Manufacturing on growth path

07 Dec 2020

There is light at the end of the tunnel for the manufacturing sector as it is set to stage a rebound next year after the latest relevant data indicated its lowest reading since May this year.

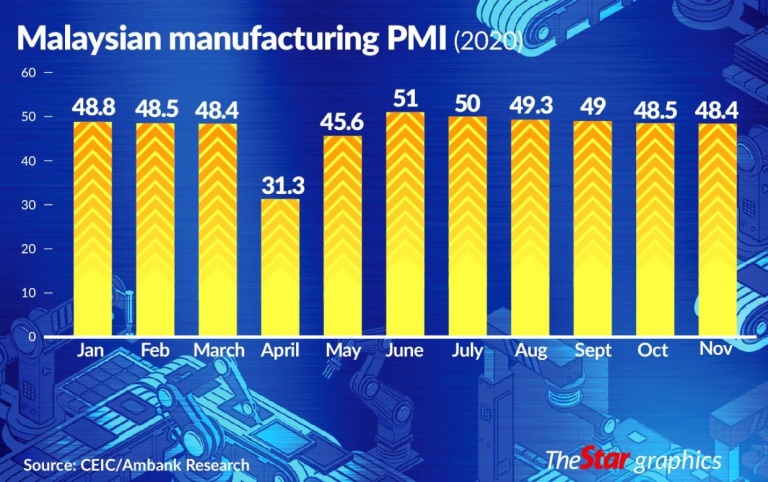

Based on the IHS Markit data, the manufacturing purchasing managers’ index (PMI) in November fell to 48.4 points from 48.5 in October. A reading above 50 signals expansion while less than 50 means a contraction. The manufacturing PMI is a measure of the prevailing direction of economic trends in manufacturing. It has remained in the contraction region for the fourth straight month.

According to Bloomberg, the index was down from 49.5 a year ago and it was the lowest reading since May this year.

It noted that output fell to 46.3 versus 47 in October. “The lowest reading since May 2020 as new orders fell versus the prior month, ” it said.

Malaysia’s economy in the third quarter contracted at a smaller pace of 2.7% compared with the 17.1% plunge in the second quarter.

Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid told StarBiz that he believes the index is set to go above the 50-point demarcation line next year attributed to the Covid-19 vaccine development.

He said the vaccine development has been quite encouraging with the efficacy of such a remedy hovering above 90%, and with the United States Food and Drug Administration (FDA) expected to grant its approval fairly soon.

“This would give us hope that the reopening of the economy could happen in a convincing way. Apart from that, key economies such as the recovery in China have been quite sturdy.

“This would help improve Malaysia’s external demand, which has been quite visible during the third quarter.

“We expect net exports would continue to grow at a decent pace. However, for 2020, Malaysia’s manufacturing PMI should settle around 48 to 49 points by December as the conditional movement control order (CMCO) has affected some of the important industries, namely, the rubber glove sector, ” he added.

Afzanizam noted that the government has made its preparation to procure the vaccine and specific allocation has been earmarked in Budget 2021.

Additionally, he said the monetary and fiscal policies have been commendable and this should provide the right boost to the economy next year.

However, he said the situation is highly fluid, as the whole economic scenario would be heavily dependent on the vaccine rollout and external headwinds. Any hiccups along this line would drastically change the outlook of the economy next year.

“But generally, it should be a positive outlook for the Malaysian economy, especially in respect to the global scenario – the Covid-19 vaccine, president-elect Joe Biden soon to be the 46th US president and higher commodity prices, ” he said.

AmBank Group chief economist Anthony Dass, who is also a member of the Economic Action Council secretariat, said following the RM305bil stimulus measures to support livelihood and businesses, plus the easing of restrictive measures, saw an improvement in the PMI numbers from May onwards.

He added that the rise in new cases and targeted restrictive measures since October have started to impact the PMI numbers.

“Given that the concern remains on the pandemic, which means the targeted restrictive measures could remain, it will remain challenging for the PMI numbers to trend upwards this year.

“Going into 2021, with global gross domestic product (GDP) and trade expected to rebound, plus the improving global semiconductor outlook, it will bode well for export-dependent manufacturers.

“Added with domestic stimulus measures, the overall outlook for manufacturers, both exports and domestic-related, should improve in 2021, ” he said.

Dass said this would mean that orders from both exports and the domestic market should gain momentum in 2021. On that note, he said there were strong possibilities for the manufacturing PMI to cross the 50 threshold next year.

Socio-Economic Research Centre (SERC) executive director Lee Heng Guie said, on the whole, the manufacturing PMI is expected to improve and stay above the expansionary path due to the continued growth in the manufacturing sector.

“This will ride on the demand of electronics and electrical products, chemicals, healthcare, etc, while a recovery in domestic demand will aid domestic market-oriented industries such as food products, transport equipment and building materials, ” he said.

Source: The Star