Penang remains committed to the development of Silicon Island to address the state’s pressing need for land, particularly for industrial purposes, with a strategic connection to the existing ecosystem in Bayan Lepas, including the Penang International Airport and the North-South Expressway.

State Infrastructure, Transport and Digital Committee chairman Zairil Khir Johari said the island, part of the Southern Penang Island (PSI) reclamation project, is slated for industrial, commercial, residential and tourism development to meet the state’s needs over the next 40 years.

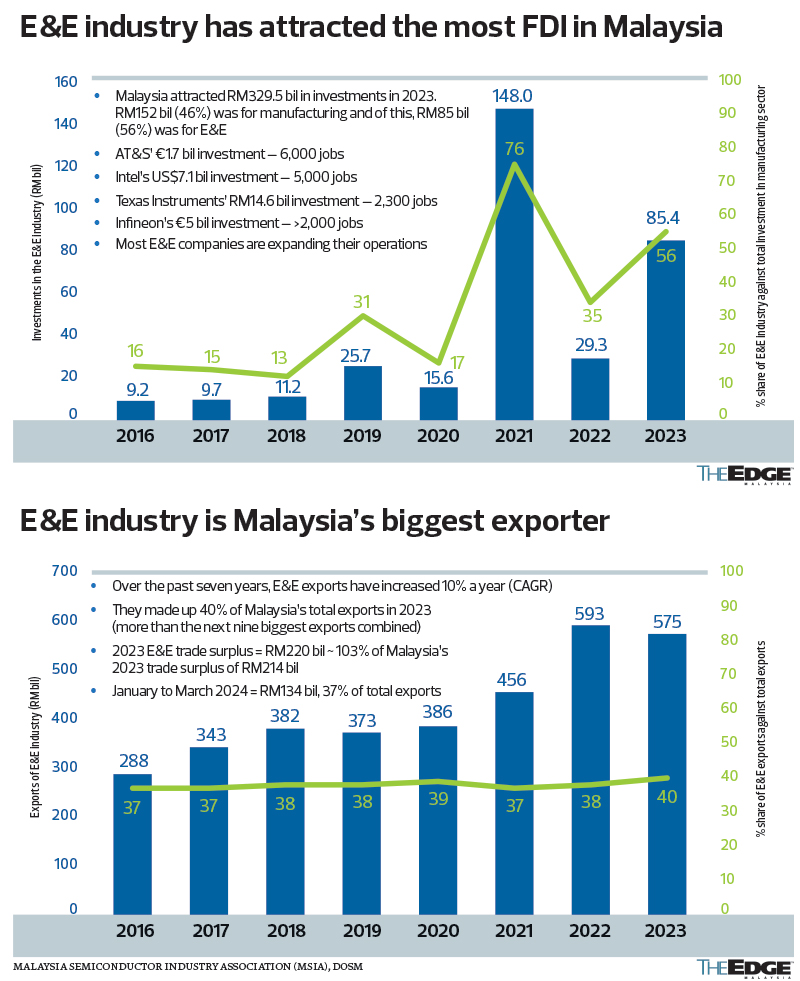

“The Bayan Lepas Free Industrial Zone (FIZ) is widely recognised as a prime destination for international investments, notably in the electrical and electronics (E&E) sector. Expanding the FIZ through the establishment of the high-tech Green Tech Park on Silicon Island caters to existing investors seeking expansion opportunities and attracts new investments.

“Through Silicon Island, Penang anticipates a significant economic impact, with a projected gross domestic product (GDP) contribution of RM1.1 trillion, attracting investments totaling RM74.7 billion and creating 220,000 job opportunities,” he said at the state assembly sitting here today.

He was replying to a question from A. Kumaresan (PH-Batu Uban), who asked about the rationale behind the continued reclamation of Islands A, B, and C, projected profits and the state government’s plans for the reclaimed land.

Zairil (PH-Tanjong Bungah) said Penang plans to utilise Silicon Island for infrastructure development, green-blue networks, public amenities and other use (888 acres), industrial zones (720 acres), housing, including affordable types (388.1 acres), mixed development (164.3 acres) and commercial purposes (139.6 acres).

Silicon Island, spanning 2,300 acres (930.78 hectares), represents Penang’s maiden venture into direct reclamation-driven development, signaling a strategic move to ensure sustained economic growth.

Following the Federal Government’s commitment to finance the implementation of the Light Rail Transit (LRT) system in Penang, the state government has agreed to scale down the PSI project, suspending the reclamation of Islands B and C for the time being.

Zairil also explained that although the state government has applied for Environmental Impact Assessment (EIA) approvals concurrently for all three islands, each island has separate approvals.

“If we implement only Island A, it has its own approval, so it’s not a problem. It doesn’t affect the EIA application because we have separated it. For Islands B and C, the approvals are still valid, but the state government has decided not to proceed upon the advice of the Federal Government,” he said.

Source: Bernama

Penang Assembly: Silicon Island development to address industrial land shortage

Content Type:

Duration: