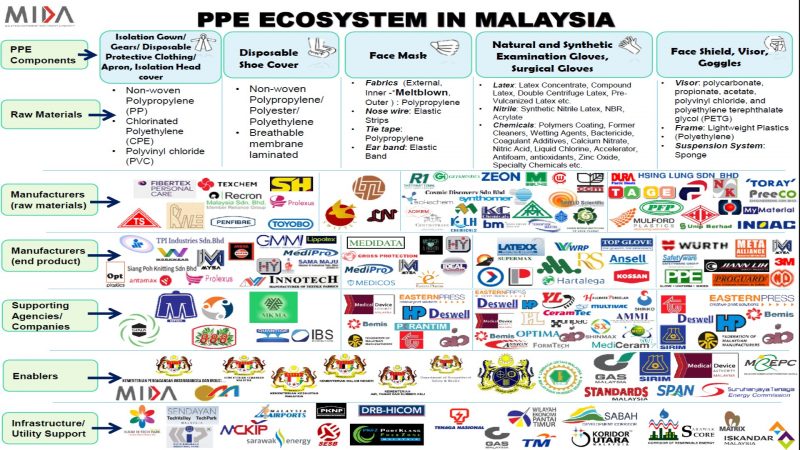

Malaysia’s PPE Ecosystem

As of March 2021, MIDA has approved 46 projects to manufacture PPE (excluding gloves) with investments of RM3.65 billion that provides 9,205 employment opportunities. Of this total investment, 70 per cent (RM2.55 billion) is contributed by domestic investors while the balance came from foreign investors. As for the gloves industry alone, 14 projects have been approved with an investment of RM3.05 billion providing 8,346 job opportunities. Of the projects approved, 71 per cent came from domestic while the remaining are from foreign sources.

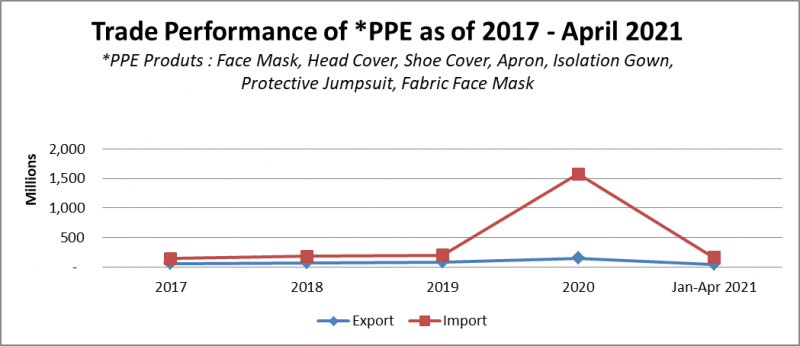

Diagram 3: Trade Performance of PPE (excluding Glove)

Source: MATRADE

Based on the five years trade performance of PPE (excluding Gloves), the county’s total import of RM2.26 billion was higher compared to the total export of RM0.5 billion.

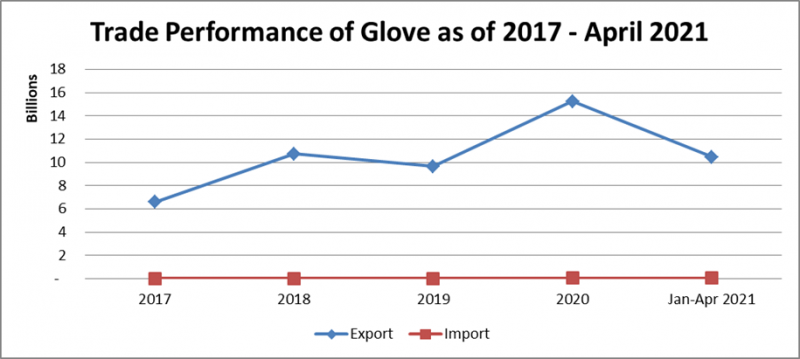

Diagram 4: Trade Performance of Glove

Source: MATRADE

Conversely, for Gloves, the total export of RM52.7 billion was higher compared to the total import of RM0.13 billion.

MIDA continues its commitment in attracting new investments by organising a significant number of e-Special Project Missions (eSPM) with MIDA Overseas Centers with the objective to entice multinational companies to invest in Malaysia for certain raw materials such as Polypropylene Meltblown. Among the global players include Berry Global (USA), Freudenberg (Germany) and Dongying Shenzhou Nonwovens Co. Ltd. (China). Local and existing foreign companies such as Durio PPE Notion Venture, Alpha Master, UPA Healthcare Products, GPI Technology, Fibertex Personal Care, Uprise Elastic Webbing and Lotte Chemical Titan were facilitated through e-Domestic Special Project Mission (eDSPM) for them to venture and reinvest in PPE products.

Diagram 5: PPE Industry Ecosystem in Malaysia

Making Safety Smarter in the PPE Industry

The future of manufacturing is digital, with smart manufacturing concepts and digitalisation becoming increasingly a global norm. Companies within this industry need to make safety smarter if they want to branch out to the global market. Automation and digitalisation are key investments for companies to reduce their reliance on manual labour. The enhancement of automation processes will certainly improve the quality of their PPE products to meet strict international safety standards.

MIDA together with MITI and SIRIM has been a strong advocate for the business community to automate and digitise their operations through providing strategic facilitation, insights and financial assistance.

Malaysian Small and Medium Enterprises (SMEs) and Mid-Tier Companies (MTCs) in the manufacturing and services sector are eligible to apply for the Smart Automation Grant (SAG) under the PENJANA initiative. This allows up to a maximum of RM1 million per company (matching basis 1:1) to kick start their development and implementation of projects by adopting technology and automation in their operations.

Another incentive under MIDA that has the same objective as SAG and can be utilised by companies is the Automation Capital Allowance (Automation CA). Companies applying for Automation CA can be considered up to a 200% tax deduction on the first RM4 million expenses incurred within 8 years of assessment (2015-2023).

In efforts to promote digitalisation, the Government has introduced the Industry4WRD Intervention Fund as a financial support facility to assist Small and Medium Enterprises (SMEs) in the manufacturing and related services sectors to make the leap into Industry 4.0. The fund provides a matching grant of 70:30 on a reimbursable basis up to RM500,000 for eligible expenditure. To be eligible for the fund, companies are required to undertake the Readiness Assessment (RA) with Malaysia Productivity Corporation (MPC).

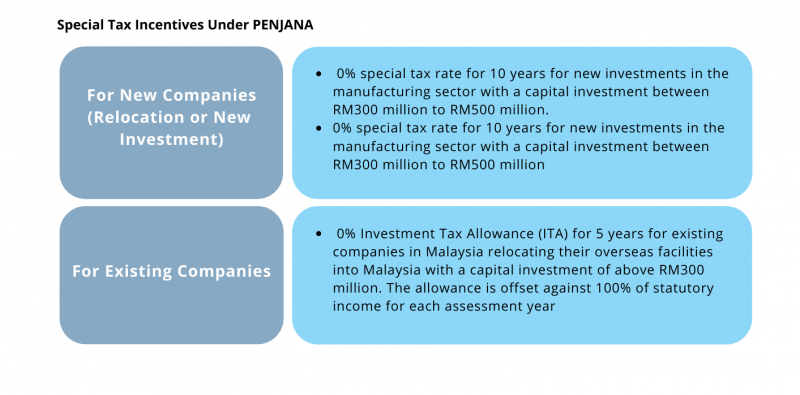

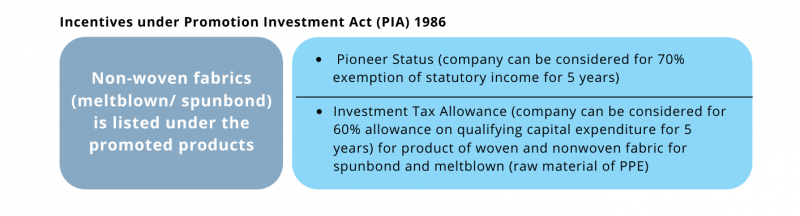

Investment Support for New and Existing Companies

The Government through MIDA is committed to assist any company that is planning on making future investments by providing incentives under PENJANA and other initiatives.

MIDA-FMFTA Initiative

MIDA in partnership with the Federation of Malaysian Fashion, Textile and Apparel (FMFTA) initiated a move to support the Government’s efforts to fill in the gap in the PPE ecosystem, particularly the isolation gown, boot covers and head covers segments.

In June 2020, FMFTA through more than 20 of its memberswho are PPE manufacturers had successfully produced over 5 million pieces of PPEs within just two months. These were essential supplies for the Ministry of Health, private hospitals and healthcare institutions. The effort is ongoing continues to assist these frontliners. In addition, FMFTA collaborated with SIRIM to develop Malaysian Standards for non-medical face masks and face shields.

Roundtable Discussion with Stakeholders and Industry Players

In addressing the issue of PPE shortage, MITI and MIDA have initiated a roundtable discussion with the relevant associations and PPE manufacturers. The purpose of the meeting was to highlight the lack of main raw materials such as Non-woven Polypropylene Meltblown and Polypropylene Resin that are essential in the PPE production.

PPE Inventory System at MIDA

A special dedicated system has been developed by MIDA to connect the buyers and suppliers/manufacturers of PPE in Malaysia. It is an active digital system to assemble manufacturers and provide updated information on the production and consumption of PPE in the country. This system is expected to be launched by the end of 2021.

What’s Next?

The future of the PPE industry is driven by product innovation, changing business models and new technologies such as wearable PPE products. Companies need to think of the long-term payoff. Rethinking current business models and adopting digital solutions will be crucial to ensure competitiveness and accelerate the road to recovery. It would be an opportune moment for investors to move into the PPE market and existing players to deploy innovative growth strategies. The priority right now is to ensure the continuity of PPE supply in the country. Decisive actions need to be taken to emerge stronger and more resilient. As the Government takes the lead in rebuilding the economy, it is important for the public and private sectors to work closely to streamline efforts and enhance local production capacity. Strategic engagement and cooperation will boost efforts in addressing the weak links in the PPE supply chain. This includes avoiding dependency on imports, establishing a more coordinated national stockpiling of PPEs and having more efficient resource allocation.

As the world reimagines safety and technology in workplaces and daily life, the PPE industry will remain relevant for businesses and individuals. Malaysia’s strong manufacturing base and comprehensive ecosystems provide the right mix for investors, local and foreign, to capture rising opportunities in this industry, hence positioning Malaysia as a major global supplier of PPE products in the coming years.

Source: MIDA e-Newsletter June 2021

Explore other related content to further

explore MIDA’s insights.