Recovery prospects intact

12 May 2021

The implementation of the third movement control order (MCO 3.0) nationwide is not expected to jeopardise the recovery prospects of Malaysia’s economy for 2021, says Bank Negara.

According to central bank governor Datuk Nor Shamsiah Mohd Yunus, (pic below) the country remains on track to achieve a gross domestic product (GDP) growth of between 6% and 7.5% this year despite the downside risks.

“The economic recovery remains on track.

“We have already said the path of recovery will be gradual and uneven across economic sectors. It may also be we will encounter speed bumps along the way. However, our assessment is the economy will continue to recover in 2021, ” she told the press at a virtual conference in conjunction with the release of the GDP number for the first quarter of 2021 yesterday.

Explaining the reason of the central bank sticking to its GDP growth forecast of 6%-7.5% for 2021, Nor Shamsiah said the number had already factored in the uncertainties of the Covid-19 pandemic, including potential resurgence in new cases and new containment measures.

“These uncertainties were reflected by the wide forecast range of 150 basis points. The assumptions behind the growth forecasts were also conservative in the sense that there would be no interstate travels until the end of this year and our international borders to remain closed throughout 2021, ” she explained.

Nor Shamsiah said the impact of MCO 3.0 on economic growth would likely be less severe than what was experienced in 2020, as almost all economic sectors were still allowed to operate under the current measure, unlike MCO 1.0, which required much part of the economy to be shut down.

“Overall, the growth recovery will benefit from better global demand, increased public and private sector expenditure, as well as continued policy support. This will also be reflected in the recovery in labour market conditions, especially in the gradual improvement in hiring activity, ” she said.

Malaysia’s economy performed better than expected for the first quarter (Q1) of 2021 despite the implementation of MCO 2.0, with a contraction of 0.5% against a Bloomberg consensus estimate of a decline of 0.9%.

The latest GDP number also represented a rebound from a contraction of 3.4% in Q4’20.

Overall, in 2020, Malaysia’s GDP contracted 5.6%.

Bank Negara noted that the recovery for the Q1’21 was supported mainly by the improvement in domestic demand and robust exports performance, particularly for electrical and electronics (E&E) products, as well as continued policy measures.

While MCO 2.0 and the continued closure of international borders and restrictions on inter-state travel were a dampener, economic activity managed to gradually pick up with the easing of restrictions in February and March.

All economic sectors saw improvement during the quarter, led by manufacturing, Nor Shamsiah said, noting the better overall performance reflected the improvement in domestic demand and the strength in the country’s exports.

OCBC Bank economist Wellian Wiranto (pic below) upgraded its 2021 GDP growth forecast for Malaysia to 6% from 5.4% previously, following the better-than-expected Q1’21 number.

Taking the view that the new MCO would not impact exports activities much, and would only have a more curtailed effect on private consumption, Wellian said growth could come in at 19% in Q2’21.

The base effect would help a lot as well, he added.

Moody’s, on the other hand, said despite the gradual easing of GDP contractions, conditions for the economy would likely stay weak in the coming quarter, given the persistence in consumption slump.

“As a domestic-driven economy, strength in the external sector is insufficient for the economy to rebound completely from its pandemic lows. The emergence of a more contagious variant of Covid-19 in Malaysia may complicate the situation more, ” the credit rating agency said in a statement.

“We should avoid being over-exuberant about the external performance and downplay the weak domestic condition, ” it added.

Moody’s said the balance of risks is tilting to the downside, as Malaysia reimposed nationwide MCO amid rising Covid-19 infections, which might undo recent progress.

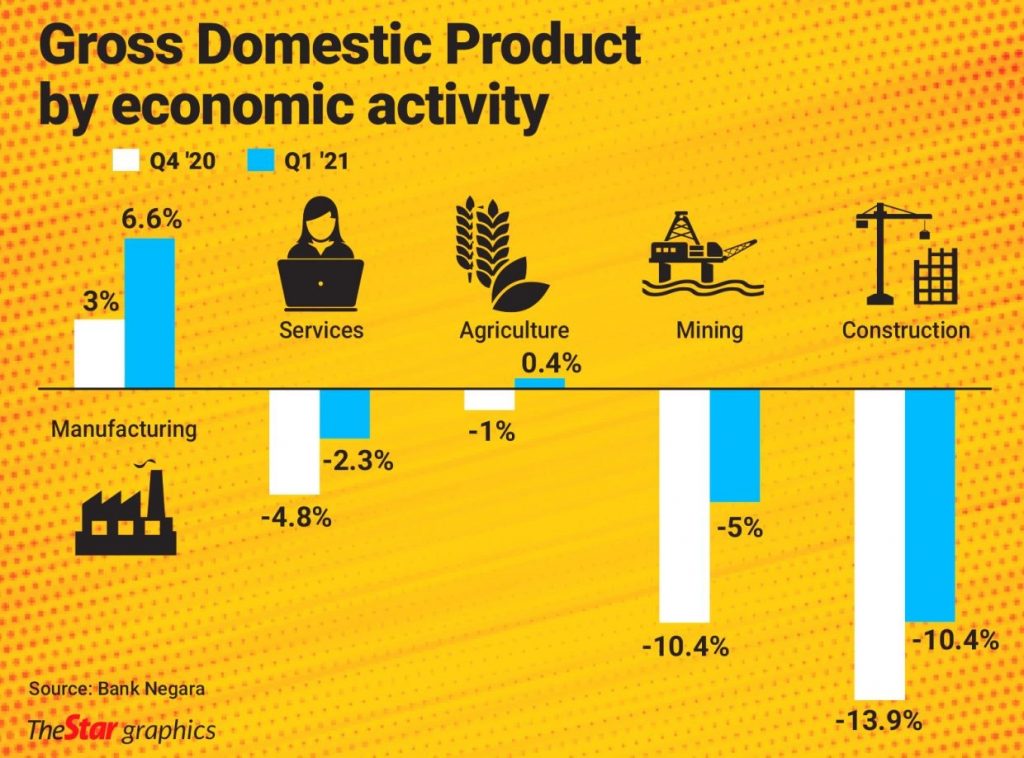

During the quarter in review, the manufacturing sector growth accelerated to 6.6% from 3% in the fourth quarter of 2020 on continued robust external demand for E&E production, while contraction in the services sector narrowed to 2.3% from 4.8% as consumer-related activities improved despite the containment measures.

The agriculture sector grew 0.4% after contracting 1% in the preceding quarter, thanks to expansion in livestock, forestry and logging as well as other subsectors. Contraction in the mining sector was slower at 5%, compared with 10.4% in the preceding quarter, as crude oil and natural gas production improved.

The construction sector also declined at a slower pace at 10.4%, compared with 13.9%, due to a ramp up in commercial projects nearing completion and implementation of small-scale projects.

Malaysia’s current account surplus stood at RM12.3bil, or 3.3% of GDP, as at end-March 2021.

Meanwhile, headline inflation turned positive to 0.5% in the first quarter of 2021, compared with -1.5% in the preceding quarter.

This was mainly due to the positive, albeit low, fuel inflation following the base effect, as well as the lapse in the effect from the tiered electricity tariff rebate which was implemented between April and December 2020.

Nor Shamsiah reiterated that headline inflation was expected to average at 2.5%-4% for 2021, compared with -1.2% in 2020, due to cost-push factors such as higher global crude oil and commodity prices.

She gave a heads-up that inflation could accelerate to 6.5%-7% in April and May, but this would just be a temporary spike, and the number was expected to fall back below 5% in June.

Bank Negara last week maintained the overnight policy rate (OPR) at a record-low of 1.75%.

Nor Shamsiah said the monetary policy would remain accommodative through the year to support the economic recovery, while ensuring prices pressures remain manageable.

She said Bank Negara still had room to cut the OPR again if conditions required the central bank to do so, but she noted lowering the benchmark interest rate is not always the answer to addressing worsening economic prospects.

“We have sufficient monetary policy space to provide support if necessary, ” Nor Shamsiah said.

“The bank remains vigilant against a build-up of financial imbalances and given ongoing uncertainties surrounding pandemic, monetary policy going forward will continue to be determined by new data and information, ” she added.

Source: The Star