Construction cranes still surround the brand-spanking-new plant in Kulim’s industrial park in Malaysia. But inside, legions of workers hired by Austrian tech giant AT&S are already gearing up to produce at full capacity by year’s end.

Outfitted in head-to-toe coveralls, with oversized safety glasses and hard hats, they’re reminiscent of the worker bees in the movie Minions, but colour coded by function: Blue for maintenance. Green for vendors. Pink for janitors. White for operators.

AT&S is just one of a flood of European and American companies that have recently decided to move to or expand operations in Malaysia’s electrical and electronics manufacturing mecca.

US chip giant Intel and German corporation Infineon are each investing US$7bil (RM32.81bil). Nvidia, the world’s leading maker of chips powering artificial intelligence, is teaming up with the country’s utilities conglomerate to develop a US$4.3bil (RM20.15bil) artificial intelligence cloud and supercomputer center. Texas Instruments, Ericsson, Bosch and Lam Research are all expanding in Malaysia.

The boom is evidence of how much geopolitical friction and competition are reshaping the globe’s economic landscape and driving multibillion-dollar investment decisions. As rivalries between the United States and China over cutting-edge technology simmer and trade restrictions pile up, companies – particularly those in crucial sectors like semiconductors and electric vehicles – are looking to strengthen their supply chains and production capabilities.

AT&S had production sites in Austria, India, South Korea and China – its largest plant – when it started hunting for a new location.

“It was clear after 20 years of investment in China, we needed to diversify our footprint,” AT&S CEO Andreas Gerstenmayer said. The company manufactures high-end printed circuit boards and substrates, which serve as the foundation for advanced electronic components that power artificial intelligence and supercomputers.

The company’s site search started in early 2020, just as warnings began to spread about a dangerous new coronavirus in China. AT&S scouted 30 countries on three continents before settling on Malaysia.

South-East Asia’s strategic position in the South China Sea and long-standing economic ties to China and the United States make the region an attractive place to set up shop. Nations like Thailand and Vietnam, AT&S’ second choice, are also aggressively courting semiconductor firms to expand, offering tax incentives and other lures.

But Malaysia has the advantage of a head start.

The country has been riding the tech wave since the 1970s when it energetically courted some of the world’s electrical and electronic superstars, like Intel and Litronix (now ams Osram, with headquarters in Austria and Germany). It created a free-trade zone on the island of Penang, offered tax holidays, and built industrial parks, warehouses and roads. Cheap labour was an additional draw, as was its large English-speaking population and stable government.

Malaysia’s history in the back end of making semiconductors was one of the primary draws, Gerstenmayer said.

“They are quite aware of what the needs of the semiconductor industry are,” he said. “And they have a well-developed ecosystem in the universities, in education, labour force, supply chain” and more. Support from the government was another attraction, he said.

Tengku Zafrul Aziz, Malaysia’s minister of investment, trade and industry, said foreign investment began to pick up in 2019, driven by the widening use of semiconductors in everything from automobiles to medical devices. “There’s 5,000 chips in one car,” he said.

After the Covid-19 pandemic revealed devastating weaknesses in global supply chains, interest in Malaysia as an additional source soared.

That trend accelerated as great power conflicts bubbled over.

Both China and the United States moved to forge their own reliable semiconductor supply chains, in addition to supporting other critical sectors like renewable energy and electric vehicles.

“US and European companies and even Chinese companies wanted to diversify out of China,” Zafrul Aziz said. China, too, is locating production facilities outside the mainland, in part, some say, to sidestep US sanctions. It’s a “China plus one” strategy.

Worries about Taiwan, the world’s largest producer of semiconductors, has further fueled investment in Malaysia, he said. The island is a source of growing friction between China, which maintains Taiwan is part of its territory, and the United States, which supports it politically.

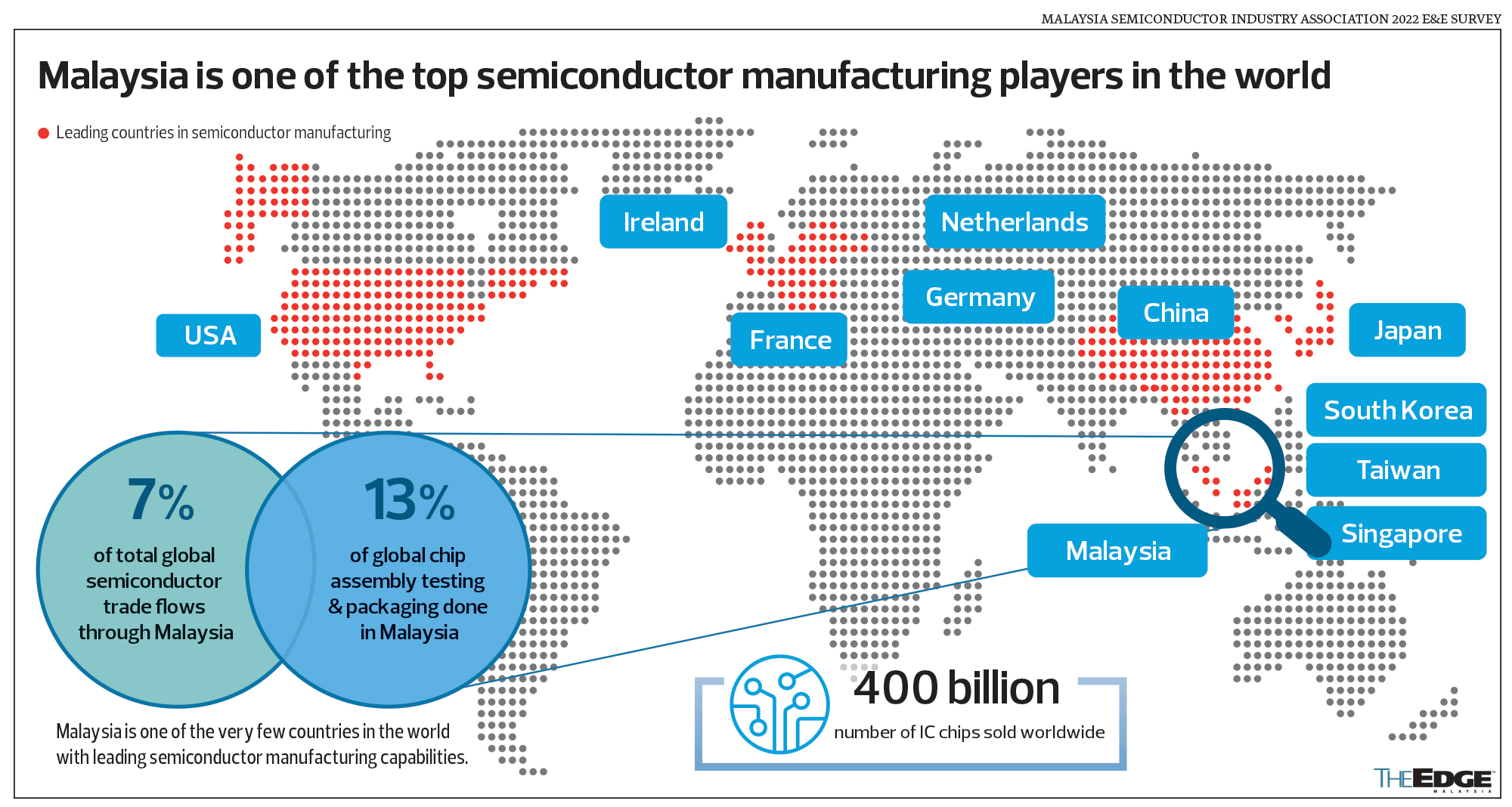

Malaysia is already the world’s sixth largest exporter of semiconductors, and packages 23% of all American chips.

“For a country of this size to be having that big an impact on the global semiconductor market is quite fantastic,” said David Lacey, director of advanced development and services at Osram, one of the world’s largest lighting companies.

Seated at a large conference table at the Sciences University of Malaysia on Penang, he rapidly pointed to the technology around the room. “There’s a TV, there are lights, there’s a projector, there are phones,” he said. “You can pretty much guarantee there is a Malaysia component somewhere.”

The proximity of so many tech companies also exerts a gravitational pull. In Penang and Kulim, which are connected by two long, snaking bridges, there are more than 300 companies.

“Everything is here,” said Eric Chan, a vice-president and general manager at Intel in Malaysia. After a half century, that network and infrastructure are not easily duplicated.

Chan also mentioned the government’s crucial cooperation during the pandemic in keeping factories open.

Foreign direct investment was nearly US$40bil (RM187.50bil) last year, more than twice the total generated in 2019.

Mario Lorenz, managing director in Malaysia for the German logistics company DHL Supply Chain, said “most of our big investments have happened in the last two years”.

During that time, the semiconductor sector has grown to dominate the company’s business in Malaysia. “We followed the trend,” he said.

Inside DHL Supply Chain’s newest global distribution center, Penang Logistics Hub No. 4, are bespoke orange and blue shelves specifically designed to handle the heavy, oversized crates used by a semiconductor company.

Four new supply chain facilities are in the works in Malaysia.

Malaysia’s track record has been mostly in the back end of the semiconductor supply chain – which includes packing, assembling and testing components – activities that traditionally have been considered less complex and of lower value.

But now the industry’s focus on packaging smaller chips – chiplets – more tightly together to increase computing power is increasing the value and technical complexity of those activities.

Intel is building its first overseas facility for advanced 3D chip packaging in Malaysia. When you bring in cutting-edge technology there is a “ripple effect”, said AK Chong, a vice president and managing director of Intel in Malaysia. That development will attract dozens of new businesses and help advance the labour force’s entire skill set.

Although such advancements will require a huge expansion of utilities like green energy, sanitation, water and a 5G digital infrastructure, several company executives said they were confident of the Malaysian government’s commitment.

“They have projects to provide green energy by building up big solar farms,” Gerstenmayer said. “Malaysia is on good path to becoming a hot spot in the electronics industry globally.”

Source: The Star / The New York Times

Malaysia rises as crucial link in chip supply chain

Content Type:

Duration: