Electronic Components

Electronic components serve as indispensable building blocks within a diverse range of electrical and electronic devices, encompassing consumer electronics, industrial electronics, and electrical appliances. This is evident in its investment impact, with the sub-sector contributing 81% of investments in the E&E industry in 2022, mainly driven by foreign investment.

This sub-sector plays a pivotal role in the expansion of the E&E industry, spanning an extensive array of products. Encompassing semiconductor devices like integrated circuits (ICs) and their design, as well as packaging activities, it extends to passive components including capacitors, resistors, connectors, and inductors. Additionally, the sub-sector covers components like storage media, disk drive parts, printed circuit boards (PCBs), LED substrates, epitaxy, microcontrollers, and various metal and plastic parts tailored for E&E applications. Projects approved were for wafer fabrication, semiconductor devices, integrated circuits,

printed circuit boards (PCBs), and sensors.

Semiconductor Ecosystem

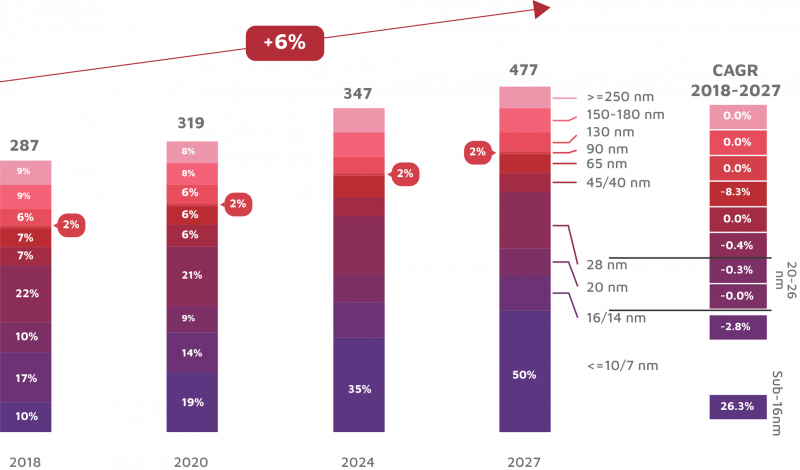

The semiconductor industry is a major contributor to Malaysia’s manufacturing landscape, with a higher concentration of multinational companies (MNCs) than domestic ones. Local industry strengths mainly reside downstream, covering assembly (advanced packaging), testing, and system integration. Although there has been some relief, there continues to be a global shortage of semiconductor chips and equipment. This scarcity persists due to robust demand for advanced chips in emerging technologies like electric vehicles (EVs), autonomous driving, 5G, and the Internet of Things (IoT).

Prospective investors can draw reassurance from the industry’s resilience amid the global pandemic, highlighting adaptability. Despite COVID-19 disruptions and government actions, there was a spike in demand for specific Electrical and Electronics (E&E) products, propelling semiconductor market growth. As of August 2023, 86% of Malaysians were fully vaccinated, reducing the pandemic’s impact and fostering growth in Malaysia’s E&E ecosystem.

We enthusiastically welcome increased investments in both the upstream and downstream semiconductor ecosystem. This includes IC design, engineering services, and solutions to bolster wafer fabrication, alongside the robust and advanced IC packaging industry in Malaysia, encompassing:

a) Design IC / system

b) Wafer Fabrication/ Front End Activities

c) IC Packaging/ Back End Activities & Engineering Services Solution.

Home Grown Electronic Companies

MNCs in Malaysia have brought innovation, jobs, and an evolved local supply chain, linking the nation to the global value chain. Furthermore, streamlined local supply chains have boosted Malaysia’s competitiveness and global market presence.

Semiconductor

IC Design

Wafer Fabrication

LED

Our Investors' Highlights

- Micron Memory Malaysia Sdn. Bhd.