This site

is mobile

responsive

Introduction

Globally, SMEs play a significant role in contributing to national GDP growth, employment and innovation. In Malaysia’s context, SMEs represent 90 per cent of business establishments. They also account for 65 per cent of the country’s employment and contribute approximately 40 per cent to the country’s GDP.

MIDA acknowledges that SMEs are the foundation of Malaysia’s future development. They are the most vigorous and fastgrowing segment of the Malaysian economy. On this premise, MIDA continuously seeks new approaches and strategies to facilitate their growth and competitiveness in the domestic arena and global markets. This is in addition to MIDA’s assistance in improving the overall business environment for local companies and SMEs.

The presence of new and disruptive technologies has transformed the overall landscape of industries globally, posing greater challenges to SMEs. MIDA consistently highlights the need for domestic industry players, particularly SMEs, to embrace innovations and harness new sources of growth to deliver the next age of economic prosperity in Malaysia. However, access to financial resources is an obstacle to the growth and sustainability of local companies and SMEs in Malaysia.

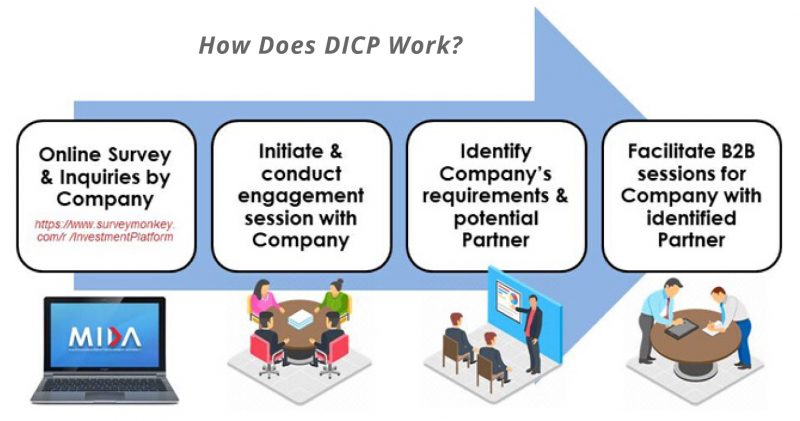

In addressing this, MIDA through the Domestic Investment Coordination Platform (DICP) team provides the missing link between businesses, funding, technology and research capability. The DICP team works closely with local regulators, technology providers, financial institutions as well as equity and corporate advisory firms to facilitate SMEs to grow their businesses; subsequently, driving more domestic direct investments (DDI) in the country. The team also engages with R&D institutions for the commercialisation of various projects.

DICP’s Scope of Facilitation

The DICP team actively and directly engage with SMEs to identify their requirements and business needs before initiating a business matching session with relevant financial institutions, potential business partners, and/or technology providers.

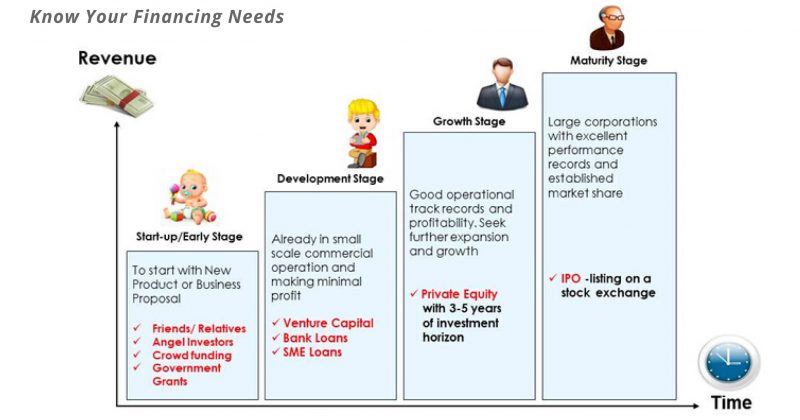

The DICP team also assist local companies and SMEs in identifying their potential sources of financing based on the current stage of their business. Companies at different stages of business, i.e. start-ups or mature corporations, will have different accessibility to funding facilities. As such, it is vital for companies to thoroughly understand their position to fully leverage the resource available to them.

Prior to the implementation of the Movement Control Order (MCO) to curb the spread of COVID-19, the DICP team conducted meetings and engagement sessions with an average of three companies per day from various industry sectors, with different needs and requirements. Some companies require capital injection for business expansion plans, structured financing for new projects as well as those seeking joint venture partners or merger and acquisition opportunities.

DICP’s Success Stories

As to date, the DICP team has successfully assisted many local companies and SMEs in pursuing their business plans. Among the achievements include:

In addition to business-tobusiness facilitation, the team also organises and promotes seminars and forum on alternative financing, in collaboration with financial institutions, equity and venture capital firms.

The DICP team is looking forward to organising a series of forums on the topic of ‘Suppliers’ Financing’ for SMEs to assist them in integrating into the domestic supply chain for large corporations. The team is also exploring the theme of ‘Introduction to Sukuk and Bonds’ for local companies to increase their knowledge of available financing alternative for their projects.

Way Forward – Post COVID-19 Pandemic

As COVID-19 has shifted from a sole health crisis to a multifaceted challenge, particularly on the economic front, MIDA is continually assessing how local businesses and SMEs in Malaysia will weather this storm. MIDA is also strategising on the types of assistance that would ensure the survival and sustainability of SMEs during these challenging times.

During this time, local businesses and SMEs must embrace the new normal in doing business. There is an urgent need for companies to transition and optimise the usage of modern technology, business digitalisation, and e-commerce platform to remain relevant. This includes simple tasks such as the increased usage of email communication and video conferencing to replace face to face communication, as well as webinars to replace group seminars and forum.

The DICP team will also provide the necessary assistance to businesses to embark on digitalisation and adoption of new technology. Local companies and SMEs are urged to leverage on DICP’s facilitation in their venture to realign and restructure their businesses. More information can also be obtained on the MIDA website at ww.mida.gov.my or email to [email protected].