Enabling SMEs to be a catalyst to advance Malaysia forward

09 Feb 2023

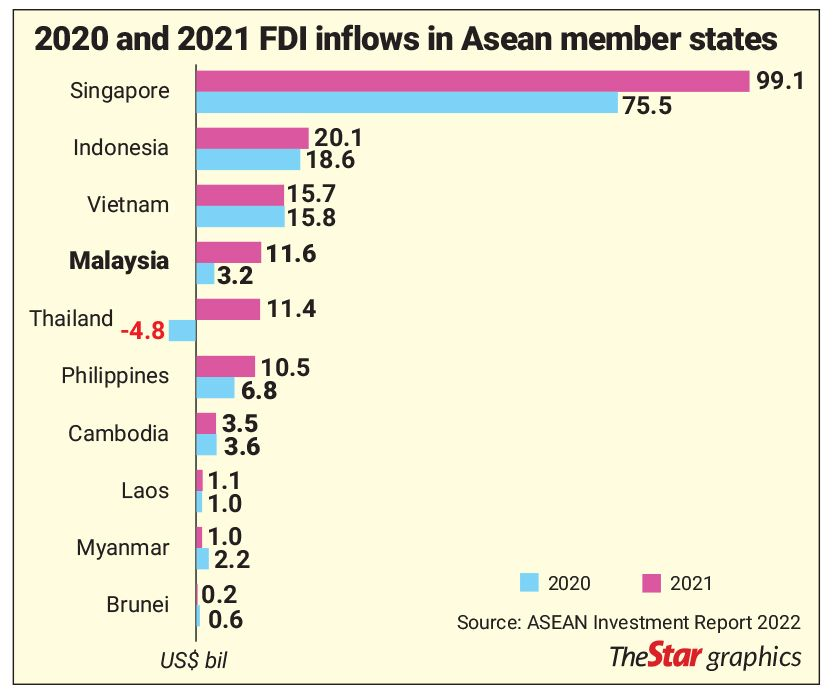

MALAYSIA has long been known as the gateway to Asean due to our prime geographical location in the heart of South-East Asia, multilingual talent pool and favourable business environment. However, in recent years, the country has fallen behind our neighbours as the preferred location for foreign direct investments (FDIs).

With declining FDIs, it is now more critical than ever for Malaysia to focus on accelerating the growth of homegrown small and medium enterprises (SMEs) through automation and digitalisation to minimise foreign dependency.

Ultimately, SMEs are the backbone of the Malaysian economy, accounting for about 97% of total businesses in Malaysia.

Against this backdrop, Prime Minister Datuk Seri Anwar Ibrahim struck the right chord when he announced that digital advancement, SMEs and the green economy will be the focus of the Budget 2023, which is being revised and retabled on Feb 24.

In the previous version of Budget 2023 tabled by the then government on Oct 7, 2022, several initiatives were proposed to support SMEs, namely, a one-off grant of RM1,000, a RM10bil fund to be managed by Bank Negara for SMEs use in automation, digitalisation, tourism and agriculture, and a reduction in income tax of 2% on the first RM100,000 of chargeable income.

However, these may not be impactful if we are to seriously focus on driving the growth of SMEs as a catalyst for advancing Malaysia forward. Here are some suggestions on what more can be done:Tax incentives and grants

From a direct tax perspective, quite a number of tax incentives and grants have already been introduced in the past to encourage businesses to adopt automation and digitalisation.

For instance, there was an automation allowance for companies in the manufacturing and services sector in the form of a 100% investment tax allowance and 100% income tax exemption for investments in automation equipment. SMEs were also eligible for a matching Smart Automation Grant (SAG) of up to RM1mil per company to automate and digitalise operations. Due to overwhelming interest, the programme has reached its fund capacity and was put on pause.

I hope to see an extension of these incentives and an increase in allocation for the automation allowance and SAG in Budget 2023.During the Covid-19 pandemic, many small businesses were strengthening their presence digitally, taking orders through online platforms and using new delivery and payment channels to continue serving their customers.

The global pandemic accelerated the adoption of technology at an unprecedented pace and the government must ensure that momentum is not lost as digitalisation is the way forward for SMEs.

This can be done through providing matching grants to SMEs that continue to invest in new technology, and offering a more broad-based double tax deduction for technology-related expenditures such as subscriptions for online applications, customisation of software and hiring of skilled information technology personnel.

Most domestic SMEs struggle to innovate and do not engage in research and development (R&D), perhaps due to a lack of adequate skills, funding or incentives to change their traditional business model.

Rather than providing grants in the form of handouts to all SMEs, it would be more effective if grants and incentives can be targeted at specific initiatives such as R&D innovation and quality improvement, new product development and skills training.

To improve innovation capabilities, the government may establish local innovation centres and encourage more university-industry collaborations.

To increase access to funding, perhaps a tax deduction equivalent to the amount invested can be provided to investors that provide funding to SMEs.

Green technology

SMEs have been found to be significant contributors of industrial pollution, not least because they are less heavily regulated than large enterprises.

How many times have we encountered disruptions in water supply due to industrial contamination?

Further, complying with environmental policies is a low priority for SMEs, an exercise often seen as an additional cost.

Instead of relying on enforcement and punitive actions, an alternative approach could be to offer tax rebates for utilising renewable energy and adopting waste management initiatives, low-interest loans for the purchase of green assets and tax incentives for investing in green technology.

Tax reduction

With rising cost of doing business, SMEs are certainly expecting a reduction in the tax rate to be announced in Budget 2023.

Whilst the 2% rate cut announced in the previous version of the budget is welcomed, a more key performance indicator-based rate cut may be more productive.

Further reductions in taxes could be provided based on the level of increase in productivity.

In 2017 and 2018, corporate income tax rates were reduced by 1% to 4% based on the percentage increase in the chargeable income of a company compared with the preceding year. I hope this can be implemented on a perpetual basis, instead of a one-off initiative, to drive continuous growth in business.

As SMEs strain under the growing challenges impacting their operations and ability to grow their business, the expectations for the government to offer them a boost is at an all-time high.

After a prolonged period of uncertainty caused by domestic and international disruptions, there is a collective hope that the newly formed unity government will be able to introduce impactful policies that can propel SMEs towards real recovery.

Lim Wai Yin is the corporate tax executive director of KPMG Tax Services Sdn Bhd. The views expressed are the writer’s own.

Source: The Star