Opportunities and trends in 2024

25 Dec 2023

With 2023 drawing to a close, talks and discussions on the outlook for the coming year are commonplace. The CEO Series 2023 Economy and Business Forum, organised by Rehda Institute, tackled topics such as Malaysia’s economic outlook and real estate trends for 2024, and policies to attract foreign direct investment (FDI).

The forum, held on Dec 7 at Le Meridien Hotel in Petaling Jaya, was attended by more than 350 key property industry stakeholders from the government and private sectors. Three sessions were held. In this article, City & Country reports on the third session, which focused on regional real estate and development trends.

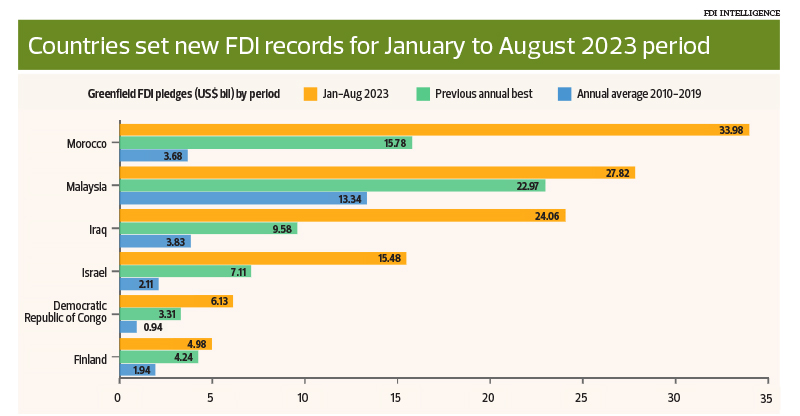

In his keynote address, Deputy Minister of Investment, Trade and Industry Liew Chin Tong said Malaysia had been the focus of foreign investors, with the World Economic Forum identifying it as one of six countries that had attracted the most greenfield FDI between January and August this year.

“Malaysia received about US$28 billion (RM131 billion) worth of greenfield FDI projects between January and August, which is more than double the annual average recorded in the decade before the pandemic … That’s a huge amount of investment, and this is unprecedented, as the amount that has come in or been promised is much larger than any time the country has seen,” Liew noted.

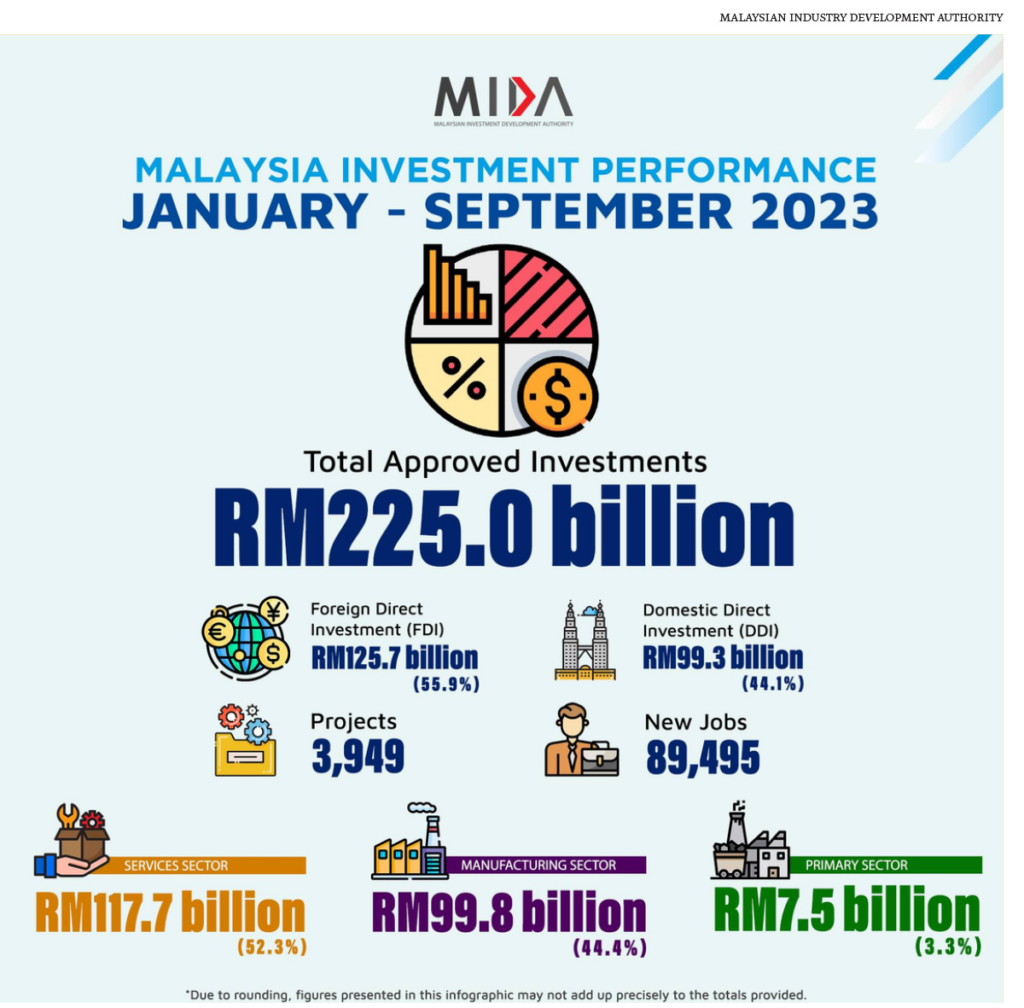

Meanwhile, the Malaysian Investment Development Authority (Mida) announced on Dec 6 that Malaysia recorded RM225 billion in total approved investments for the first nine months of 2023. These were in the services (RM117.7 billion), manufacturing (RM99.8 billion) and primary (RM7.5 billion) sectors.

Liew is confident that the record amount of investments this year will complement Malaysia’s New Industrial Master Plan (NIMP) 2030.

NIMP 2030 aims to increase the manufacturing sector’s value added to RM587.5 billion, employment to 3.3 million and the median salary to RM4,510 a month by 2030. These will be driven by six engines of growth — reindustrialisation, green transition, tech up, good life, services and empowering regions.

Liew said: “There are paradigm shifts for an agile, resilient and thriving Malaysia. It is about maximising the indispensable middle position of Malaysia in the global supply chain; shifting from land/resource-based to tech-based capital, and from real estate to real sectors; shifting from labour-intensive to valuing and paying for skills; and from a low-wage workforce to a resilient middle-class society; as well as putting climate at the centre of economic consideration.”

Impact of China Plus One strategy on Malaysia

The first presentation of Session 3, titled “China’s current market trends and their implications for the Malaysian market”, by PropertyGuru Group Singapore director of special projects Winston Lee highlighted how the China Plus One strategy has benefited Southeast Asia, particularly Malaysia.

According to Lee, the strategy, driven mainly by the US-China trade war and Covid-19 pandemic, encourages China-based companies to reduce their dependency on China and diversify in terms of investment and manufacturing into other countries. Southeast Asian countries have been the most popular choice of investors.

He noted that Malaysia had positioned itself well to capture the opportunities from the strategy, as it has a policy of “continuing to build and strengthen the cross-border economic trade ties between Malaysia and China”.

Lee cited the example of a trip to China by Prime Minister Datuk Seri Anwar Ibrahim in April, during which he secured RM170 billion worth of projects from Chinese companies.

In fact, data from Mida shows that Chinese investment in Malaysia has exceeded that from the US and Singapore. “With the sheer size of the manufacturing base in China, there are tremendous opportunities for Malaysia to capture from the industrial, commercial and residential sectors to serve the needs of everyone in Malaysia,” he added.

Local property market outlook for 2024

In his presentation titled “Malaysia’s 2024 real estate outlook (residential, retail, office, industrial): NIMP 2030 + NETR + ESG: Impact to Malaysia’s real estate sector”, CBRE | WTW group managing director Tan Ka Leong gave his take on the outlook for the commercial, office and residential sectors for next year.

For the retail sector, he pointed out that more purpose-built retail spaces will embrace environmental, social and governance (ESG) elements while more retailers will have multiple uses for retail space to cater for an omnichannel shopping experience. These channels include in-store, mobile and online, and retail space can be used as fulfilment centres, goods collection points and hubs for online returns.

In addition, he expects the trend of concept stores for products, experiences and services to continue. Over the past 12 months, there has been an increase in the number of such concept stores, particularly for electrical and electronic products. These include the SenQ concept store at Cheras Leisure Mall, Machines Apple Premium Partner stores and the Samsung & ESH Consumer Electronics Premium Experience Store at Bangsar Shopping Centre.

In the purpose-built office sector, Tan said there was rising demand for green-certified prime building office space as more companies undergo a flight-to-green process to enhance their portfolio agility. Meanwhile, tenants will continue to expect more flexibility in terms of space layout, size and lease terms from building owners.

As such, Tan foresees that while rental price will remain the same, office supply and vacancy rates will increase, owing to more incoming supply, which will widen the gap between older and newer purpose-built office buildings.

For the residential sector, he highlighted a few catalysts that will support sector growth in 2024 — the relaxation of the Malaysia My Second Home requirements, as proposed in Budget 2024; an increase in allocation from RM5 billion to RM10 billion for Skim Jaminan Kredit Perumahan, which will benefit around 40,000 borrowers; and continued demand driven by owner-occupiers for competitively priced properties in good locations. Additionally, Tan foresees there will be greater demand for multigenerational and senior-friendly spaces owing to Malaysia’s ageing population.

Meanwhile, Far Capital CEO Faizul Ridzuan said residential projects that promote a good lifestyle and have unique selling points and smaller units would be in demand next year.

In his session titled “2024 consumer real estate buying trends in Malaysia and Indonesia”, Faizul explained that smaller units would continue to be a trend in 2024 because single-family households are the fastest-growing in Malaysia. He emphasised, however, that high-rise projects that focus on smaller units should offer attractive common areas and lifestyle facilities to draw buyers.

Bridging Johor-Singapore gap

In his presentation titled “Singapore real estate market trend updates: Real estate demand spillover effect towards Johor real estate demand”, Knight Frank Singapore head of research Leonard Tay spoke about the performance of the Singapore residential market and its spillover effect on Johor. He highlighted that the cooling measures in Singapore, which have made its properties more expensive for foreign buyers, have presented an opportunity for Johor.

“We have seen renewed interest among buyers and brokers [for property in Johor]. However, this is only anecdotal, not translating into historical transactions yet. Singapore and Johor have a special relationship that can benefit each other. The one thing that prevents Johor and Singapore from unlocking their potential, however, is the traffic congestion at the Causeway,” Tay pointed out.

He said besides tackling the physical accessibility between the crossing points, collaboration between the two governments on infrastructure and policy that will benefit both countries is equally important. These include the Johor Bahru-Singapore Rapid Transit System, the Iskandar Malaysia Bus Rapid Transit and the revival of the Kuala Lumpur-Singapore high speed rail.

“More than infrastructural solutions, strong collaboration between the two governments is even more pertinent. There must be political will on both sides to make [the bridge] closer. Policies such as the Special Economic Zone (SEZ) will help too. When the details of the SEZ are announced in a month or two, it will harmonise this and bring both columns together,” Tay said.

The SEZ aims to improve the flow of goods and people between both sides of the Causeway and enhance the ecosystem of the Iskandar development region and Singapore.

ESG increasingly important

Rehda Malaysia vice-president and Sime Darby Property Bhd group managing director Datuk Azmir Merican, who was the moderator of the panel discussion for the session, raised the topic of ESG and what it means to be ESG-compliant.

CBRE | WTW’s Tan and Knight Frank Singapore’s Tay concurred that a large number still do not fully understand what it means to be ESG-compliant even though many companies have jumped on the bandwagon, as ESG has become more relevant over the last few years.

“In Malaysia, ESG is more for commercial buildings [such as offices] … When MNCs come in, ESG is a requirement. They require landlords to tell them their plans to transform the building into an ESG-compliant building. It takes time for landlords to plan it because they need to strike a balance between the cost and return. At the same time, we have seen tenants move out of a building because it is not ESG-compliant,” said Tan.

Source: The Edge Malaysia