Right time for economic reform

28 Dec 2020

The time is ripe for Malaysia to pursue economic reforms to ensure the country remains on track to become a high-income economy amid structural issues compounded by the ravaging Covid-19 pandemic.

Economists are urging the government to reset its economic strategy and policies to ensure the nation’s aspiration to become a high-income economy is achievable.

They are confident the country would be able to achieve this goal if structural issues could be addressed and certain reforms could be carried out.

Senior economist and Socio-Economic Research Centre executive director Lee Heng Guie (pic below) told StarBiz that the country has fallen short of the economic growth target.

For example, he said, Wawasan (Vision) 2020’s economic growth target was 7.1% per annum for the period 1991-2020, but had achieved annual growth of 5.6% from 1991 to 2019.

The economy contracted sharply by 7.3% in the 1997-98 Asian financial crisis (AFC), and minus 1.5% in 2009 during the global financial crisis.

For this year, he said the economy is estimated to contract 5.5% due to the pandemic.

Economists are projecting a GDP growth of 6% to 7.3% next year. In the third quarter, the GDP improved with a slower contraction of 2.7% year-on-year (y-o-y) versus a 17.1% y-o-y contraction in the second quarter.

For full-year, the Finance Ministry predicted that the economy would shrink by 4.5% y-o-y due to the adverse effects of the Covid-19 pandemic.

Commenting on structural issues, Lee said these include the lack of making bold and decisive economic reforms, inadequate regulatory reforms to enhance conducive investment climate and lacking labour productivity and capital efficiency (technological investment) to drive growth.

He said investment currently is more focused on physical structures instead of machinery and equipment, which is crucial to boost the productive capacity of the economy.

AmBank Group chief economist Anthony Dass, (pic below) who is also a member of the Economic Action Council secretariat, said the possibilities for Malaysia to become a high-income economy over the next decade is still in sight.

To achieve the high-income nation status, he said, the country needed to reset some of its strategy.

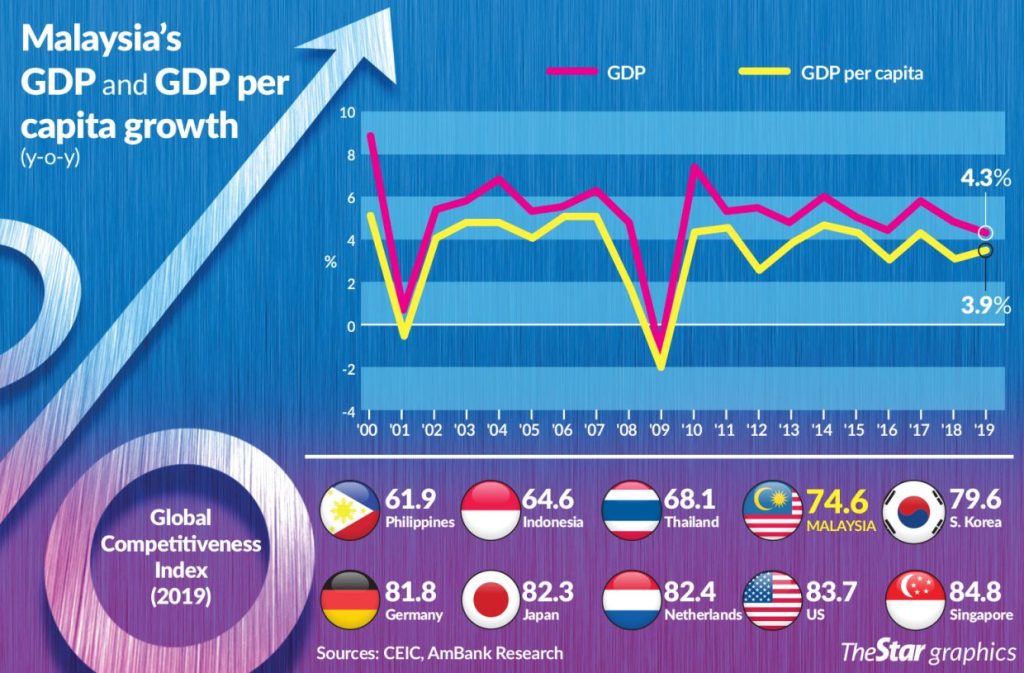

“The reason being both gross domestic product (GDP) and GDP per capita have lost some dynamics, especially post-1997 AFC.

“Part of such drop appears to have come from falling exports-to-GDP share. As a trading nation, the drop in this share implies the country is undergoing severe stress on its global competitiveness more than to say that domestic demand is contributing more to GDP.

“This would mean that there are strong challenges to productivity, ” he said.

Dass said there is a need to revisit some of the medium and long-term policies to ensure the economy is on the right track towards a high-income nation.

To achieve this status, there is a need to have well-designed pro-growth policies that are broad-based and sustainable. It may address some of the structural issues that are Covid-driven and those that have been there for a period of time to raise the growth of the economy.

“Emphasis needs to be on forward-looking measures that promote productivity, reduce households’ economic insecurity, better align domestic and international growth impulses, and counter the increasingly disconnect between the financial system and real economy. It should be beyond the focus of the growth target of the economy, ” he said.

While the short-term measures are important to ensure growth remains at a sustainable level, Dass said there is a need of not losing sight of what is important.

These include areas in human capital, education, health, social protection, infrastructure, efficiency of bureaucracy, ease of doing businesses, inclusiveness, environmental social and governance (ESG) and women participation, he said.

Lee said for the country to achieve high-income status, it is critically dependent on the need to carry out major reforms, including a high-paying workforce.

He said the government must plug leakages in affirmative action policy to ensure the most vulnerable ones would be given priority in terms of a new approach towards social safety protection systems.

Lee said due to the digital and disruptive technologies, there is also a need for skills transformation that is central to the current and future development progress.

Skilled labour currently makes up 29.1% of total employment in the third quarter of the year against the 11th Malaysia Plan’s (11MP) target of at least 30.1%.

“Digital experience needs to be enhanced in terms of speed, reliability and coverage to narrow the urban-rural digital divides.

“The current e-government system is probably at 30%-40%, meaning that the process of digitalising public delivery services must be more comprehensive and accelerated.

“Malaysia needs to enhance global as well as regional collaboration and linkages in trade, services, investment, technology as well as in financial and capital.

“There is clearly still room for Malaysia to improve the World Bank’s ease of doing business ranking (12th in 2020) and to further streamline the impediments to investment in Malaysia, ” Lee said.

OCBC Bank economist Wellian Wiranto (pic below) said technically, there’s nothing stopping Malaysia from achieving the high-income status.

As of now, it is already well within the upper echelon of middle-income countries and is just about 10% short of the nominal threshold for the high-income grouping.

The issue, however, is that the threshold itself may be a moving target that gets occasionally adjusted upward, he said.

The ongoing pandemic challenges have made it harder to achieve that goal but if Malaysia can prove itself in coming out stronger from it, he said then any positive momentum can become a renewed call-to-arms for further push on growth.

“Within that, attracting more foreign direct investments (FDI) would be key. While the country has already shown signs of being a beneficiary of the China+1 FDI strategy pursued by MNCs, especially in the tech cluster, more needs to be done to cement that, including providing better policy continuity.”

Furthermore, Wellian said as long as political uncertainty prevails, Malaysia may not be able to adopt a longer-term strategy that puts it even more strongly on the radar screen of FDI investors.

“Still, ultimately, with or without the achievement of high-income status, it is at the end of the day merely a label. What matters more than the number – which is an average per capita GDP – as long as Malaysia can pursue not only higher but more equitable growth, it would be an achievement of its own over the next decade, ” he said.

Meanwhile, Juwai IQI chief economist Shan Saeed (pic below) said Malaysia could achieve high-income status if it embarked on three broad strategies – effective skill set enhancement, market-driven economic policies and technology-centric focused.

With economic and financial fragilities growing with every passing day, he said agility and speed are the key to achieve the growth potential envisioned by the policymakers in the coming decade.

Technology would make the labour force economically and financially empowered in the long run, Shan said.

Source: The Star