This site

is mobile

responsive

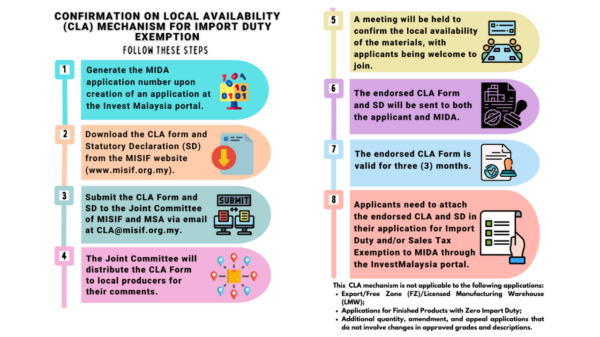

Starting from 1 January 2024, prior submitting applications for Import Duty and/or Sales Tax Exemption on raw materials and components (Iron and Steel – HS Code 7201-7316) for raw materials under HS Tariff Codes 7208, 7209, 7210, 7211, 7212, 7213, 7214, 7304, 7305 and 7306, applicants are required to secure a Confirmation on Local Availability (CLA).

The CLA form can be obtained and must be endorsed by the Malaysian Iron and Steel Industry Federation (MISIF) and the Malaysia Steel Association (MSA).

The establishment of the IMFC reflects the Government’s commitment to ease of doing business and continuous reforms, providing effective and efficient services to investors. By creating a physical establishment where face-to-face negotiation and facilitation take place, the IMFC builds trust, instils confidence, and fosters stronger collaboration between investors, industry players, and government ministries/agencies. This, in turn, drives increased investments and economic growth.

The CLA Mechanism introduces a new procedure, replacing the former Mesyuarat Mingguan Besi Keluli (MMBK). This mechanism aims to verify the availability of raw materials and components within the iron and steel industry. It presents a more streamlined approach to the application process, making it crucial for applicants to familiarise themselves with these new requirements.

Please Take Note: Changes in the policy on Tinplate (HS Code 7210.12.90000) Import Duty Exemption

Effective 1 January 2024, applications for import duty exemption on Tinplate under the HS Code 7210.12.9000 will only be considered for the Export/Free Zone (FZ)/Licensed Manufacturing Warehouse (LMW) markets. Applications for the Domestic market will no longer be accepted. For the latest information on the import duty exemption policy for Tinplate, please contact the Tariff Division of MIDA at 03- 22673633.

Ensure your business is compliant and well-prepared for these new requirements! Stay up-to-date with the latest policies to maintain a competitive edge.