This site

is mobile

responsive

In our ever-changing world, one of the most pressing challenges we face is to sustainably feed a growing global population, estimated to reach 10 billion by 2050. Balancing the production and consumption of animal products becomes crucial as we strive to achieve this goal while stabilising the climate, promoting economic development and reducing poverty.

The global consumption of meat currently stands at approximately 350 million tonnes per year, while the demand for milk reaches a staggering 740 million tonnes annually. As the global population continues to grow, so does the need for animal-derived products. It is, therefore, imperative that we ensure a consistent supply of animal feed and its ingredients to support the well-being and productivity of livestock.

Asia, known for its high demand for animal products, has witnessed significant increases in the import of key animal feed ingredients. Notably, China’s maize imports have tripled in 2021, reaching over 28 million tonnes, as reported by Reuters. Similarly, countries such as the Philippines, Malaysia, Thailand, and Vietnam have also seen a substantial rise in maize imports, surpassing 5 million tonnes each.

Animal feed plays a vital role in the supply chain, referring to specific crops grown to be processed and enriched with functional ingredients to meet the dietary needs of livestock, poultry, aquatic animals, and pets. The primary ingredients used in commercially prepared feed are feed grains, such as corn, soybeans, sorghum, oats, barley and fishmeal. These grains are milled with premium feed additives or supplements to create varied feed specifics, including poultry feed, pet food and aquaculture feed.

The global animal feed market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.3% during 2023- 2028, as it reached US$501.9 billion in 2022. The rising demand for meat and animal-based products with the consequent increase in commercial livestock, poultry and aqua farm production represent some of the factors driving the global animal feed market. As for Malaysia, in 2021, the sales value of manufactured prepared animal feeds in Malaysia was approximately RM16.49 billion, more than RM3 billion increase in value compared to the previous year.

On the scope of the pet market, the global pet food market (valued at USD 110.5 billion in 2021) is projected to grow to USD163.7 billion by 2029, exhibiting a CAGR of 5.11 per cent, as quoted by Fortune Business Insights. As for Malaysia, a survey by animal market research firm, PetFair, reported ownership of cats at 658,000 and dogs at 398,000 in 2019.

According to the Department of Statistics Malaysia (DOSM), in 2020, about 69.7 per cent of Malaysia’s working age (15-64 years) have adopted pets, especially cats and dogs. Pet owners purchasing practices and changing attitudes significantly impacted the pet food industry. The Malaysian Pet Food market is projected to grow at a CAGR of 6.2% to hit USD331.7 million by 2026 as Malaysian pet owners are being more cautious in ensuring their pets receive the best nutrition.

Malaysia’s animal feed industry is supported by prominent players such as Gold Coin Feedmills, Leong Hup Feedmill, MFM Feedmill, Ang Hock Stockfeeds, PK Agro-Industrial Products, and FFM, who are members of the Malaysian Feedmillers Association (MFA). These companies, operating for over 30 years, recognize the pressing need to expand the animal feed ecosystem and strengthen the supply chain.

Currently, Malaysia heavily relies on imported corn, soybean and barley grains for poultry and ruminant feed. According to World Grain, in 2018, Malaysia imported 4 million tonnes of grain corn, mainly from Argentina and Brazil, while various grains are sourced from the United States, Ukraine, Russia, Canada, India and Australia. The members of MFA also own nationwide integrated farms, which drives the continuous expansion of feed mills and the production of feed additives to meet their own needs as well as cater to the retail market. Notably, prominent industry players like Cargill, CJ Bio and Win Men Biotech have ventured into specialised feed additives.

As at 31 March 2023, a total of 139 approved projects by MIDA are in operation in various animal feed production, with a total of RM 3.8 billion investments.

There are pertinent issues confronting the animal feed industry today. The high price of meat, including chicken meat in Malaysia is the result of the increased cost of running the agriculture farming and meat processing industry. Among the 2,300 poultry breeders nationwide, the cost of poultry feed constitutes 70% of the overall expenses, in addition to logistics, labour, utilities and medicines. The market observed the price of poultry feed increased from RM500 per tonne to RM2,500 per tonne over the past few years.

Furthermore, the livestock industry is also facing significant sustainability challenges due to the scarcity of available land for animal grazing and forage production. Farmers are paying up to RM 80 for a 50kg bag of cattle feed in 2023 compared to RM45 in January 2022, as livestock feed materials are increasingly imported.

Impacts from the imported raw materials persist, as the global supply of grains and soymeal cannot fully cater to rising demands. This deficiency is further exacerbated by the challenges faced by source countries, which are striving to recover from the post-COVID economic downturn. In addition, these countries encounter difficulties due to extreme weather patterns and geopolitical conflicts that impeded the cultivation of farmland for grain production.

In ensuring the long-term survival and growth of this sector, the industry and government is working on a concerted effort to develop the animal feed supply chain on a larger scale. For example, initiatives such as sorghum and corn cultivation in dedicated arable land in Malaysia and increased utilisation of palm kernel waste, such as, fermented palm kernel cake as feed additives and high dietary fats, should be pursued to explore the domestic supply chain further. This will help promote a sustainable supply and reduce dependence on imported feed in the long run. Furthermore, as commercial chicken farms adopt innovative and food-safe alternatives, the government should consider providing incentives to encourage the use of domestic materials through investment facilitation.

The animal feed, pet adoption and agriculture ecosystem must entice millennials to venture into such activities. Their ingenuity may also sync with the global environmental conscience while contributing inclusively to the Malaysian economy.

The viewpoints of the Government, corporate animal feed producers and smallholder entrepreneurs are centered around protecting national resources and livelihoods. The Department of Veterinary Services (DVS) plays a key role in the development of animal feed and animal farming in Malaysia by providing guidance and training on regulation adherence for the poultry and livestock industry, pet care, research on animal diseases and genetic sources, as well as expanding the scope of animal feed additives alternatives.

MIDA and DVS actively seek feedback regarding regulations and policy reviews, which may be detrimental to the progress of the sectors. The midstream and downstream supply chain of Malaysia’s agriculture and food processes remains strongly connected as Malaysia’s dynamic and pioneering business forces would open pathways to new frontiers to build sustainable ecosystems in the animal feed value chain.

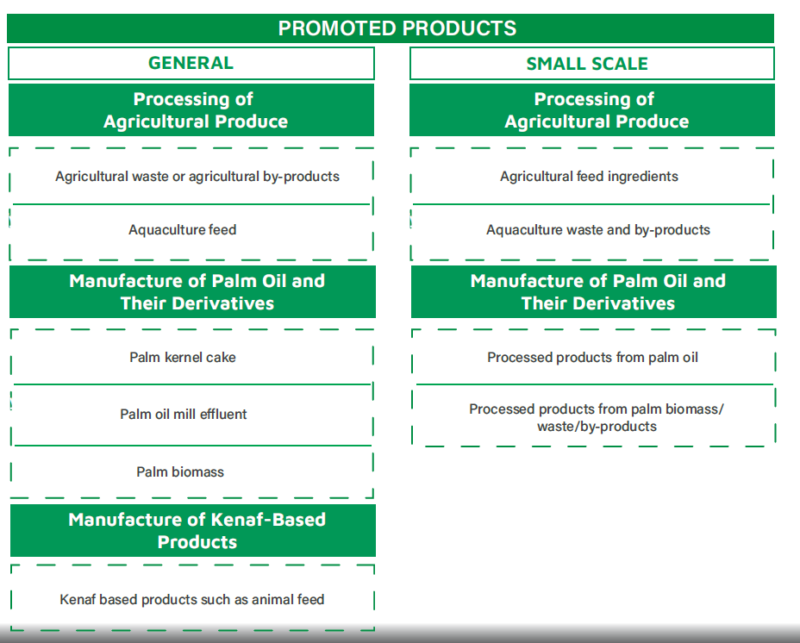

MIDA plays a supportive role by offering tax facilitation for eligible projects that incorporate technology and value-added processes in the production of animal feed ingredients. This encourages investments in the industry and promotes the adoption of innovative practices. By embracing innovation, environmental consciousness, and inclusive economic growth, Malaysia can position itself as a leader in the animal feed industry, contributing to the nation’s well-being and effectively addressing the global challenge of feeding a growing population. To learn more, refer to https://www.mida.gov.my/staffdirectory/food-technology-resource-based-industries-division/.