Chief Minister Idris Haron said figures released by the Malaysian Investment Development Authority (Mida) showed domestic investments accounted for RM2.6 billion, or 59.1%, while foreign investments totalled RM1.8 billion, or 40.9%.

“It was indeed a satisfactory year for Melaka as it achieved its best investment figure so far. It was comparable to 1995 when Petronas set up their oil refinery in Sungai Udang.

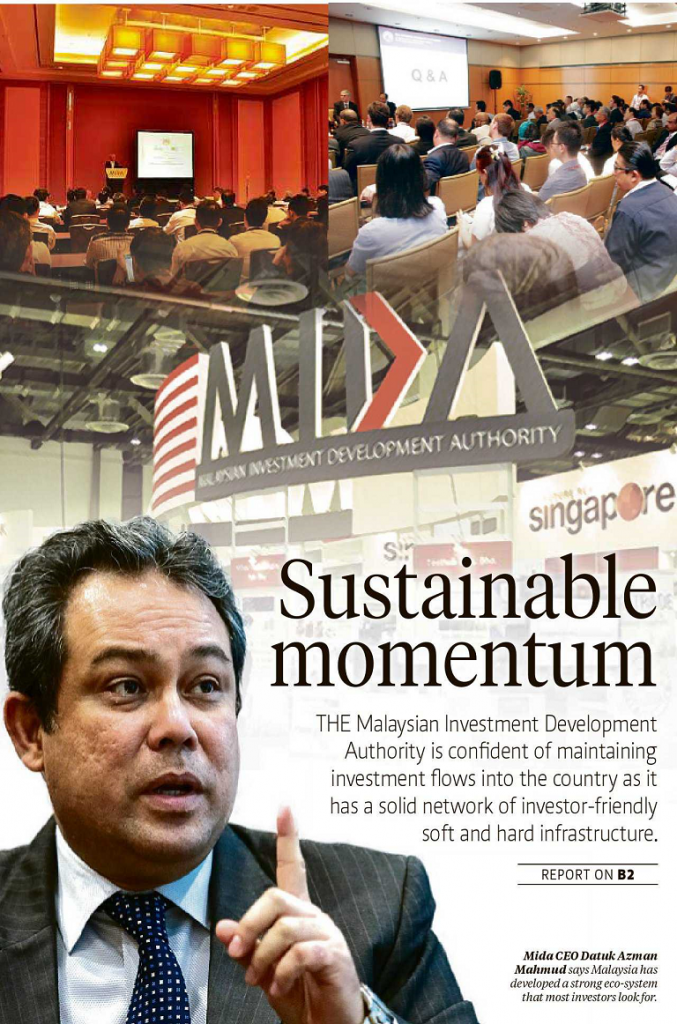

“We targeted RM5 billion for the whole of 2014 and another RM5 billion investments for this year,” he told reporters after closing the “Grow with Us” seminar organised by Mida and Malaysian Investment Development Finance Bhd (MIDF) here today.

Over 150 participants, from the food, transport as well as the electrical and electronics sectors, attended the one-day seminar.

Idris said the investments were mainly in electronics and electrical products, petroleum products including petrochemicals, transportation, chemical products and food manufacturing.

“The state government will continue its efforts to sustain the conducive and competitive business environment in the state,” he said.

Idris said RM1.2 billion is already in the pipeline when Xinyi Glass, a Chinese company, set up its manufacturing plant in Lipat Kajang, Jasin.

“Another RM2.9 billion is expected from a local company to establish a manufacturing plant in Telok Gong, Alor Gajah for the transportation sector,” he said, adding the state is also looking for more investments in the maritime sector.

Melaka receives record RM4.4 bil investments in 2014

Content Type:

Duration: