This site

is mobile

responsive

Paywatch is a multi-product neo-fintech (NeoFI) company championing fair financial access for underserved workers across Southeast Asia. Its flagship – Earned Wage Access (EWA) solution is the largest in the market, enabling over 200,000 employees to access their earned wages in real time—debt-free—while promoting financial inclusion and resilience for workers throughout the region.

With over USD150 million in EWA transactions processed, Paywatch is now Southeast Asia’s leading EWA provider by volume and reach. The company is backed by top-tier banks such as Citi, OCBC, HSBC and CIMB, and is trusted by Global Fortune 500 companies including Genting Group, CP Group (Lotus’s), DFI Retail (Guardian), Wilmar, TELUS, and Shangri-La Hotels. Headquartered in Malaysia, the company has grown quickly to operate in the Philippines, Indonesia, South Korea, Singapore and Hong Kong—demonstrating the scalability and impact of its inclusive fintech model.

Recognised globally, Paywatch has been featured in studies backed by the UN’s International Labour Organisation and Gates Foundation. It has also collaborated with the UN Capital Development Fund (UNCDF) as a financial inclusion champion, was named among Forbes’ Top 100 to Watch in 2024 and won the Top ESG award in the 2023 Fintech Frontier Awards.

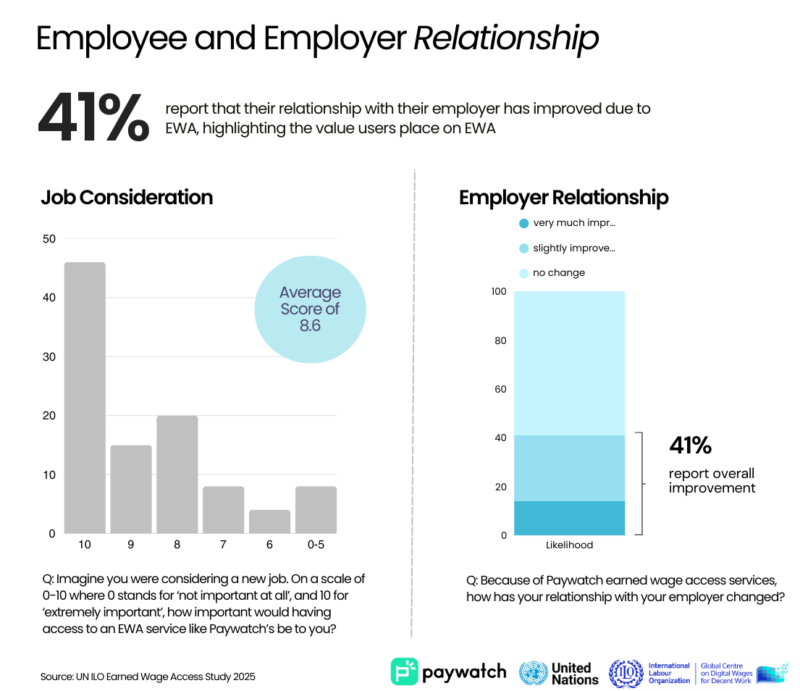

Recent implementation studies reveal compelling HR benefits when companies deploy Paywatch’s EWA as an employee benefit. The data shows that 41% of users experienced improved relationships with their employers after gaining access to earned wages. Perhaps even more significantly, 46% of employees indicated they would actively seek employers offering EWA benefits when considering future job opportunities, underscoring its value as a powerful retention and recruitment tool.

Paywatch’s platform has expanded beyond its core EWA solution to offer a comprehensive financial wellness ecosystem. It now includes bill payments, employee rewards, savings, global money movement, and insurance features—tools that holistically promote healthier financial habits. Users can stay on top of their bills, including daily necessities such as mobile data and water. Also, car insurance payment plans are available for employees to pay directly with their EWA balance.

The transformative impact of these solutions has been validated by a landmark study conducted by 60 Decibels in partnership with the International Labour Organisation (ILO), a United Nations agency. Their research found that responsible EWA solutions like Paywatch’s demonstrably enhance financial well-being, with 80% of users reporting measurable improvements in their overall quality of life. These findings confirm EWA’s critical role in building financial resilience while simultaneously driving workplace satisfaction and productivity.

The choice to headquarter in Malaysia wasn’t accidental. With its vibrant fintech ecosystem and a national vision for digital innovation, Malaysia offered fertile ground for Paywatch’s bold ambitions. In fact, the company’s journey was catalysed by an invitation from the Malaysia Digital Economy Corporation (MDEC) in 2020, following the Financial Innovation Gig Economy Challenge.

Founder and CEO Richard Kim reflects on the company’s mission, stating, “Paywatch is revolutionising how workers access their wages, bridging financial gaps while promoting responsible financial habits. For workers, EWA is becoming a crucial factor in job decisions, while for employers, it strengthens workplace offerings and demonstrates commitment to employee well-being.”

While Paywatch now operates across Southeast Asia, its rapid growth in Malaysia was supported by MIDA – particularly through its Seoul office’s proactive support, reflecting Malaysia’s strong commitment to nurturing high-impact, innovation-driven investments and was instrumental in positioning Paywatch as a regional fintech leader.

Paywatch has attracted over USD30 million in capital investment from global investors outside of Malaysia, including from the US, South Korea, Hong Kong, Singapore and more. As Malaysia is our headquarters, the lion’s share of the USD30 million has been reinvested into the employees, operations and technology developed in Malaysia.

Since then, Paywatch has created over 50 skilled jobs in Kuala Lumpur and is looking to double that number as it builds AI capabilities to serve companies in Penang and Johor with new office branches in plan to open in the future.

As Paywatch continues to innovate, it plans to expand its service offerings and increase its presence in key markets. Currently operating in Malaysia, the Philippines, Indonesia, South Korea, and Hong Kong, the company plans to expand to Vietnam in due course.