Source: Bernama

Proton to build plant in Pakistan

Content Type:

Duration:

|

|

This site

is mobile

responsive

Source: Bernama

Proton to build plant in Pakistan

Content Type:

Duration:

The carmaker, which has been struggling in past years due to declining sales, is seeing signs of recovery following the emergence of China-based Geely which acquired a 49.9% stake in Proton in 2017.

In a statement reply to StarBiz, Zhejiang Geely Holding Group said the move to set up a factory in South Asia was “part of Geely’s commitment to help restore Proton to its position as a bestselling brand in Malaysia and also a leading Asean brand.”

Proton setting up factory in Pakistan will be its first facility in South Asia, tapping into a new market in a country with a population of 210 million.

The plant will be a joint effort between the Malaysian carmaker and its local partner Alhaj Automotive.

Hong Leong Investment Bank (HLIB) Research said the plant in Pakistan marks an important milestone for Proton to expand its export market and becoming an international OEM.

The research house reckons that Proton may not need to pump fresh capital expenditure into the plant in Pakistan as Proton will not own it.

This would, in turn, benefit DRB-Hicom in the long term.

“Al-Haj had already acquired land for an assembly plant for Proton cars nearby Port Qasim area in Karachi.

Al-Haj will own the assembly plant by itself, while Proton will provide the necessary technical support to Al-Haj,” HLIB said.

It reckons that Al-Haj is the exclusive authorised distributor and assembler of Proton vehicles in Pakistan, following an official signing ceremony back in August 2018. It was reported back then that Al-Haj planned to introduce modern and high tech vehicles in different categories including entry level sedans, mid-level sedans, crossovers/SUVs, MPV and hatchbacks in Pakistan.

“We are positive with the new Proton plant set-up in Pakistan, in order to cater to the local Pakistan market, as well as potentially, the regional South Asia market.

“We understand that Proton will not incur capex for the Pakistan assembling plant, as Proton does not own the plant,” HLIB said in its recent report.

It maintained its “buy” call on DRB-Hicom with a target price of RM2.58 on the back of strong demand from Proton’s first SUV model, the X70, which set a precedent to the next model launches by Proton.

“We believe the strong demand for Proton’s new X70 will provide confidence to the market on Proton’s subsequent new model launches (based on Geely platform),” HLIB said.

Three months ago, Proton launched its first SUV model, the X70, which has boosted the carmaker sales significantly.

Proton’s sales rose 42% year-on-year to 12,300 units in the first 2 months, of which almost half was from SUV X70 sales.

The SUV X70 sales had also boosted DRBHicom earnings.

The group recorded a net profit of RM73.02mil for its third quarter ended Dec 31, 2018, compared with a net loss of RM70.03mil in the previous corresponding period, due to better operating financial performances from all of its business divisions.

Revenue in the third quarter rose to RM3.17bil from RM2.9bil a year earlier.

“The higher revenue was contributed by the better performance of the automotive companies, including the sale of the X70 SUV by Proton, which was launched in December 2018,” DRB-Hicom said.

Source: The Star

Another boost for Proton

Content Type:

Duration:

Lotte ChemicalTitan Holding Bhd’s joint venture in the United States is expected to increase group earnings beginning next year after the operations of its two plants stabilise.

The projects – a one-million-tonne per annum ethane cracker plant and a 0.7-million-tonne per annum mono ethylene glycol (MEG) facility – will add 0.64 tonnes or an additional 18% to Lotte Chemical’s total capacity based on the apportionment of its equity stake.

Maybank IB Research has raised the company’s financial year 2020 (FY20)-FY21 earnings forecast by 8.6% and 19.3%, respectively, on the back of higher expected contributions from the two projects.

“Previously, we assumed a contribution of RM40mil in FY20 and RM80mil in FY21. Based on our latest forecast, it was too modest.

“FY19 earnings estimates are unchanged as the US associates will break even and have zero impact on Lotte Chemical’s earnings, based on our forecast,” it said in a research note.

Contribution from the projects to Lotte Chemical are forecast to be RM162mil in FY20 and RM289mil in FY21.

The research house has also upgraded Lotte Chemical from a “hold” to “buy” with a target price of RM4.70, as the share price has de-rated and is now exhibiting deep value.

“Lotte Chemical’s share price has declined by 6% in the past month and is trading at a deep discount, relative to its peers, based on its price-to-earnings ratio, enterprise value-to-earnings before interest, taxes, depreciation and amortisation and price-to-book value.

“We forecast a 5.4% dividend yield in FY19 despite the current outlook,” the research house said in a note.

The two US projects begun operations in February and is now undergoing commissioning ahead of a full commercial production.

The official launch is scheduled for May 7 and the total project cost is US$3bil, consistent with its initial budget.

Lotte Chemical has associate stakes in both projects, 36% in the ethane cracker plant and 40% in the MEG plant.

These are from its 40% holding in Lotte Chemical US, which then has a 90% shareholding in Lotte Axial Chemical Corp LLC US (ethane cracker plant) and wholly owns Lotte Chemical Louisiana LLC (MEG plant).

The US$1.9bil ethane cracker is run with a local US partner, Westlake Group, which holds the remaining 10%. The MEG plant is a downstream facility, the single-largest of its kind in the US costing US$1.1bil.

Maybank IB Research said the new facility came at a time when US’ ethane cracker margins are under pressure due to the ongoing trade war between the country and China.

The bulk of the petrochemical new builds was meant for exports particularly to China but due to the additional barriers imposed, these have been diverted to non-traditional regions such as Africa, South Asia and SouthEast Asia, causing a big decline in product margin.

The research house believed the US investment would help to diversify and reduce Lotte Chemical’s systemic risk, including in foreign exchange.

It said the lower risk profile could potentially increase investor appeal to Lotte Chemical and warranted a re-rating.

Source: The Star

Lotte Chemical earnings set to rise on US plants

Content Type:

Duration:

To be set up on a greenfield site in Karachi, the plant is expected to start operations by the end of next year and create 2,000 direct employment opportunities in its first three years of operations, Proton said in a statement today.

“It is estimated that a further 20,000 indirect jobs will also be created as a result of the new plant being commissioned,” the national carmaker said.

ALHAJ Automotive chairman Al-Haj Shah Jee Gul Afridi said the company would initially source completely built-up units from Malaysia before switching to CKD products once the new assembly plant begins operations.

“We will leverage on our current dealerships located nationwide to start selling Proton vehicles as soon as possible while developing standalone 3S/4S outlets at the same time,” he said.

In Islamabad today, Prime Minister Tun Dr Mahathir Mohamad and his Pakistani counterpart Imran Khan officiated the symbolic groundbreaking ceremony for the plant.

Before they witnessed the ceremony at a hotel there, the two Prime Ministers attended a round table meeting with captains of industry from their countries at the same hotel.

In his speech during the round table meeting, Dr Mahathir said he wanted to promote Proton, so he would give a Proton car to Imran.

“It’s not that I want to bribe Pakistan’s Prime Minister but I want to promote one of Malaysia’s products. I want to give him a Proton car,” he said.

He then presented Imran a replica of the Proton X70 car key.

Proton had in 2017 unveiled the seven stars strategy, a roadmap to achieve their long-term goals including targeting to sell 400,000 units by 2027. A major future growth area for the company is export sales, and the establishment of CKD assembly plants in overseas markets is one of the steps taken to grow those numbers.

To establish Proton in Pakistan, an agreement with ALHAJ Automotive was inked on Aug 29, 2018, with the group being appointed as the sole distributor for Proton vehicles in the country

Source: Bernama

ALHAJ Automotive to build Proton assembly plant in Pakistan

Content Type:

Duration:

MyEG Services Bhd is investing RM6.1mil in Chinabased artificial intelligence (AI) company Jingle Magic (Beijing) Technology Co Ltd.

In a statement, MyEG said its investment arm, MyEG Capital Sdn Bhd, had signed an agreement with Jingle Magic for an investment in a Chinese virtual reality (VR), augmented reality (AR) and AI-based education company.

Jingle Magic, formed in 2016, is known as one of the major VR, AR, AI and 3D Internet education platform providers in China.

“Other investors in this latest funding round are Zhejiang Zhongdi Investment Management Co Ltd, an education sector-focused investment fund that is affiliated with Tsinghua Holdings Group’s Muhua Education Fund; and Beijing Dianjing Zhiyuan Investment Centre, a venture capital firm backed by several leading public-listed Chinese technology names such as Cheetah Mobile, Kingsoft and Xiaomi.

“Among the investors in the previous round of funding in 2016 were Anhui Kexun Venture Capital LLP, a venture capital firm under iFlytek Co Ltd, China’s largest public-listed AI company along with Nantong Muhua Equity Investment Center which is part of Muhua Education, and Beijing Yifan Taihe Venture Capital Centre,” MyEG added.

This investment in Jingle Magic by MyEG marks its second investment in a China-based company following last year’s investment of a 3.125% interest in Guangzhoubased Ximmerse.

MyEG noted that these investments were part of an overall strategy to tap into disruptive technologies with commercial value to the group.

MyEG managing director T. S. Wong believed that schools in the future would use AR systems to enhance the learning experience.

“In this regard, we are excited to work with the leading AR education systems provider, leaders in the AI sector like iFlytek and leaders in the education sector like Tsinghua Group to shape the classrooms of tomorrow,” he said.

MyEG’s portfolio of investments also include a variety of technology businesses, including FashionValet, Agmo Studio and Stampede Solution.

Source: The Star

MyEG to invest in China-based AI company Jingle Magic

Content Type:

Duration:

Source: NST

Proton conducting research on Egyptian ops, says Syed Faisal

Content Type:

Duration:

Medical devices company BCM Alliance Bhd is looking to expand its operations outside of Malaysia this year.

In its 2018 annual report, it mentioned tapping into business opportunities in the medical devices industry in South-East Asia, either through a partnership with local companies or other business models.

By having a strategic alliance with existing local players, BCM would be able to expand in the target country by leveraging on the partners’ network and business connections, the company said.

It was identifying potential partners and a suitable business model.

Given that capitalising on new business opportunities would broaden its customer base, BCM aimed to expand its product range, verticals and geography for the financial year ending Dec 31.

In FY18, the group expanded its product offerings to include the distribution of healthcare and clinical devices through its new subsidiary, Cypress Medic Sdn Bhd.

For its medical devices arm, the group expected to benefit significantly from the stronger growth of Malaysia’s medical devices industry.

The country is set to become a global medical device manufacturing hub, which is one of the high-potential growth sectors under the 11th Malaysia plan.

Under Budget 2019, the Health Ministry received an allocation of RM29bil, which was a 7.8% increase year-on-year (y-o-y), enabling it to spend more on medical equipment.

Last year, the medical device exports grew 16.1% y-o-y to RM22.97bil, exceeding the RM20bil mark for the first time.

The country’s medical instruments, apparatus and appliances exports surged 21.5% y-o-y in 2018 to RM4.92bil. The domestic medical devices industry consists of over 200 manufacturers with investments of up to RM14.2bil.

BCM believed it is well-positioned in the health industry to post higher sales, mainly driven by its internal growth strategies, including the expansion plans for FY19.

“Many of BCM’s clients such as KPJ Hospitals and Columbia Asia Hospitals are actively expanding their facilities or have commenced the refurbishment of their hospitals. This will entail the purchase of additional medical equipment which will benefit BCM.

“The distributorship rights that we secured from Siemens Healthineers in February 2018 will also be a key business catalyst, as it allows us to offer the well-received Siemens’ range of cardiac angiography system and fluoroscopy system in the Malaysian market,” it noted.

As for its commercial laundry equipment division, the group is looking to expand to more than 1,400 outlets from 1,200.

“Our management and marketing teams are working to expand our customer base,” it said.

The group also planned to set up five Speed Queen self-service launderette outlets in addition to the six existing outlets.

“We are currently assessing the suitable locations for the launderettes,” it said.

In the near to medium term, the group would focus on enhancing its revenue growth, improving profitability as well as strengthening its business and operational support functions to accelerate its business momentum.

BCM is optimistic of delivering a healthy performance on the back of introducing more products and brands for the medical and the commercial laundry equipment business.

“Our efforts to widen the range of our product offerings in the commercial laundry equipment and medical devices industries provide us a very significant advantage over our competitors.

“Heading into FY19, BCM will continue to undertake good corporate governance and social responsibility, as it strives towards stronger business growth and better financial results.

“BCM remains focused and driven to achieve its long-term aim of becoming a leading player in SouthEast Asia’s medical devices and commercial laundry equipment scene,” it added.

The group’s net profit surged sharply by 83.5% to RM8.22mil in FY18 from RM4.48mil in FY17 on the back of positive growth across its commercial laundry equipment, medical devices and healthcare product businesses.

Source: The Star

BCM plans overseas expansion

Content Type:

Duration:

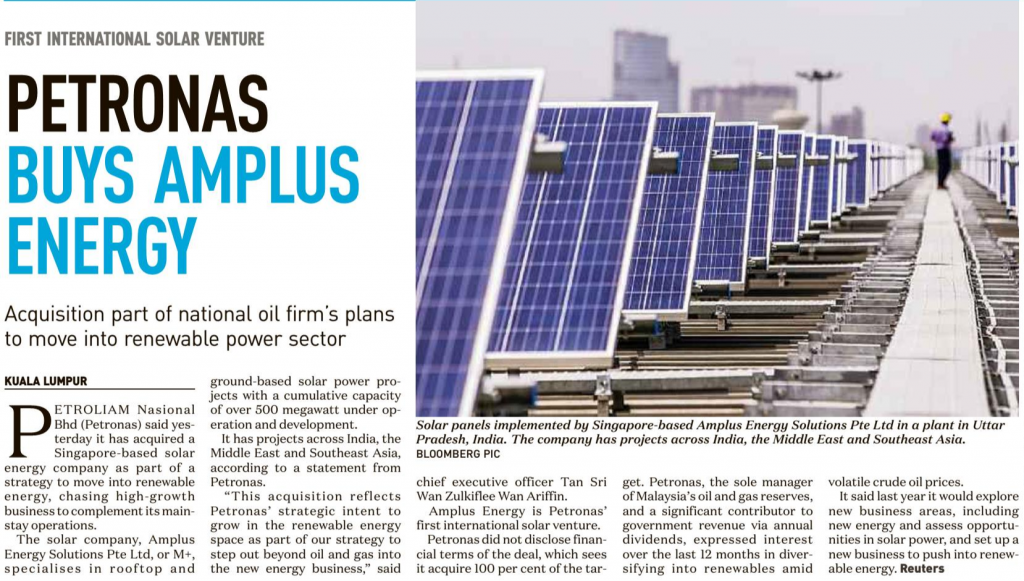

Source: Reuters

Petronas buys Amplus Energy

Content Type:

Duration:

Petronas Chemicals Group Bhd (PetChem) is buying Netherlands-incorporated Da Vinci Group BV from its shareholders, who include, among others, funds managed by Bencis Capital Partner, for €163 million (about RM760.8 million), to venture into the specialty chemicals business.

The full cash consideration is subject to customary completion adjustments, PetChem said in a stock exchange filing today.

Da Vinci is a private limited liability company with global operations involving own-brand reselling, formulating and manufacturing of silicones, lube oil additives and chemicals.

“The completion of the acquisition is subject to fulfilment of certain conditions precedent. The acquisition is PetChem’s first foray into special chemicals via inorganic growth,” PetChem said in a statement.

Once completed, Da Vinci will become a wholly-owned subsidiary of PetChem.

“The acquisition is a strategic entry point for PetChem’s specialty chemicals portfolio. The acquisition accelerates the realisation of PetChem’s vision to create value by diversifying its product portfolio into differentiated and specialty chemicals,” said the group’s managing director/chief executive officer Datuk Sazali Hamzah.

“Da Vinci provides a compelling access into the growing silicones business. The acquisition enables PetChem to enhance its competitive position in attractive end-markets such as personal care, construction, paints & coatings, electronics, automotive and healthcare, particularly in the Asia Pacific region,” he added.

PetChem shares slipped 1 sen or 0.11% to close at RM8.84, giving it a market capitalisation of RM70.72 billion.

Source: The Edge Markets

PetChem buys Dutch firm Da Vinci for RM760.8m in specialty chemicals foray

Content Type:

Duration:

GUH Holdings Bhd, one of the largest manufacturers of printed circuit boards (PCBs) in the country, will produce automotive PCBs in China to reduce its dependence on the consumer electronic goods industry.

Group managing director Datuk Seri Kenneth H’ng told StarBiz that the group would manufacture in multi-layered printed circuit board (PCBs) at its upcoming manufacturing facility in Yancheng, Jiangsu, in late 2020.

“The plant is scheduled for completion in early 2021 and we expect it to contribute to the group’s revenue in 2021,” H’ng said.

The new plant will raise GUH’s PCB production capacity from 310,000 sq m per month (or 3.72 million sq m per annum ) to 410,000 sq m per month (or 4.92 million sq m per annum).

“Currently, the automotive PCBs are produced at the Bayan Lepas plant.

“When we started producing automotive PCBs here a few years ago, the contribution of automotive PCBs was insignificant.

“Today, it has increased to more than 15% of the Bayan Lepas plant’s revenue, driven by the smart infotainment and navigation system used in cars.

“The growth of the automotive sector in Asia, Latin America, and the Middle East also impacts positively on the automotive PCB market,” he said.

According to a new Market Research Report, the global automotive PCB market is expected to experience a 5.98% compounded annual growth rate (CAGR) for the 20182023 period.

“In 2017, the infotainment system segment accounted for 56.6% market share.

“During the forecast period, the segment is expected to increase at a 6.24% CAGR,” the report said.

GUH is investing US$22mil for the Yancheng plant which will enable the group to tap into the huge domestic market with the delivery of high quality products at a competitive price.

Currently, GUH manufactures PCBs for branded home appliances, consumer electronic, air conditioners, audio, video and music products.

The PCB business generates more than 80% of the group’s revenue in 2018.

According to H’ng, the group is expected to register a 5% to 10% growth in 2019 over 2018.

“We set this target because of the slowdown in the property and the water treatment market, which will impact on our top and bottom line for 2019.

“Our property division foresees property sales to remain stagnant because of the tough operating environment.

“The water treatment division also faces challenging times because of the intense competition in open market tendering,” he said. The group’s subsidiary, Teknoserv Engineering Sdn Bhd, is currently tendering for RM500mil worth of water treatment projects, which it hopes to secure in the second half of 2019.

“We are exploring build, operate, and transfer (BOT) water treatment opportunities in SouthEast Asia that will generate recurrent and stable income,” H’ng said.

On the property division, GUH is now planning the overall master development plan for the 46 acres development land at Simpang Ampat, Penang.

“It will be an integrated township development with vast landscape, integrated infrastructures to accommodate public transport system, lifestyle shops, housing schemes, and a commercial hub,” he said.

As of Dec 31 2018, GUH’s total assets stand at RM689.7mil, an increase of 1.8% from RM677.3mil in 2017.

The increase is due to the additional capital investment and growth in businesses.

Its total receivables has decreased by 11% to RM71.2mil from RM80mil in 2017.

As at Dec 31 2018, GUH has net cash in hand of RM106.5mil, compared to RM96.2mil in 2017.

Source: The Star

GUH to produce automotive printed circuit boards in China

Content Type:

Duration:

It was a big day both for Malaysia and Sri Lanka amidst a strong presence of Sri Lankan dignitaries led by Prime Minister Ranil Wickremesinghe who inaugurated a Malaysian-owned US$30 million (RM124.2 million) lubricant blending plant near here on Monday.

The gala opening ceremony of the plant at Muthurajawela was a timely morale-boosting event that somewhat lifted the gloom two months after the Easter Sunday suicide bomb attacks in several places on this island nation that left 258 people dead.

The plant, owned by Hyrax Oil Sdn Bhd and financed by loans from Malaysia’s Exim Bank Bhd, marks the resumption of investments in Sri Lanka by Malaysians after a long spell of inactivity and is the first foreign investment from Malaysia during the current government that came to power four years ago under President Maithripala Sirisena and Wickremesinghe.

In his speech at the ceremony, Wickremesinghe spoke fondly of Hyrax Oil founder and group managing director Datuk Hazimah Zainuddin, whose grandfather happened to be a Sri Lankan from the Gall Province.

Hazimah is also the chairman of Perbadanan Usahawan Nasional Bhd, the key entity that gives out loans to finance small and medium enterprises.

“Her grandfather came from Gall and now the grand-daughter has come back to invest in Sri Lanka that will boost trade and cultural relations between our two countries,“ said the prime minister to the cheers of a large gathering of guests who included ministers, deputy ministers, provincial governors and members of Parliament.

Wickremesinghe said after the recent Easter terrorist attacks, he had met with many trade delegations from Hong Kong, Taiwan and Malaysia and this showed their continued confidence in Sri Lanka’s potentials for investment.

“In the past, many countries such as Malaysia and Singapore were behind Sri Lanka on development, but with the war we fought for 35 years, these countries developed ahead of us. Therefore, we have many responsibilities to ensure that correct leadership is given for the development of the country,“ he said, referring the civil war waged by the Liberation Tigers of Tamil Eelam for a separate homeland in the North East that finally ended 10 years ago.

Wickremesinghe also pointed out that when his government came to power, the Sri Lankan economy was in a bad state due to too many loans taken by the previous government that were due for repayments.

“We didn’t have the money to pay the loans but due to the great effort put in by the government, we were able to service the due repayments with the greatest difficulty. We had to go through a difficult time and the people of the country faced many hardships during this time,“ said Wickremesinghe.

But he said plans were in place to ensure Sri Lankans would have a good future ahead.

He also disclosed that the government had changed many laws to boost further investor confidence following feedback received from many investors in many countries about the existence of laws that were not investor-friendly.

Source: Bernama

Sri Lankan PM inaugurates Malaysian-owned lubricant plant

Content Type:

Duration:

Industrial adhesive manufacturer Techbond Group Bhd, which raised almost RM40 million via its initial public offering last December, will be spending US$2.7 million to build a factory complex in Vietnam for the group’s expansion.

In a filing with Bursa Malaysia, Techbond said its wholly-owned subsidiary Techbond MFG (Vietnam) Co Ltd has signed a construction contract with main contractor Trung Hau Construction Corp for the construction of a factory complex in Vietnam-Singapore Industrial Park in Binh Duong province.

Techbond said the contract is scheduled to be completed by the first quarter of 2020.

The group said the main contractor will hand over the project with a certified construction warranty of 24 months and a warranty guarantee of 5% of total contract value.

Techbond’s share price gained 0.5 sen or 0.73% to close at 69 sen, giving it a market capitalisation of RM158.7 million.

Source: The Edge Markets

Techbond to spend US$2.7m to build Vietnam factory

Content Type:

Duration:

Prime Minister Tun Dr Mahathir Mohamad said Malaysia is looking forward to the establishment of Proton Holdings Berhad’s automotive assembly plant in Pakistan.

He made the announcement in his speech at the 32nd Rawalpindi Chamber of Commerce and Industry (RCCI) International Achievement Awards tonight.

“I would also like to suggest to Malaysian businessmen to look into the various available trade opportunities in Pakistan.

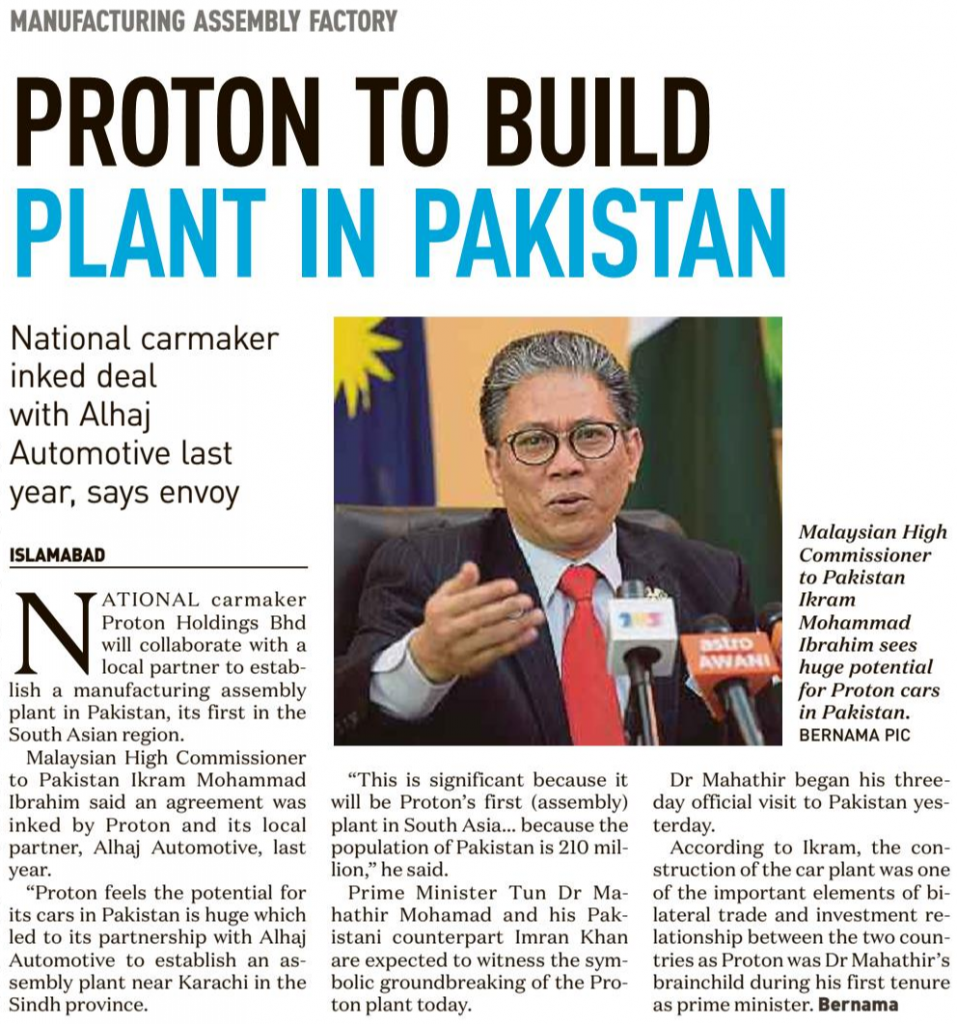

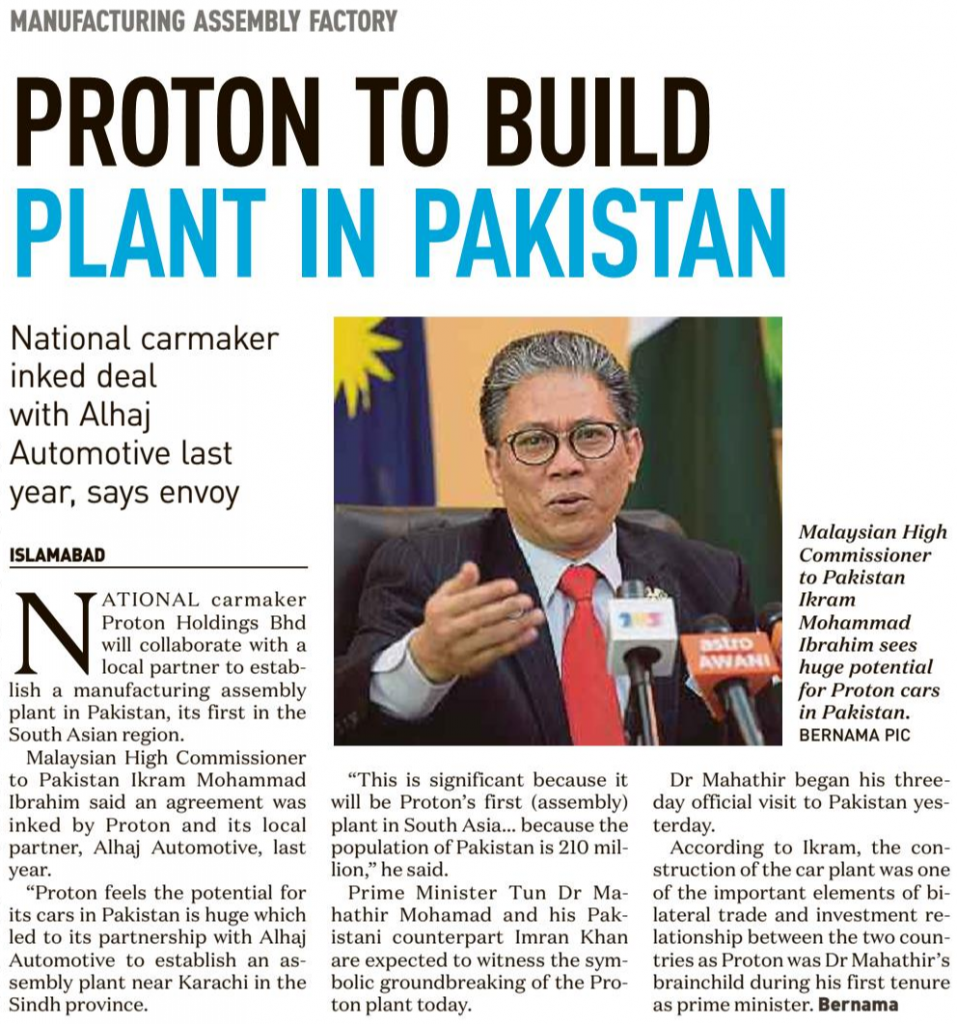

“There is immensely huge untapped potential to enhance bilateral trade between Malaysia and Pakistan,” he said. Also present were his wife Tun Dr Siti Hasmah Mohd Ali, RCCI president Malik Shahid Saleem and Malaysian High Commissioner to Pakistan, Ikram Mohammad Ibrahim.

Dr Mahathir said Malaysia is committed to providing business-friendly environment and cooperation for anyone who desires to invest here.

He drove home the point that Malaysia and Pakistan being friendly nations with a combined population of 224 million make a very large consumer market.

“Our unique relationship and closeness should be tapped so that we can exploit this massive market to the advantage of both nations.

“Since each have their own unique industries and economic activities, we have a lot of areas to venture without having to compete with each other.

“In fact, as Malaysia hopes for greater economic cooperation, mutual exchange of knowledge and expansion of trade with Pakistan, we look towards a collaboration of complementing each other,” he said.

Dr Mahathir pointed out that Malaysia and Pakistan need to share their strengths and overcome each other’s weaknesses to emerge as an economic force globally.

“I am happy to note that the Right Honourable Prime Minister of Pakistan, Mr Imran Khan, shares the same sentiments and is very keen to explore all available potential in our bilateral interests,” he said.

Dr Mahathir opined that the business community is the back bone of the economy and therefore both leaders can play significant roles in enhancing bilateral trade between the two countries.

At the event, the Brand of the Year award was given to G’Five Mobile Pvt Ltd, MIA Corporation received the Customer Excellence award, the Leadership Excellence in Global Education award was given to Datuk Tiffanee Marie Lim, and the Fastest Growing Company of the Year award went to Mari Petroleum Pvt Ltd.

Source: Bernama

Malaysia to establish Proton automotive assembly plant in Pakistan — Dr Mahathir

Content Type:

Duration:

Johor-based Guan Chong Bhd, the world’s fourth largest cocoa grinder, is buying Europe-based chocolate maker Schokinag Holding GMBH (SHG) for €29.93 million (RM137.84 million) as part of the group’s global expansion strategy.

Guan Chong said the proposed acquisition will enable it to expand its presence to Europe and position the group to target new growth opportunities in the world’s largest chocolate consuming market.

“Through the (exercise), the company expands its product range into the downstream industrial chocolate business-to-business market,” it said in a bourse filing today.

Guan Chong, through its sub-subsidiary GCB Cocoa Singapore Pte Ltd, has today entered into a sale and purchase agreement with the Netherlands’ Schokinag Holding BV for the proposed acquisition.

Guan Chong said it will fund the proposed acquisition via internal funds.

SHG is engaged in the business of manufacture, sale and distribution of industrial chocolates, including chocolate couvertures, from liquid to solid, in various sizes, shapes and packaging types, as well as liquid compounds.

Located in Mannheim, Germany, SHG’s industrial chocolate plant has an annual capacity of 90,000 tonnes, while its cocoa processing plant can grind 7,000 tonnes of cocoa beans into cocoa mass per year.

The proposed acquisition is expected to be completed within the first quarter of 2020.

“We are making our next major move by expanding our presence to Europe. The acquisition of SHG certainly sets us strategically to target new growth opportunities in the world’s largest chocolate consuming market,” said Guan Chong managing director and chief executive officer Brandon Tay Hoe Lian in a separate statement.

“The latest move is ideal as we aim not just to enlarge our global client base, but also expand our range of value-added downstream industrial chocolate products to supply to major chocolate players.

“Additionally, SHG will require about 40% to 50% of the supply of cocoa ingredients from our upcoming cocoa processing plant in Ivory Coast. This ensures that our incoming new cocoa grinding capacity will be met with immediate demand,” he added.

In September, Tay told The Edge in an interview that size is important to the group. “There are still areas where we don’t have a presence and we need to go [there],” he said, noting that the group does not have a cocoa bean processing plant in the US, Europe and South America.

Earlier in August, the group had announced that it was investing €60 million (RM278 million) in a new cocoa bean processing plant in Ivory Coast – its first plant in Africa. “As of September 2019, land preparatory works have commenced, with commissioning expected in the first quarter of 2021,” said Guan Chong.

Guan Chong shares closed down 3 sen or 1.03% at RM2.89 today, bringing a market capitalisation of RM2.91 billion.

Source: The

Edge Markets

Guan Chong expands global footprint with European acquisition

Content Type:

Duration:

Malaysian Investment Development Authority (Mida) has partnered Muehlbauer Technologies Sdn Bhd to boost cooperation between academic institutions and industry players to enhance vocational training.

Under the partnership, the Germany-based machine manufacturer contributed RM200,000 worth of automation integrated system to four higher-learning institutions, namely Universiti Malaysia Pahang, Universiti Teknikal Malaysia Melaka, Universiti Tun Hussein Onn Malaysia and the German-Malaysian Institute (GMI).

The system, known as the Beckhoff mock-up, was presented to each university, inclusive of 40 hours of training and support, which entails image or vision processing technology or other advancements based on the institutions’ needs.

“We are pleased that more and more companies are responding positively to our call for narrowing the gap between the latest practical know-how of the industry and university syllabus.

“We continue to encourage companies to invest in talent and technology to improve productivity and capability, and become future-proof,” Mida CEO Datuk Azman Mahmud said at the equipment handover ceremony in Kuala Lumpur yesterday.

Azman said the partnership between industry players, particularly multinationals and higher learning institutions, is important for Malaysia to grow its technology capability towards the Industry 4.0.

Students in mechatronics engineering are expected to gain early exposure on the Beckhoff system that is used in industries related to mechanical, electrical, programming, instrumentation and vision technology.

Source: The Malaysian Reserve

Mida partners Muehlbauer to enhance vocational training

Content Type:

Duration:

The agency said one of the ways to close the deficit in the services trade current account is to reduce dependency on foreign services and to export home-grown services to the global market.

Local service providers are encouraged to register their businesses with the portal to be more visible and accessible to potential customers.

The three main objectives of the portal are to assist investors looking for local service providers, promote and encourage the utilisation of local service providers for investment projects and facilitate connections to other programmes organised by MIDA or other agencies.

This gateway would be an avenue to market the services of the local service providers and their solutions locally and abroad, it said.

“Local service providers should leverage on this portal as a medium to expand their markets and catapult their business activities in today’s globalised and rapidly changing business environment.

“Domestic and international companies could also avail themselves to this portal as a gateway to source local services, which provides a cost-efficient and convenient way of conducting business,” it said in the Malaysia Investment Performance Report 2018 released recently

The report noted that Malaysia has recorded a deficit in its services trade current account from 1947 until 2017 (except from 2007 to 2011) and this deficit has been widening since 2012.

The deficit stood at RM22.8 billion in 2017.

Malaysia’s major sources of services exports were travel, especially personal travel and other business services such as research and development services, professional and management consultancy services and technical, trade related and other business services.

On the other hand, services imports were mainly derived from higher payments for travel, transport and construction, it said.

The agency said although exports of services have been in the upward momentum since 2010 (increasing by RM47.7 billion within the last 7 years), corresponding imports have accelerated at an even faster pace with a value of RM77.1 billion, resulting in a widening of the deficit in the services trade current account.

Citing Malaysian Institute of Economic Research (MIER) Malaysian Economic Outlook 2018 report, MIDA added the trend is expected to persist this year, owing to the nation’s high dependency on foreign services, particularly for freight and haulage.

Source: Bernama

MIDA bids to reduce services sector deficit via i-Services Portal

Content Type:

Duration:

This is to ensure the availability of knowledge-equipped skilled-talent in the right industries to meet the needs of the emerging Industry 4.0 landscape.

“Technological advancement calls for a matching talent pool that is both present proofs yet future-ready and this challenge is a reality globally.

“Given the fact that the quality of a country’s talent pool is also one of the key attractions for investors, it comes as no surprise that Malaysia too has set her sights on becoming one of Asia’s key players in the talent pool arena,” it said in the Malaysia Investment Performance Report 2018 released recently.

The agency said while changes in technology spell new opportunities, Malaysia must strive to reduce the talent gap, thereby compelling both industry and academia to refresh their systems, policies, processes, and strategic initiatives.

As part of its talent pipeline initiative, MIDA has launched an Apprenticeship Programme, which is a trilateral partnership between MIDA, Federation of Malaysian Manufacturers (FMM) and Ministry of Education, aimed at addressing the shortage of technical skills highlighted by FMM members.

For its pilot project, MIDA engaged a total of five member companies that assisted in placing 34 students at respective vocational colleges for the four main courses offered, namely industrial machining, electrical, welding and electronics.

“To further compliment such talent pipeline initiatives, universities and companies can do more by collaborating to develop industry-ready graduates,” it said.

Heading this agenda, MIDA played advocate on Oct 31, 2018, to the National Policy on Industry 4.0, in addressing the need for digital transformation of the manufacturing sector and its related services.

Source: Bernama

MIDA to continue foster partnership, ensuring knowledge-equipped skilled-talent

Content Type:

Duration:

Deputy chief executive officer Zabidi Mahbar said from next month, the agency will expand the programme nationwide to attract more companies and trainees with potential to participate in it.

“The second phase of the programme will begin at the end of next month and MIDA urges more companies to step up and participate to create even more places for training,” he added.

He said this after witnessing the presentation of the Malaysian Skills Certificate to 24 graduates of the programme in conjunction with the Apprenticeship Programme 2019 Convocation Ceremony.

The certificates were presented by the deputy secretary general of the Ministry of International Trade and Industry, Datuk Seri Norazman Ayob.

Zabidi said the Apprenticeship Programme was a two-year initiative targeting Form Three Assessment (PT3) school leavers.

“The programme is based on the German training model of the technical and vocational education and training (TVET) where 70 per cent of the training is undertaken in industry and 30 per cent at training institutes,” he added.

He said it was a fast track programme aimed at preparing skilled workers who can be immediately absorbed into industry.

The Apprenticeship Programme is the result of cooperation between MIDA, the Education Ministry, Skills Development Department and the Federation of Malaysian Manufacturers.

The first phase of the programme involved five companies, namely Royal Selangor International Sdn Bhd, Top Glove Corporation Bhd, Gethi Engineering Sdn Bhd, Fire Fighter Industry Sdn and YKGI Holdings Bhd.

It also embraced three vocational colleges – Setapak Vocational College, the Klang Vocational College and Sungai Buluh Vocational Collage.

Source: Bernama

MIDA’s Apprenticeship Programme to go nationwide in phase two

Content Type:

Duration:

The business community will now be able to obtain real-time information on the latest i-incentive portal set up by Malaysian Investment Development Authority (Mida).

Mida deputy chief executive officer II Zabidi Mahbar said the interactive web portal would provide a comprehensive information on all incentives offered by various ministries and agencies.

“It currently features 124 incentive schemes managed by 12 ministries and 28 government agencies.

“These incentives include tax exemptions, grants, soft loans and other forms of incentives like equity financing, regional establishment status, and training and facilitation programmes.

Organised by Mida, the seminar saw over 300 participants taking part in talk sessions on various topics.

Zabidi said the seminar was part of Mida’s on-going engagement to update industry players in the northern region on the latest policies and facilities available.

“We are delighted to see many participants with a wide representation from the industry’s stakeholders today as Penang is one of the country’s choice locations for domestic and foreign investments.

“Over the last five decades, Penang has consistently ranked among the top investment destinations in the country.

“From 1980 to 2018, Mida approved a total of 4,084 manufacturing projects with investments worth RM129.1bil for Penang.”

Zabidi said among the approved projects, 3,072 projects with investments valuing at RM98.8bil were implemented here.

“These projects have created over 380,000 job opportunities mainly in electrical and electronics, machinery and equipment, and fabricated metal products industries.

“In the first quarter of this year, Penang also recorded RM8.8bil in total approved investment in the manufacturing sector.

“Thus, to encourage more investments, Mida will continue to undertake various activities and programmes to pave the way for further growth, particularly among the domestic players,” he said.

Zabidi added that Mida also developed an i-Services gateway portal as an avenue to market services and solutions of local service providers locally and internationally.

“We hope everyone would register their businesses to increase visibility and accessibility for their potential customers.”

Penang domestic and international trade committee chairman Datuk Abdul Halim Hussain said they hoped Penang would sustain its competitiveness as a leading state for industrialisation.

“We will continue to engage with stakeholders, to listen and obtain feedback from the marketplace.

“Since digital transformation is coming, we cannot be complacent, otherwise disruptions will happen,” he said in his speech.

Source: The Star

Portal offers info on incentives for business sector

Content Type:

Duration:

Malaysian Investment Development Authority (MIDA) has established an East Coast Rail Link (ECRL) Unit as a dedicated contact point to facilitate and promote the development of the Economic Accelerator Projects (EAP) along the ECRL corridor.

In a statement, the government agency said the unit is currently engaging with the respective states and interested parties to inform and promote the EAPs.

“The EAPs will include the development of an industrial park in the East Coast and West Coast of Peninsular Malaysia to attract trade and investments along the ECRL corridor.

“It also involves the establishment of logistics hubs at transport interchanges to promote connectivity and transportation of goods under the ECRL project, and transit-oriented development (TOD) stations to promote new development and to support the growth of industrial parks,” MIDA said.

MIDA, as the principal investment promotion agency of the country, will identify and assist interested Malaysian companies to cooperate with China Communications Construction Company LTD (CCCC) in the EAPs, based on the memorandum of understanding inked with CCCC.

Thus far, MIDA said it has been involved in many awareness programmes to provide information regarding ECRL and planned to organise seminars as well as business events to further promote and receive information from companies keen to take part in EAP development.

Source: Bernama

MIDA urges local companies to join the economic accelerator projects

Content Type:

Duration:

The Malaysian Investment Development Authority (MIDA) has bagged the Top Investment Promotion Agency 2019 award in the Asia Pacific National category by the Site Selection, an internationally circulated business publication.

MIDA in a statement said the Site Selection covers corporate real estate and

economic development and published six times a year by Conway Data Inc.

The agency won the award along with EDB Singapore.

“This renewed commendation reflects MIDA’s continuous efforts in responding to the needs of expanding companies, maximising efficiency and earning the trust and respect of decision-makers across the globe.

“It is also a valuable signal to potential investors that MIDA is indeed a leading investment promotional agency in Malaysia,” it said.

MIDA which also won the same award in 2015 and 2016 said, it will continue to enhance its quality of service and remain dedicated to supporting Malaysia’s aspirations.

The award was given based on a set of criteria including best reputation for

protecting investors’ confidentiality, access to recent investors in the region for testimonials, most professionally responsive to inquiries, as well as a reputation for after-care services, among others.

Source: Bernama

MIDA crowned Top Asia Pacific’s Investment Promotion Agency by international publication

Content Type:

Duration:

Equity investment such as private equity and venture capital is a viable funding option for companies seeking business expansion, said the Malaysian Investment Development Authority (MIDA).

Deputy chief executive officer Zabidi Mahbar said besides securing funding from banks, which catered more to stable and mature companies, equity investment could also be considered for business expansion, particularly by early-stage companies.

He said MIDA is now gearing up effort to promote domestic direct investment (DDI) and assisting local businesses to enhance their competitiveness and capacity.

As for the first quarter of this year, the country’s approved domestic direct investment stood at about RM24.6 billion compared with RM29.3 billion of approved foreign direct investment.

“Out of the DDI approved, those leveraging on equity investment are still small.

“Hence, we want to open up this space for companies to consider as an option to raise capital towards taking their businesses to the next level,” he told Bernama on the sidelines of the inaugural forum on business financing opportunities themed “Equity investment for Business Growth 2019” here today.

Attended by 150 participants, Zabidi said the forum was aimed at providing a strategic platform for financial houses to share their investment strategies, sectors and industries that they are focusing on.

He said the event was a continuous engagement undertaken by MIDA through the Investment Coordination Platform (ICP), which was set up in 2018, to facilitate companies with their expansion plan and business growth.

The ICP team works closely with equity and corporate advisory firms, as well as local regulators and technology providers in assisting companies in conducting business to business matching, capital raising through debt and equity, merger and acquisition, divestment, and initial public offering, he said.

Zabidi added that the ICP team has engaged with over 200 manufacturing, services, plantation companies and 50 strategic technologies and funding partners and to date has arranged over 60 business to business meetings session.

Notably, he added the team has also enabled a local steel company to meet the requirement for listing on the ACE market of Bursa Malaysia.

Source: Bernama

Equity investment a viable funding option for business expansion — MIDA

Content Type:

Duration: