O&G revival will be stronger and last longer, says Uzma

02 May 2023

The oil and gas (O&G) industry is poised for a big comeback “both in terms of time and magnitude” after years of under-investment in the sector, says Uzma group CEO Datuk Kamarul Redzuan Muhamed.

Uzma, which is involved in the upstream O&G services segment, is seeing signs of a vibrant market — a rising number of contract awards and jobs being tendered, as well as the start of a manpower shortage in the sector.

Ganjaran Kesetiaan Simpan SSPN Prime Appreciates Loyal Depositors, Encourages Savings Habit

Kamarul, who attended the recent US energy conference CERAWeek, says “the feeling was very, very upbeat” at the event.

“Even though there are the headwinds of recession, a banking sector crisis and a strong US dollar at one point, the oil price is still strong.

“The price swings have got smaller and smaller … I think the revival is real this time around,” says the petroleum engineer in an exclusive interview with The Edge.

The company also faced hiccups at its maiden large scale solar (LSS) project in Sungai Petani, Kedah. The sharp rise in solar panel prices resulted in cost overruns.

The solar energy venture is Uzma’s strategy to grow recurring income to cushion the volatility brought about by the cyclical nature of the O&G industry (see sidebar).

After the oil price crash in 2014/15, the local O&G service industry experienced only a short-lived resurgence. In 2018, it was impacted by the US shale boom and Middle East supply shock, and in 2020, the Covid-19 pandemic hit.

Uzma could not escape cost overruns which could hit millions of ringgit in a quarter.

“It was a serious nightmare [during the pandemic] … Even the work permits took months. The indirect costs [due to quarantine rules] hurt the most, when you had to have your vessels for [about an additional week at a time], and that [claim to cover that cost] is subject to negotiations,” Kamarul says. “I am glad that is behind us now.”

He adds that the indirect cost claims were generally “not very successful” although national oil company Petroliam Nasional Bhd (Petronas) did help in the negotiation process.

That said, after three dismal years, Uzma posted its best second-half earnings since 2016 in calendar year 2022 despite losses in most non-O&G segments, signalling that the pandemic impact is largely behind it.

At press time, Brent crude oil was hovering around US$83 per barrel (bbl). The commodity averaged at US$82/bbl this year, compared with US$64.16/bbl in 2019.

Since 2022, the Russia-Ukraine crisis has supported prices. In addition, demand has returned and the Organization of Petroleum Exporting Countries (Opec) made a supply cut of one million barrels per day this month.

At home, the oil rig count has exceeded 20, industry players say. Petronas said in its Activity Outlook report that it plans to drill 25 exploration wells this year, and the market believes there could be more in the pipeline.

In the last few months, Uzma raised its firm O&G order book (excluding renewables) by some RM800 million, to just under RM2.5 billion, including the extension of key contracts such as the operation and maintenance of the water injection facility at the mature D18 oilfield offshore Sarawak.

Kamarul is also proud of the job that Uzma secured for the provision of electrical submersible pumps (ESPs) for five wells over three years for Petronas Carigali Sdn Bhd, announced in February, in a market predominantly controlled by Baker Hughes and Schlumberger.

“The most popular way of artificially lifting the oil is using a gas lift, but there is a better use for that gas,” Kamarul says. “If we can deliver [ESP as an effective alternative], I think we are looking at a bigger market.”

Overseas markets turning ‘very, very attractive’, local rates catching up

Amid the optimism, Kamarul points to several headwinds, including rising interest rates and what he describes as “pricing resilience” in the local markets, where contract rates have risen but cannot yet compete with international rates.

Uzma is looking to deploy excess capacity (such as for coil tubing and hydraulic workover) overseas, with an overseas revenue target of 30%, from 18% currently.

“We are driven by the fact that the rates overseas are very, very attractive … One operation [overseas] is like me running three operations here, and that is including escalated costs over there,” Kamarul says.

Uzma is exploring opportunities in Australia and the UK, in addition to operations in Thailand, Indonesia and the Philippines (geothermal). Uzma has some exposure in Europe, India, Sudan and Turkey as well, Kamarul adds.

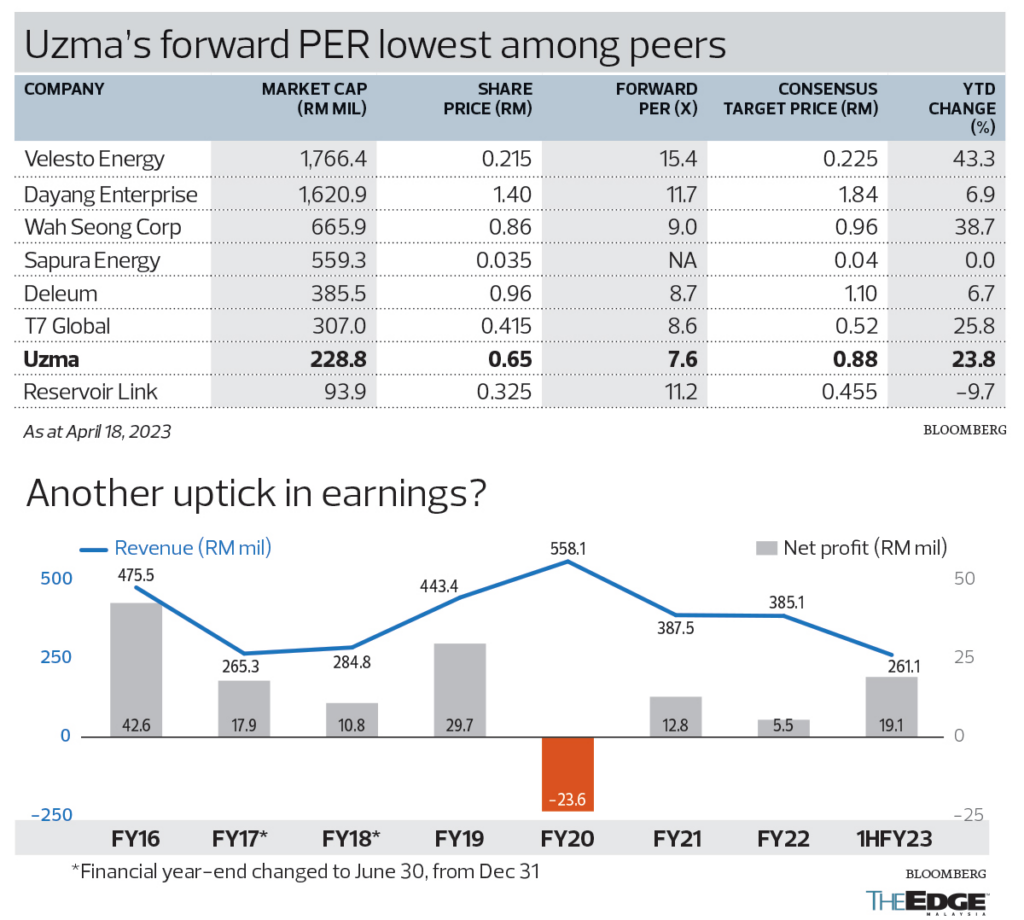

At 65 sen per share on April 18, the company is trading at 7.6 times forward earnings, compared with an average of 10.3 times among companies in the support services space. Its consensus target price stood at 88 sen a share.

Uzma posted a record revenue of RM558.06 million in the financial year ended June 30, 2020 (FY2020), but it made losses owing to the pandemic. Its best net profit was recorded in FY2016, with RM42.59 million in net profit on RM475.47 million in revenue.

For FY2023, consensus net profit forecasts were recently revised upwards to RM30.4 million, compared with 1HFY2023 results of RM19.13 million on revenue of RM261.05 million.

“If you look at the last 23 years of Uzma’s existence, we always grow on the back of the downturn. I think this time we will see a higher magnitude; the worse the downturn that we see, the higher the upswing,” Kamarul adds.

Doubling down on solar ventures despite hiccups

Uzma Bhd is continuing to look at solar projects even though its journey into this new area has not been an easy one so far.

The oil and gas service and equipment specialist was not spared the recent shock of high panel prices faced by the solar industry.

Despite cost overruns and being behind schedule by almost two months for its first large scale solar (LSS) project in Sungai Petani, Kedah, Uzma is hopeful of completing the 50MW project in time by end-2023 — less than nine months away.

The group is fulfilling the conditions precedent for the financial close, group CEO Datuk Kamarul Redzuan Muhamed says.

“That (delay) doesn’t worry us because once the financial close is completed, then things [will pick up] from there,” he tells The Edge in exclusive interview. “I think [the progress] has smoothened out; we syndicated our loan.”

Uzma plans to participate in its second LSS project, via the corporate green power programme (CGPP), with a target size of 30MW. It also remains on the lookout for acquisition opportunities, says Kamarul.

Analysts covering the company and other solar players have highlighted the impact of rising costs on the LSS4 projects, even with the extension of the power purchase agreement to 25 years, from 21.

Uzma’s latest cost projection for its LSS4 project in Sungai Petani was RM229 million. Kamarul alludes to a 30% increase in costs for the project, which was awarded in March 2021.

Going into the capex-heavy utilities business may translate into higher gearing for the company. At the end of last year, Uzma had cash equivalent of RM121.74 million, against RM430.87 million in borrowings, translating into a net gearing of 0.6 times. An 80% debt financing for the project amounts to RM183.2 million.

The group’s total equity of RM547.28 million includes perpetual sukuk of RM40.85 million. It announced in March that it was raising RM21 million via a private placement to fund the project.

Kamarul says that costs for panels and logistics have fallen, adding that “there is still room for improvement” on Uzma’s deliveries by tweaking the engineering works for LSS4.

Uzma’s projections on the returns are conservative, he says. Similarly, if the company acquires brownfield assets, it will also be to improve returns through better equipment and efficiencies, he adds.

The group targets 60% of group revenue coming from recurring income by 2025. The RM20 million annual cash flow expected by analysts from the Sungai Petani plant from 2024 is not enough, relative to group revenue of over RM400 million.

Meanwhile, the CGPP asset has an end-2025 deadline, according to a guideline from the Energy Commission.

The group has engineering, procurement, construction and commissioning contracts through 49%-owned Suria Infiniti Sdn Bhd. Its solar-related order book amounted to RM970 million, bringing the group’s total firm order book to about RM3.4 billion.

The group is also open to taking on bigger, utility-scale projects. Having local experience in larger solar farms will help build the credentials for competing overseas, Kamarul adds.

“Rightly or wrongly, the government [slices the LSS project sizes as it] wants to have more players,” he says. “We want to have 60% of revenue from recurring income … It requires 500MW to 1,000MW [of capacity] to get that kind of contribution.”

“We are taking this solar business quite seriously. It is not solely chasing for returns [but] it helps us with balancing [the cyclical nature of] our portfolio, and offsetting our carbon footprint.”

Source: The Edge Malaysia