This site

is mobile

responsive

Malaysia’s digital economy was estimated at USD21 billion (RM88.41 billion) in gross merchandise value (GMV) in 2021, according to the e-Conomy SEA 2021 report by Google Inc, Temasek Holdings Ltd and Bain & Co. Malaysia’s 2021 GMV is projected to hit USD35 billion by 2025 with an 85% permanent shift in digital adoption to utilise digital services.

The nation has seen a surge in digital adoption among businesses and consumers which was driven by the pandemic, which, in turn led to growth of both digital payments for goods and services, especially for e-commerce transactions.

Timeline to June 2021, the e-wallet transactions increased 89% to RM468 million, and online banking has improved 36% with RM12.1 billion payments made over the same period. For businesses, registrations for QR payment facilities jumped 57%, with one million sign-ups over the period.

Digital Financing and MSMEs

Digital financing is able to serve businesses and the underserved, given its ability to lower transaction costs, and increase speed, transparency and availability of financial services. This will allow greater participation of micro, small, and medium enterprises (MSMEs) into the digital ecosystem.

The Department of Statistics Malaysia revealed that there were altogether 1,226,494 MSMEs in 2021 which accounts for 97.4% of all businesses in Malaysia. Of over 1.2 million MSMEs, more than 489,000 MSMEs adopted e-commerce while 378,000 SMEs were trained in e-commerce as of the end of 2020.

The Government via policies such as the Malaysia Digital Economy Blueprint (MyDIGITAL) – launched in February 2021 – is putting in place key infrastructure and governance support systems to

ensure this rise in digital payments use is not a pandemic flash-in-the-pan, but continuous to build sustainably in the coming decade.

Among MyDIGITAL’s key targets are: digitalising 875,000 MSMEs via e-commerce by 2025; the digital economy contributing 22.6% of Malaysia’s GDP by 2030; attracting RM70 billion in international and domestic digital investments by 2030.

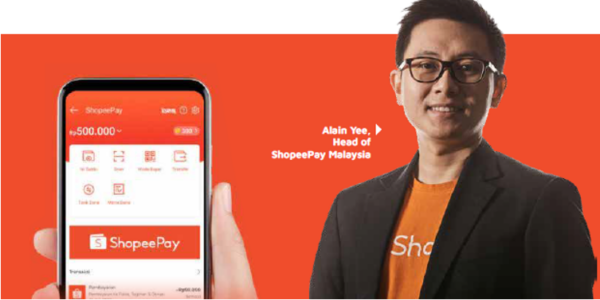

(L-R) Alain Yee, Head of ShopeePay Malaysia with Hardaz Burger Bistro & Coffee, Pulau Pangkor owners.

ShopeePay Takes Digital

Merchants to Greater Heights

With strong government support, a digitally savvy merchant base, and the convenience of the Central Bank of Malaysia (BNM)’s unified QR code DuitNow (enabling users to make payments from several e-wallet operators and banks), Malaysia has become fertile ground for tech unicorns and major brands such as Singapore’s Sea Ltd, which operates e-commerce marketplace Shopee.

Its payments arm, SeaMoney was established in 2014, and is now a leading digital payments and financial services provider in Southeast Asia. SeaMoney’s offerings include mobile wallet services, payment processing, credit, and related digital financial services and products. These services and products are offered under ShopeePay, SPayLater, and other brands in the region.

Shopee launched in Malaysia in 2015, followed by ShopeePay in 2019. This positioned the payments provider to reap the benefits of pandemic-aided digital payments surge across Malaysia and Southeast Asia.

Alain Yee, Head of Shopee Pay, said: “ShopeePay aims to empower the business community by helping those in need to benefit from technology and the digital economy in line with objectives outlined in MyDIGITAL.

ShopeePay is committed to supporting the digitalisation of MSMEs by onboarding micro merchants who have been accustomed to traditional or offline methods of operating their business to go online. Besides helping MSMEs to go online, ShopeePay also facilitates acceptance of e-wallets offline through partnerships with DuitNow QR.

We also have features on the app like ShopeePay Near Me, an online-to-offline feature that uses location-based services to help users discover ShopeePay vouchers from nearby merchants including bazaar stalls, cafes, restaurants, and services,” Yee added.

Inclusive Digitalisation Initatives with B40 Merchants

In the past three years, ShopeePay has worked with various government agencies on collaborations to enable more B40 (bottom 40%) micro-traders to be a part of the digital economy.

This includes the ShopeePay Pushcart Initiative in 2021 to help B40 food and beverage micro merchants impacted by the pandemic to adopt mobile payments for their businesses.

(L-R) Alain Yee, Head of ShopeePay Malaysia with Hardaz Burger Bistro & Coffee, Pulau Pangkor owners.

Through the programme, ShopeePay helped to digitalise 120 micro vendors across five states. ShopeePay’s contribution to participating traders: 0% transaction fee (Merchant Discount Rate) until January 31, 2022; exclusive ShopeePay vouchers; and vendors’ brands to be featured on the ShopeePay Near Me microsite.

This year ShopeePay onboarded 263 vendors to adopt e-wallets via the Retail Sector Digitalisation Initiative Programme (ReDI) organised by the Ministry of Domestic Trade and Consumer Affairs in Pulau Pangkor and Sandakan.

“Digital payment is now a critical component for all business sizes, types and functions. Through our partnerships with ministries, state offices, and government agencies, ShopeePay is committed to improving access to digital payment services for MSMEs and also micro-traders,” Yee said.

Training the Next Generation of Merchants

Thus far, ShopeePay has worked with the Malaysian Communications and Multimedia Commission (MCMC) to train and empower more than 10,000 rural e-commerce sellers via Shopee University classes at MCMC’s rural internet centres.

The e-wallet brand also participated in the Shop Malaysia Online and Go-eCommerce campaigns in 2020 and 2021 with the Ministry of Finance and the Malaysia Digital Economy Corporation to spur the domestic economy, digitise MSMEs, and help Malaysian sellers export overseas. Cumulatively, these campaigns have assisted over 220,000 sellers.

ShopeePay partnered with the Ministry of Higher Education in Siswa Mall, an initiative that helps to educate and train graduates of higher institutions of learning, polytechnic and community colleges nationwide on e-commerce aspects as well as business skills. The initiative expects to benefit over 12,000 graduates.

Separately, together with Universiti Teknologi MARA (UiTM), ShopeePay launched the UiTM E-Mall to help, educate, and train UiTM students to become online entrepreneurs. Currently, there are more than 800 UiTM E-Mall sellers, of which 52 sellers are entirely new to e-commerce.

“Moving forward, we want to continue empowering MSMEs and the underserved communities in Malaysia via our peer-to-peer transfer service within ShopeePay that allows users to transfer, pay, and request money from another ShopeePay user upon verification.

This is a convenient and secure solution for users to transfer money between one another, while assisting in digitalising micro traders who wish to start accepting e-wallets as a form of payment,” Yee said.